Terra’s Interoperability Updates Could Help LUNA Soar

Key Takeaways

Terra is about to launch Inter-Blockchain Communication.

The new protocol will allow sovereign chains to communicate with each other.

LUNA appears to have benefited from the news as it has rebounded strongly.

Share this article

Terra is about to see a spike in network adoption as it enables interoperability with other blockchains. The boost in use cases could help push LUNA into higher highs.

Terra Goes Multi-Chain

Terraform Labs, the South Korean company developing the stablecoin-focused blockchain Terra, is making significant strides to increase the blockchain’s utility.

With the upcoming launch of Inter-Blockchain Communication (IBC), the firm is aiming to open the network to countless dApps in the Cosmos ecosystem. IBC will help different blockchains connect and communicate, allowing the transfer of tokens between those chains that adopt the protocol.

Wormhole’s expansion to Terra is also another significant milestone ahead of IBC’s launch. The cross-chain bridge will enable Terra-native assets like UST and LUNA to be transferred to Solana, Ethereum, and Binance Smart Chain through one interface.

Do Kwon, the co-founder and CEO of Terraform Labs, says that demand for UST in cross-chain environments will accelerate the expansion of the stablecoin’s supply. Earlier this year, he said that he thought UST would hit a market cap of at least $10 billion by the end of 2021.

Meanwhile, Terra’s native token, LUNA, has recently bounced off a crucial support level.

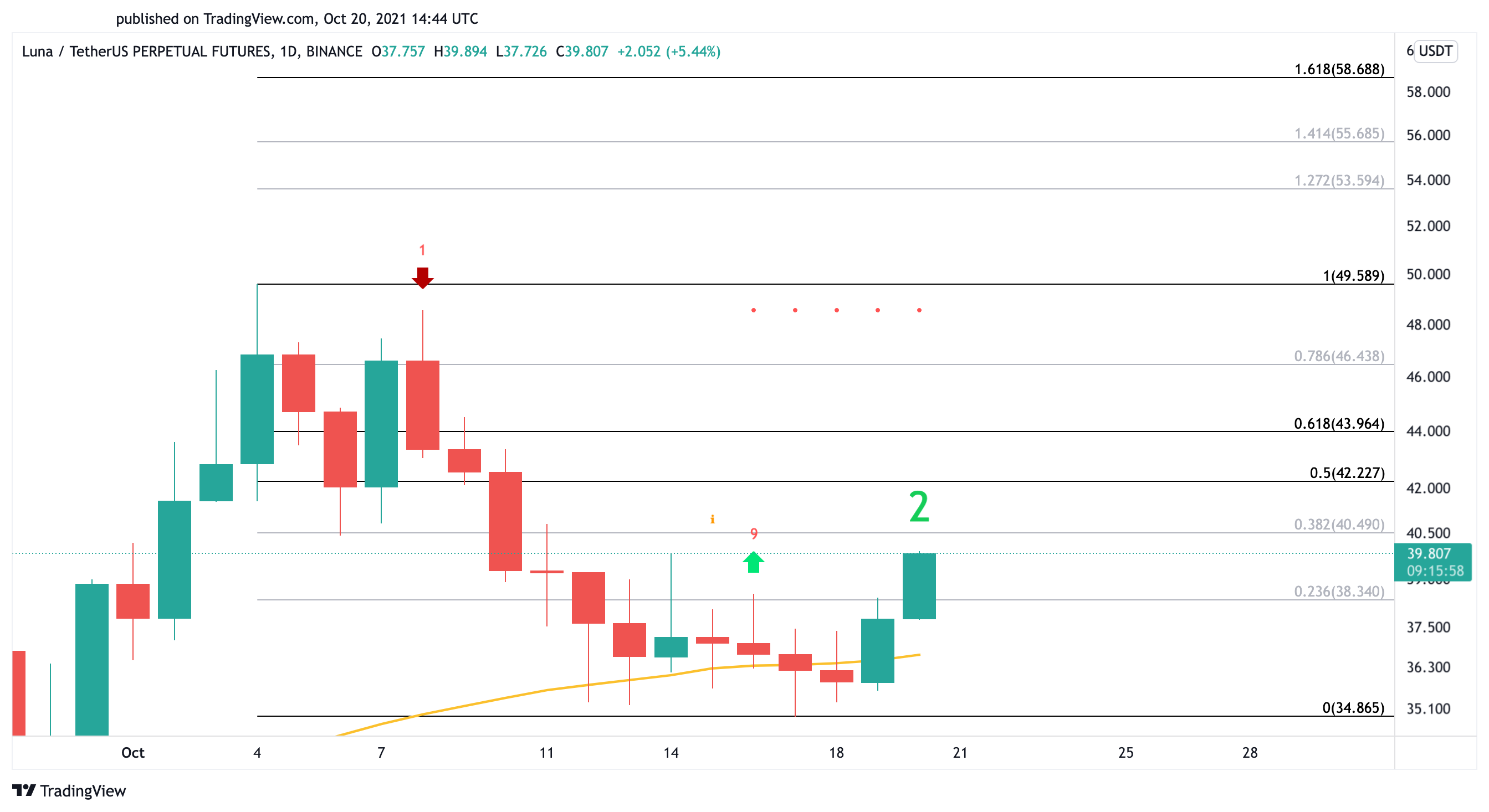

LUNA suffered a 30% correction after reaching a new all-time high at $49.60 on Oct. 4. The sudden bearish impulse appears to have been contained by the 50-day moving average as prices were able to rebound from this crucial support level. The formation of a buy signal per the Tom DeMark (TD) Sequential indicator also contributed to the upward price action LUNA has experienced over the last few days.

Now that LUNA presents a green two candlestick trading above a preceding green one candle on its daily chart, the TD’s bullish formation can be considered validated. Further buying pressure could lead to another two green candlesticks or the resumption of the uptrend.

The supply zone between $42 and $44 can act as stiff resistance, preventing LUNA from advancing further. Still, a decisive daily candlestick close above this barrier could result in a retest of the all-time high at $49.60.

As long as the 50-day moving average at $37 continues to hold as support, the bullish outlook should prevail. However, failing to stay above this strong foothold could result in significant losses as the next important demand zone sits around $31.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

A Beginner’s Guide to Terra’s DeFi Ecosystem

Terra is a Layer 1 blockchain protocol that aims to create a thriving payments-focused financial ecosystem offering interoperability with the real-world economy. Its two key ecosystem components are the so-called…

Terra Columbus-5 Network Upgrade Goes Live

Columbus-5, Terra’s most significant mainnet upgrade to date, has successfully launched. Terra Migrates To New Network Stablecoin-based Layer 1 blockchain Terra has completed its Columbus-5 upgrade. The Terra team announced…

What Is Terra? The Blockchain for Stablecoins Explained

Terra is a smart contract blockchain that aims to provide an ecosystem for algorithmically governed, seigniorage-based, fiat-pegged stablecoins in a decentralized manner. Terra Unpacked Terra is a blockchain protocol and…

What is Impermanent Loss and How can you avoid it?

DeFi has given traders and investors new opportunities to earn on their crypto holdings. One of these ways is by providing liquidity to the Automated Market Makers (AMMs). Instead of holding assets,…