Stablecoins Are Here to Stay, Says Leading Asset Manager

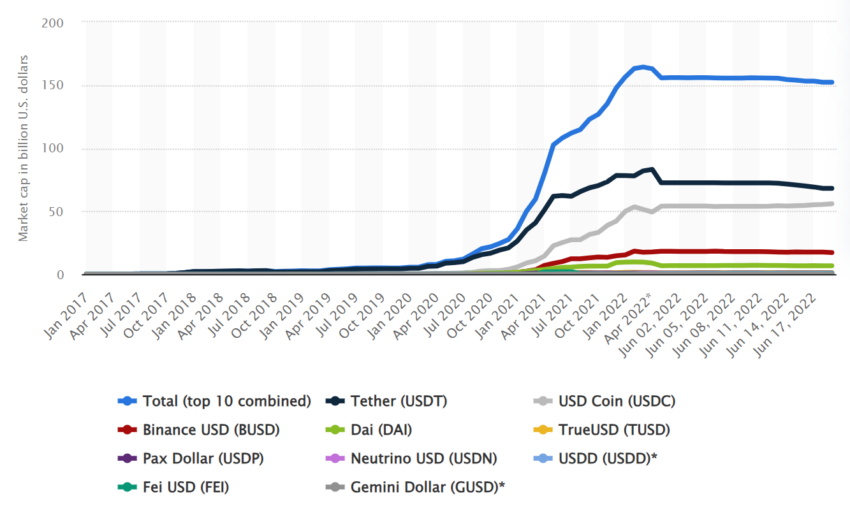

Stablecoins have become an increasingly ubiquitous part of the crypto ecosystem in recent years. But with their rise comes unprecedented scrutiny. In an exclusive BeInCrypto interview, Wade Guenther, a partner at asset manager Wilshire Phoenix, shared his thoughts on their long-term prospects.

Stablecoins these days are as useful as they are controversial. They offer a medium of exchange and a store of value for traders who don’t want to off-ramp from the crypto ecosystem. Unlike almost every other crypto token, they offer stability, at least in theory. In crypto, a price fluctuation of 10% is common. Whereas, on forex markets, a 2% change in a fiat currency’s price over 24 hours is considered significant.

How Much Can You Trust Stablecoins?

Earlier this month, however, TrueUSD depegged—the word denotes an uncoupling from the asset it is pegged to. In this case, the US dollar. As with all widely used stablecoins, the depeg stoked panic across the market as participants worried about its knock-on effects.

The same happened during the spring banking crisis in the United States. In March, as regional banks began to fail, Circle, the issuer of the USDC, revealed a $3.3 billion exposure to Silicon Valley Bank. On June 15, the biggest stablecoin by market capitalization, Tether’s USDT, depegged after losing the confidence of investors. Markets panicked as the USDT balance on Curve’s 3pool rose to 72%.

Given the recent crises, can investors safely “park their cash” in stablecoins?

“Conceptually, it could make sense for investors to park their cash in asset-backed stablecoins if the stablecoin company follows the mandate,” said Guenther.

“However, asset-backed stablecoins have a major drawback when compared to other US-issued cash or cash equivalents. Namely, they’re not directly backed by the full faith and credit of the US Federal Reserve.”

So the question becomes: whom do you trust more? The Fed or the stablecoin issuer?

“Asset-backed stablecoins are not decentralized and are run by companies and corporations,” continued Guenther. “This is especially true for fiat currency-backed stablecoins. The issuer company manages the fiat currency reserves, and there can often be a lack of transparency on actual reserves.”

Concerns About Transparency

The lack of transparency with regard to stablecoin reserves has been a running sore for the industry. Tether once held significant short-term debt issued by companies. But the company didn’t disclose details about the firms whose debt it owned. Later, Tether switched to US Treasurys, which are seen as a more stable asset for its reserves.

In response to widespread industry concern about its openness and accountability, Tether hired the accounting firm BDO Italia to publish attestations and assurance reports and reassure the market about its assets. However, these reports are not as robust or extensive as a full audit.

“The trust is placed in the stablecoin company’s internal management,” said Guenther. “Tether has experienced multiple investigations into its stated reserves. So far, USDT has survived these investigations, but the risks due to its centralized control will always remain.”

Even so, despite widespread concern about the stability of stablecoins, including a report out this week from the Bank of Italy saying they “have not proved stable at all,” Guenther sees reasons to be optimistic.

“Stablecoins play an important role within crypto as the oil that greases the market and also serves as major collateral,” he explained.

“[They] both strengthen and propel the financial crypto system. With the recovery and growth of crypto going forward, we expect the stablecoin market to expand both within the crypto space and within traditional finance.”

An Inflation Hedge?

Guenther said he and his colleagues at Wilshire Phoenix see fiat-backed stablecoin adoption as an emerging long-term trend. There are many benefits here, he argued. Namely that regulators can enforce transparency. Plus central banks may opt to issue their own fiat-backed stablecoins. This will initiative a flight to quality, Guenter believes.

“Central bank backing of stablecoin reserves could help reduce the runs on stablecoins that sometimes occur,” Guenther added.

This shouldn’t be a surprise. The use of stablecoins can help keep up purchasing power. Not to mention counter the effects of hyper-inflation, given USDT’s peg to the US dollar, he stated.

“We believe the largest growth potential is in regions with high levels of inflation. The public has relatively easy access to USDT, whereas this type of hedging instrument would have been more of an institutional solution ten years ago,” said Guenther.

Guenther pointed to a number of things to watch in the stablecoin space. Namely, changes around know-your-customer (KYC) and anti-money laundering (AML) regulations. And broader shifts in banking culture.

“The traditional banking system will likely evolve as broad adoption of stablecoins continues,” he added. “Observing the banking system’s evolution as potential stablecoin credit intermediaries will be an interesting development.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.