One Year Before the Bitcoin Halving 2024: How to Prepare

With just one year left before the much-anticipated Bitcoin halving event, experts and investors in the crypto industry are closely monitoring its potential impact on the market.

In the following feature, BeInCrypto delves deeper into the intricacies of the halving phenomenon, how it affects miners and the broader implications for the entire cryptocurrency ecosystem.

The Bitcoin Halving Unpacked

The halving is a fundamental mechanism in Bitcoin’s protocol. It is designed to reduce the mining reward by 50% every 210,000 blocks, or approximately every four years. This reduction serves a dual purpose. One is controlling Bitcoin’s inflation rate and emulating the scarcity of precious metals like gold. And the second is ensuring a predictable and decreasing supply of new BTC entering the market.

The primary objective of the halving event is to create a deflationary environment for Bitcoin. It gradually reduces the rate at which new coins are minted. This scarcity is intended to preserve BTC’s value over time, making it an attractive store of value. As a result, the halving mechanism is a crucial component of Bitcoin’s long-term economic sustainability.

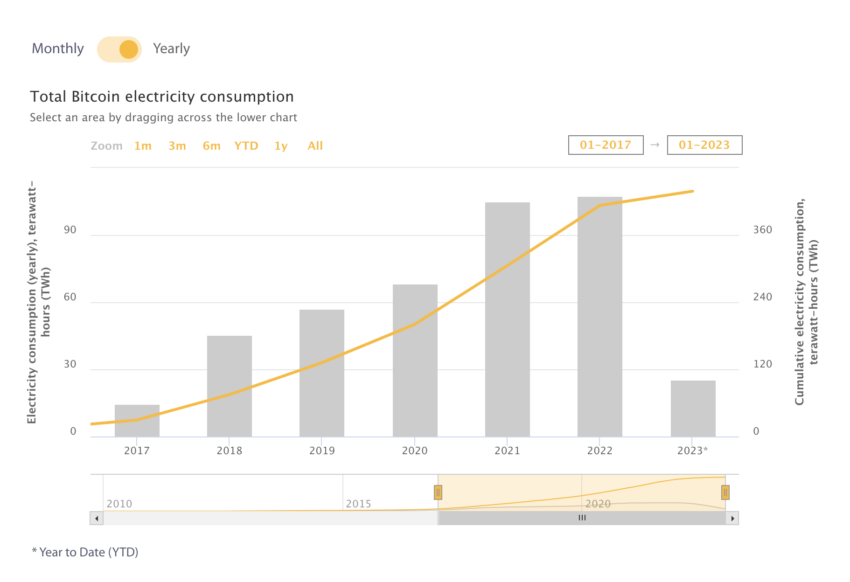

Historically, halving events have significantly impacted Bitcoin’s price due to the reduced supply of new BTC. For instance, in the 2012, 2016, and 2020 halving events, the price of Bitcoin experienced substantial increases in the months following each event, as market participants anticipated a supply shock and increased demand for the now scarcer asset.

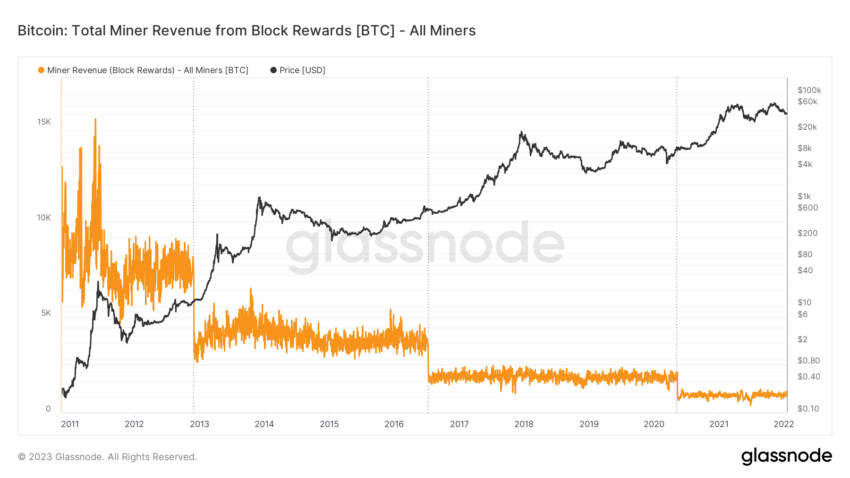

Currently, the mining reward stands at 6.25 BTC per block. After the next halving event, which is expected to take place in 2024, the mining reward will decrease to 3.125 BTC per block. This reduction in mining rewards will further limit the number of new BTC entering the market. Consequently, this potentially drives up the price as demand continues to grow amidst a decreasing supply.

However, it’s important to note that past performance does not guarantee future results. Various factors, such as market sentiment, regulatory developments, and macroeconomic trends, can influence Bitcoin’s price trajectory following the halving.

As such, market participants should approach the upcoming halving event with a balanced perspective. It is important to consider both its historical significance and the unique factors shaping the current market landscape.

Historical BTC Price Performance

Experts predict that the halving could lead to substantial changes in BTC’s price, as has been the case in previous halvings. However, factors such as global economic conditions, regulatory developments, and institutional investors’ strategies can influence the outcome.

