P2P Platforms, Cross-border Transactions Drive African Crypto Markets

Africa’s crypto market remains relatively small compared to other continents, but it is developing at a fast pace, driven by peer-to-peer (P2P) platforms and increasing use of crypto for international commercial transactions, according to blockchain analysis company Chainalysis.

“Not only has Africa’s cryptocurrency market grown over 1,200% by value received in the last year, but the region also has some of the highest grassroots adoption in the world,” the analysts said, pointing to the inclusion of Kenya, Nigeria, South Africa, and Tanzania in the top 20 countries of its Global Crypto Adoption Index.

Africa received USD 105.6bn worth of crypto between July 2020 and June 2021, per Chainalysis.

P2P platforms have emerged as a major driving force behind Africa’s crypto industry growth in the past years. No other region uses such platforms to a greater extent than African crypto users, as they account for 1.2% of the continent’s transaction volume, and 2.6% of all volume for bitcoin (BTC).

One factor that could explain P2P platforms’ exceptional popularity among African users is that many of the continent’s countries have made it troublesome for customers to transfer money to crypto businesses from their bank accounts, either by enforcing strict regulations, or advising local banks not to permit such transfers.

“Binance used to be the most popular platform by far, but after the central bank’s sanction, many are moving to P2P platforms, like Paxful and Remitano,” Adedeji Owonibi, CEO and Founder of a Nigerian blockchain consultancy company Convexity and the associated 1st cryptocurrency community hub CBHUB, told Chainalysis.

“Informal P2P trading is huge in Nigeria on Whatsapp and Telegram. I’ve seen young people and businessmen in these groups carry out transactions for several million with popular [over-the-counter] merchants.”

Cross-region transfers of crypto are also uniquely popular in Africa, with 96% of the region’s transaction volume, compared with 78% for all of the world’s regions combined.

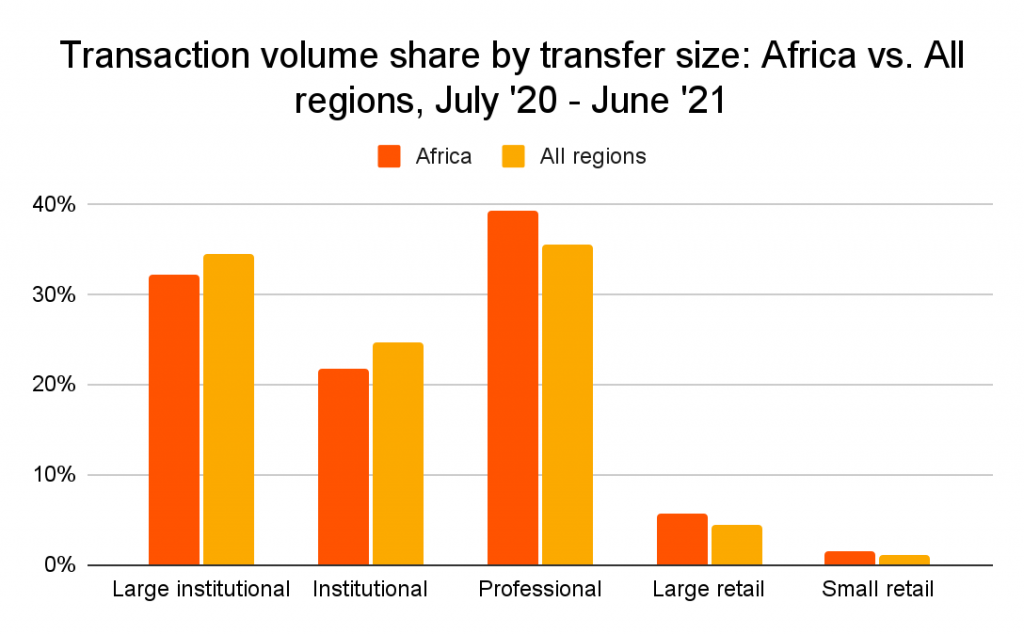

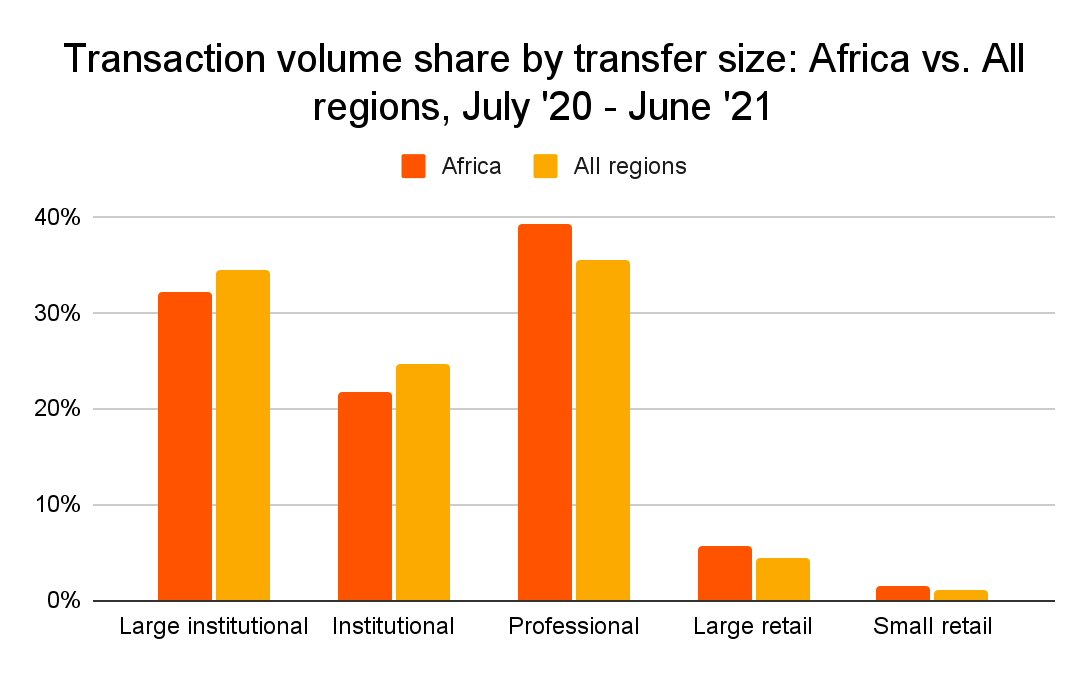

Another particularity of Africa’s crypto market is that it has a larger share of its overall transaction volume in terms of retail-sized transfers than any other region of the world, at more than 7%, compared with the global average of 5.5%.

“Drilling down further, Africa also sees a bigger share of its transaction volume made up of large retail and small retail-sized payments than the global average,” according to the analysis.

“These numbers are a big part of why so many African countries rank high on our adoption index, as smaller transfer sizes suggest higher grassroots adoption amongst everyday users.”

Meanwhile, some of the region’s countries such as Nigeria have unveiled plans to launch their central bank digital currencies (CBDC). This said, some local industry observers remain skeptical if African crypto users will put their faith and money into a government-run coin.

“Last week in a Clubhouse room of Nigerian crypto users, I asked the group if they would use the e-naira when the central bank rolls it out,” Owonibi said. “The overwhelming majority of attendees said no because they expect it to have the same instability and management issues the naira has today.”___Learn more: – Nixon’s Decision to Delink the Dollar From Gold Still Hounds the IMF and Africa – IOTA’s African Pilot Moves From Flowers to Tea, Fish, and Textile

– South African ‘Exit Scam’ Sees Brothers Vanish with USD 3.6B in Bitcoin – Crypto Regulation and Decriminalization May Be on their Way in Africa