Polygon (MATIC) Price Dips: Will the Correction Persist?

Polygon (MATIC) shows signs of a complex pattern. This is highlighted by an increase in whale activity alongside a decrease in daily active addresses.

This confluence of on-chain metrics points to mixed sentiment within the market.

Polygon’s Mixed Signals

Initially, there was a decline in the number of addresses holding substantial amounts of MATIC, dropping from 273 to 252 by March 30. However, this trend reversed in the following days, with the count increasing to 266 by April 3.

This behavior indicates that whales are potentially “buying the dip,” a strategy that suggests optimism for MATIC’s price increase.

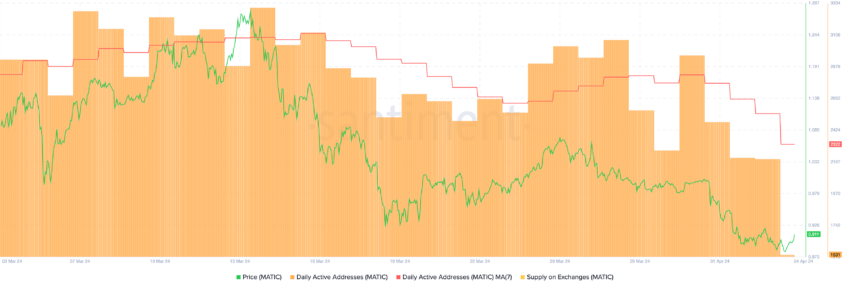

Contrastingly, the daily active addresses have shown a consistent decline. These went from 2,959 by March 31 to 2,216 by April 3, which traditionally suggests reduced market interest.

At the same time, the supply of MATIC on exchanges, after decreasing through March, has found a level of stability.

This equilibrium suggests that the selling pressure has eased, and a consolidation phase might be setting in, potentially laying the groundwork for future price movements.

MATIC Price Prediction

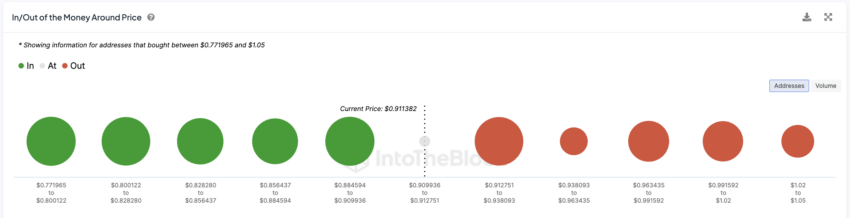

The In/Out of the Money Around Price (IOMAP) analysis shows significant resistance ahead for MATIC, with notable levels up to $0.99 and between $0.80 and $0.88.

These insights, alongside the observed market dynamics, paint a picture of potential consolidation, where the price might stabilize before making a decisive move.

Read more: Polygon (MATIC) Price Prediction 2024/2025/2030

Given these factors, MATIC’s future price direction hinges on market sentiment and the ability to overcome resistance levels.

A bearish trend might see MATIC retreat to lower support levels, possibly around $0.68. On the flip side, overcoming the resistance could propel MATIC toward $1.30, a level not reached since April 2022.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.