US Investors Abandon Saving Accounts, Flock to Bitcoin in Droves

As an almost counter-intuitive development, savings interest rates in the United States have reached a 15-year high. Given the higher returns they now offer, one would ordinarily expect such a move to encourage more deposits in savings accounts. However, an unexpected trend has been observed — despite the attractive interest rates, fewer Americans are choosing to park their money in savings accounts.

The number of savings accounts has declined, regardless of rising interest rates. This surprising turn of events reflects a significant shift in investor behavior and trust, moving away from traditional banking methods and towards alternative investment and savings avenues.

The Decline of Trust in Traditional Savings Accounts

The shift away from savings accounts can be partially attributed to the increased scrutiny customers of traditional banks are experiencing. It has become common for even regular activities to be flagged as “suspicious,” leading to inconvenient account freezes.

This strict oversight, designed to deter illegal activities, is causing disruptions for bona fide account holders, thereby sowing seeds of mistrust.

“I received no kind of warning or red flag. [My bank account was closed] just out of the blue,” said former Chase customer Naafeh Dhillon.

The plummeting trust in traditional savings accounts is not exclusively an outcome of banks’ regulatory actions. The current banking crisis in the United States, which has seen massive cash withdrawals from big and small financial institutions, is compounding the issue.

JPMorgan Chase estimated that a colossal $550 billion in deposits shifted from smaller and regional banks to larger banks and money market funds in the fortnight following the failure of Silicon Valley Bank and Signature Bank.

“Turmoil in the markets always puts money in motion. The big concern right now is: Is my money safe? How can I make it safer? People who have cash in simple savings accounts are using this as an opportunity to move their money,” said Danielle Lucht, a financial adviser at Everwell Financial.

Smaller banks, in particular, are feeling the brunt of this exodus. Unlike larger institutions, these banks are more susceptible to financial distress amid large-scale withdrawals due to their limited operational scale and financial reserves.

Despite the considerable cash outflows, financial regulators maintain that the American financial system remains robust. They point towards high levels of capital reserves banks hold and the strength of the regulatory framework established post the 2008 financial crisis.

“The federal government took forceful actions to strengthen public confidence in the banking system – following the failures of two large regional banks. The situation has stabilized since then. Aggregate deposit outflows have steadied. And the Fed’s Bank Term Funding Program and discount window are working as intended. Like our community banks, the US banking system remains sound. There is strong liquidity and capital in the system,” said Secretary of the Treasury Janet Yellen.

Yet, the magnitude of the withdrawals highlights a deep-seated shift in public perception toward the stability and trustworthiness of the traditional banking system.

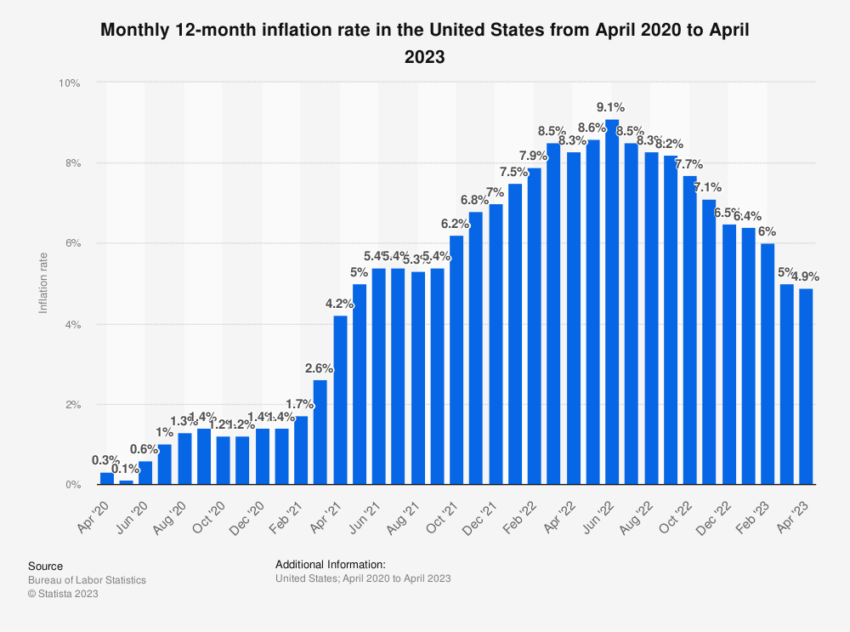

Moreover, external factors such as fluctuating inflation rates and socio-economic shifts play a part. Especially, younger generations – millennials and Gen-Z – are proving to be more financially astute, reducing their dependence on conventional savings mechanisms.

