Terra continues to capture DeFi market share, Luna token rockets

Luna has been on a tear recently, shooting up a staggering 50% in the last week. At $34 billion, it is currently the seventh largest cryptocurrency by market cap. Even more headline-worthy is that it has now flipped Solana ($32 billion) and Cardano ($31 billion), who occupy the eighth and ninth spots respectively.

Via CoinMarketCap

Luna Token

Luna, of course, is the token that fuels the DeFi ecosystem of Terra Labs. The real product is a group of stablecoins, the largest of which is the dollar-pegged UST. To boil the token’s utility down in simple terms, Luna’s price will go as far as UST goes.

As UST gains adoption, Luna rises, and vice-versa. If UST market cap rises, Luna supply is burned and hence the Luna price goes up (and vice-versa). This is due to the unique algorithmic mechanism by which the Terra stablecoins retain their fiat pegs (market agents are incentivised to do this via arbitrage).

Right now, the UST stablecoin is sitting pretty with a market cap of $13 billion (15th largest crypto) – the fourth largest stablecoin but the only one offering the tantalising quality of decentralisation. This decentralisation is the unique selling point of UST, of course. The three heavy hitters ahead of UST are all centralised, which is very much a dirty word in crypto. The biggest is the much-maligned Tether ($79 billion, 3rd largest crypto), Circle’s USDC is next ($53 billion, 5th largest) and Binance USD is third ($18 billion, 12th largest).

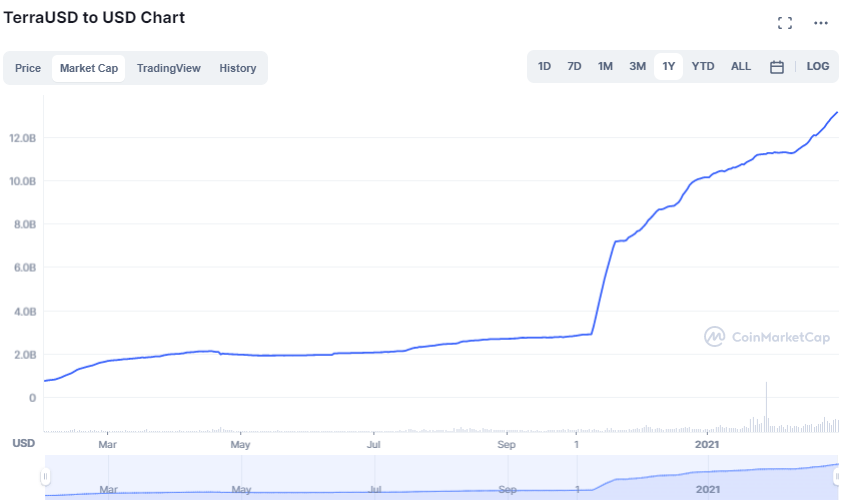

So with Luna’s meteoric rise over the last year in mind, it follows that we can expect to see similar growth in the stablecoin – which the graph below from CoinMarketCap details, a formidable rise from just $2.8 billion this time last year to today’s $13 billion for the market cap of UST.

UST market cap via CoinMarketCap

UST market cap via CoinMarketCap

Total Value Locked

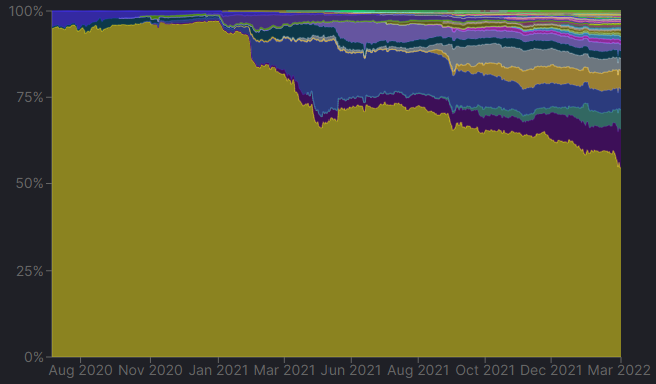

Another way of tracking the mushrooming UST market cap is to examine the total value locked (TVL) in the Terra ecosystem. Much like every other datapoint related to Luna, it makes for impressive reading. A chunky 11.2% of the $290 billion TVL in the entire DeFi space is now locked up in Terra, according to DefiLlama. Galloping past Solana, Avalanche, Fantom and BSC, Terra now comfortably sits in second, with its $23.5 billion in TVL well clear of BSC in third at $12.4 billion. Ethereum, of course, still rules the roost with its $117 billion representing a 55% share of TVL.

TVL on Luna (purple on graph) has been growing steadily, now representing 11.2% of total DeFi TVL

TVL on Luna (purple on graph) has been growing steadily, now representing 11.2% of total DeFi TVL

Contra-Market

But it’s not just the gross gains that stand out. An intriguing quirk of Luna over the last year or so has been it’s propensity to move countercyclically. It is currently only 10% off all time highs (Bitcoin is 36% off all time highs while most alt coins are significantly worse off) – a symbol of how it has been resilient through a fallow period for crypto over the last few months. Indeed, at a correlation of 0.34 with Bitcoin over the last 9 months, it’s remarkably low by crypto standards. The reason for this is that during periods where crypto has fallen, investors have shed crypto exposure and instead bought up the stablecoin UST, hence pumping the Luna price.

So to wrap this up, Luna now boasts the following:

Second largest TVL in the DeFi space

Largest decentralised stablecoin (UST)

Only 10% off all time highs

Extremely low correlation to the wider market by crypto standards

With these impressive attributes and a market cap of $34 billion, Luna is no longer an alt coin. It’s in the bigtime.