Stay away from Grayscale Bitcoin Trust despite discount narrowing to 10-month low

Key Takeaways

The Grayscale Bitcoin Trust (GBTC) has persistently traded at a discount to its net asset value

The discount has narrowed to its lowest mark since September off hope the fund is more likely to be converted to an ETF

The entire GBTC debacle represents the mess that is the institutional regulatory climate in the US

Spot ETFs are a question of when rather than if, and such investment vehicles will then be a thing of the past

That won’t assuage frustration of GBTC investors, who have been caught badly as alternative Bitcoin investment vehicles have come online and demand for the trust has dried up

Among the interesting aspects of the fallout from the slew of recent spot Bitcoin ETF filings is how it affects the controversial Grayscale Bitcoin Trust (GBTC).

The trust has been flying, up 56% in the three weeks since Blackrock’s ETF filing was announced.

Notably, this means it has significantly outpaced its underlying asset, Bitcoin. That sounds like a good thing, but it really summises the problem with this investment vehicle that has done nothing but frustrate investors in recent years, but we will get to that in a moment.

I have plotted the movement of the GBTC against Bitcoin itself in the next chart, highlighting the outperformance the Trust has had since the ETF filing, with Bitcoin itself up “only” 21%.

Grayscale discount to net asset value narrowing but still enormous

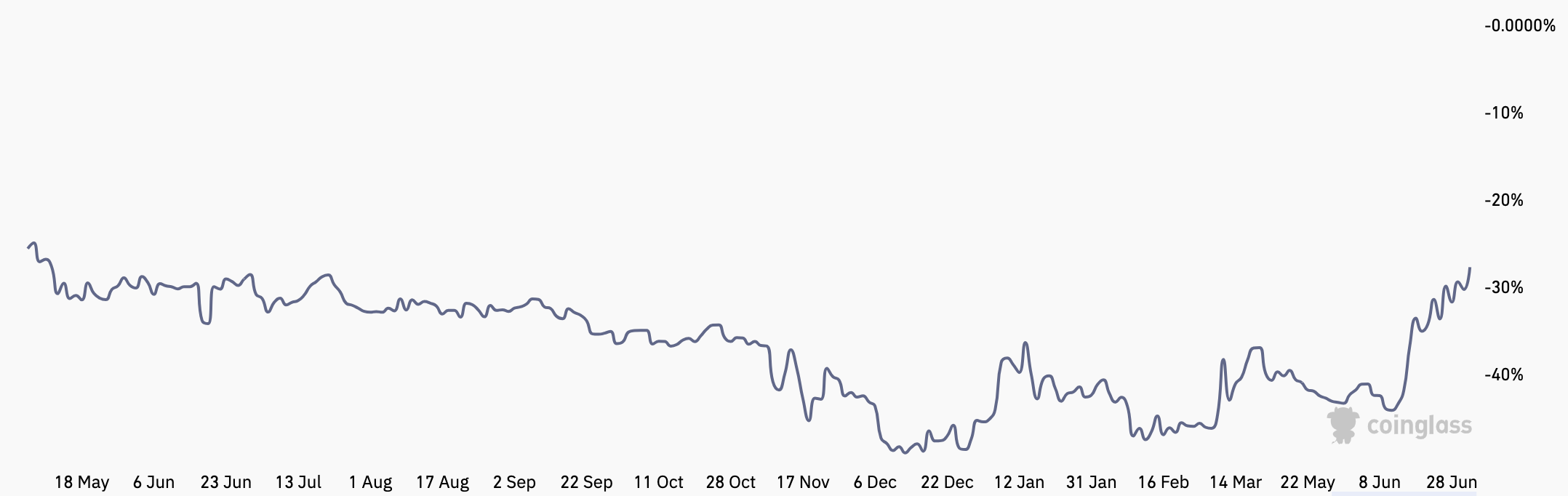

The trust’s discount to net asset value has also narrowed to its smallest mark since September, now below 30%. This comes as investors bet the trust is now more likely to finally be allowed to convert to an ETF.

Should this conversion occur, the discount would narrow to near zero, as funds would then be allowed to flow in and out of the vehicle without affecting the underlying assets. For the time being, while it remains a trust, there is no way to get Bitcoin out of GBTC. This, coupled with steep fees (2% annually) means that a heavy discount has persisted.

In truth, the very existence of the Grayscale trust is a black mark on the sector. The discount it trades at is farcical – even following the recent narrowing, a 30% delta is an enormous chasm, one that is hurting investors.

The outsized assets under management – essentially trapped due to the closed-fund nature – feels like a throwback to the days when anyone and everyone wanted to get exposure to Bitcoin through whatever means necessary. Grayscale was the only shop in town, and such was the demand for Bitcoin, coupled with that monopolistic power, that it even traded at a premium for much of its early history.

However, as more mediums through which Bitcoin exposure can be had have come online, the premium has flipped to a discount, and that discount has become large. It is probably fair to say that investors displayed a lack of due diligence for how the fund works, another throwback to the up-only bull market of days gone by.

Without donning a captain hindsight outfit, there was always going to be competitor firms coming online and the premium was bound to come under pressure. An investment in GBTC essentially amounted to two things: a bet on Bitcoin, and a bet that the trust would be converted into an ETF quickly.

But at that, perhaps sympathy can be shown to investors. Investment management firm Osprey Funds has a similar product, and earlier this year sued Grayscale, alleging that its competitor misled investors about how likely it was that GBTC would be converted into an ETF. This, they allege, is how they captured such a share of the market.

“Only because of its false and misleading advertising and promotion has Grayscale been able to maintain to date approximately 99.5% market share in a two-participant market despite charging more than four times the asset management fee that Osprey charges for its services”, the suit alleges.

Whether Grayscale knew of the regulatory difficulty it would face or not, it has tried and failed for years to convert the vehicle into an ETF. Last year, it sued the SEC itself, declaring the latest rejection “arbitrary”.

Institutional climate turning

My thoughts on the trust overall remain the same. I believe it represents a terrible investment (obviously), and its mere existence is only a byproduct of the regulatory travails that the sector has struggled with. There is no reason to even consider buying this unless there is quite literally no other vehicle through which to gain Bitcoin exposure.

There will come a day when all this squabbling over trusts and ETFs will likely be nothing but a throwback of a more uncertain time. But time is a luxury that many investors don’t have, and Grayscale has been a horrendous investment, typical in a lot of ways of the travails the space has had in bridging the gap to become a respected mainstream financial asset.

Not only is the discount jarring as it is, but it widened beyond 50% in the aftermath of the FTX collapse as it emerged that crypto broker Genesis was in deep trouble. Genesis’ parent company is Digital Currency Group (DCG), the same parent company of Grayscale. Genesis eventually filed for bankruptcy in January.

This sparked concern around the safety of Grayscale’s reserves, something which they company did not exactly comfort investors about when it refused to provide on-chain proof of reserves, citing “security concerns”.

6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure.

— Grayscale (@Grayscale) November 18, 2022

While the furore over reserves has quietened down, the episode is yet another stark reminder of the oft-repeated (but perhaps not often enough) phrase: “not your keys, not your coins”.

The problem for institutions to date is that they have had trouble accessing Bitcoin directly for a variety of reasons, primarily regulatory-related. While spot ETFs will also technically violate the “not your keys” mantra, with prudent regulatory oversight and a strong custodian, this should be a safe way for institutions to gain exposure to Bitcoin.

That would end all this nonsense (and that really is the right word) such as trusts trading at 30% discounts, and give investors a secure avenue through which to put their views on Bitcoin into conviction. That may still be a long way off, but if demand for these products remains, it’s only a matter of time.