Amid all these factors, an unexpected alternative has been gaining ground – Bitcoin.

Bitcoin Wallets Surge: The Rising Star

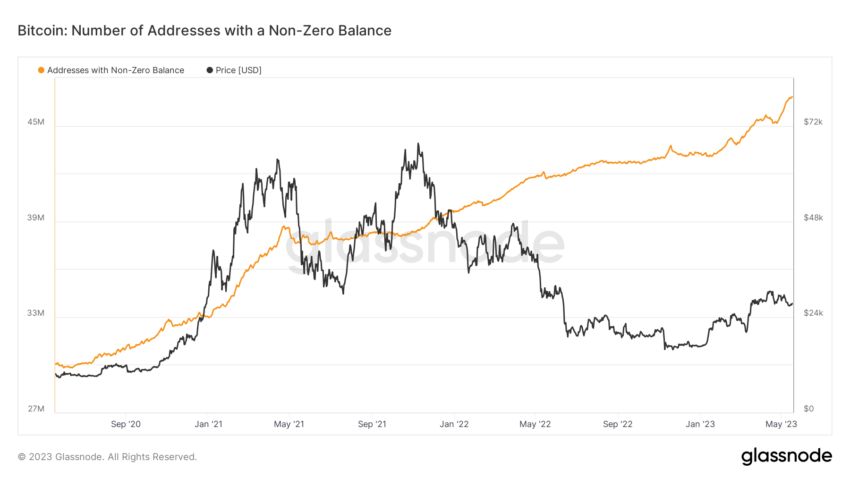

In contrast to the downturn in savings accounts, the number of non-zero Bitcoin addresses is hitting record highs. This increase signals a growing interest in cryptocurrency, despite the volatile nature of the market.

On-chain data from Glassnode reveals a surge in the number of new Bitcoin wallets created on a daily basis. More importantly, non-zero balance Bitcoin wallets recorded an uptick, surpassing 48 million.

This uptrend showcases the increasing acceptance of cryptocurrencies like Bitcoin as a viable investment and savings option.

More individuals and businesses are starting to trust cryptocurrencies, increasing their usage. Bitcoin’s decentralized nature and the potential for high returns appeal to those disillusioned with the conventional banking system.

While the anonymity and independence offered by Bitcoin are appealing, another significant aspect of its allure is its scarcity. The 21 million BTC tokens cap has instilled a sense of exclusivity, increasing the digital currency’s appeal.

As more people strive to get their hands on this limited resource, the value of Bitcoin continues to soar.

Moreover, Bitcoin provides transparency that is unavailable in traditional financial systems. The blockchain records all transactions, making them accessible to anyone, anywhere. This accessibility builds trust among users and promotes a sense of community

The Global Financial Scenario: Ripple Effects of Changing Investor Behavior

This shift is not confined to the US. It is emblematic of a broader global trend. The global economic climate, characterized by its vacillating nature, has seen commensurate fluctuations in traditional asset markets. Redirection of global investment flows has occurred, leading to fluctuations in the value of stalwart currencies like the US dollar.

Given the trends, it appears that Bitcoin is on a trajectory to becoming a mainstream investment option. While still popular, traditional savings accounts are witnessing a shift in user behavior. Banks must innovate to stay relevant in an increasingly digital financial landscape as this trend continues.

As more individuals and businesses trust and understand cryptocurrencies, their adoption rates will likely increase. As a result, regulatory bodies worldwide may need to update their regulations to accommodate this new form of digital asset.

While the savings account’s decline and the surge in Bitcoin wallets might seem paradoxical, they are part of a broader shift in global financial behavior. It remains to be seen how this shift will play out, but the present trends indicate a future where digital currencies play a significant role in global finance.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.