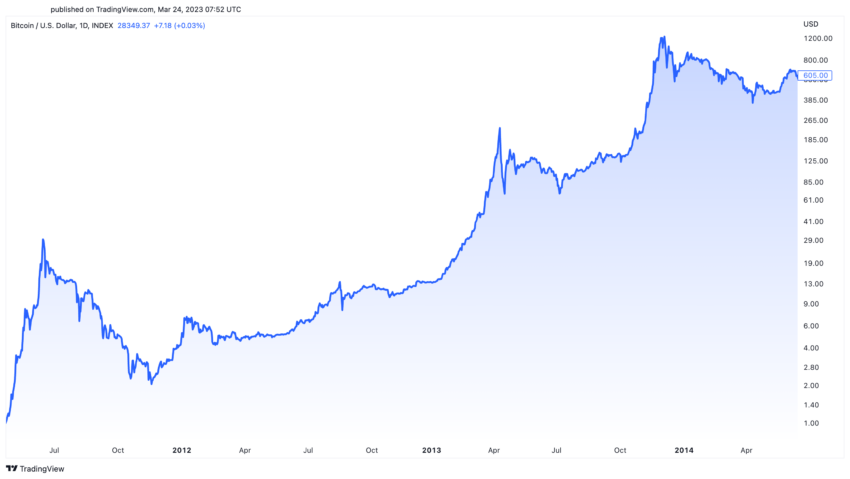

In the 2012 halving, Bitcoin’s price increased from around $11 in November 2012 to a peak of approximately $1,100 in November 2013, marking a remarkable increase within a year.

During this period, Bitcoin was still a relatively new concept. And the market was primarily driven by retail investors and early adopters who foresaw the potential of decentralized digital currency.

The 2016 halving saw Bitcoin’s price rise from about $650 in July 2016 to nearly $20,000 in December 2017. Market sentiment during this period was predominantly bullish. It was fueled by increased mainstream media attention, a surge in initial coin offerings (ICOs), and the entrance of institutional investors.

Still, regulatory developments, such as crackdowns on ICOs and attempts to impose stricter rules on crypto exchanges, added a layer of uncertainty and contributed to market volatility.

The 2020 halving event saw Bitcoin’s price increase from around $9,000 in May 2020 to an all-time high of roughly $69,000 in November 2021. The 2020 halving was characterized by heightened institutional interest, with major corporations and investment funds entering the crypto market.

The COVID-19 pandemic also played a significant role in shaping market sentiment. As the global economic downturn and unprecedented fiscal stimulus measures raised concerns about inflation and currency debasement, demand for Bitcoin grew as a digital store of value.

Institutional investors, in particular, hold considerable sway over the market. Their reaction to the halving event can substantially impact Bitcoin’s price and the broader cryptocurrency market.

For example, during the 2020 halving, institutional investors’ growing interest in Bitcoin as a hedge against inflation and macroeconomic uncertainties contributed to its price increase.

The Impact on Miners

The upcoming halving event will reduce mining rewards by 50%, exerting significant financial pressure on Bitcoin miners. This reduction in rewards may compel miners to adapt their operations to maintain profitability and continue supporting the network.

In response to the reduced rewards, miners may choose to upgrade their equipment, investing in more energy-efficient and powerful hardware to optimize their mining operations. By leveraging the latest technology, miners can reduce their energy consumption and operational costs. Meanwhile, increasing their chances of successfully mining new blocks and earning rewards.

However, the increased costs associated with upgrading equipment and improving energy efficiency might disproportionately affect smaller miners. These smaller mining operations often lack the financial resources to compete with larger, well-funded mining pools.

As a result, some smaller miners may be forced to exit the market. They may also be forced to consolidate with larger mining operations to share resources and mitigate risks.

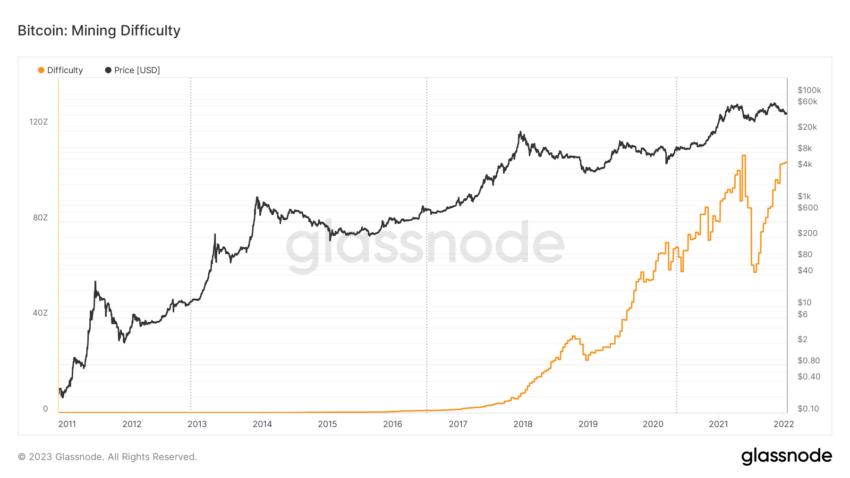

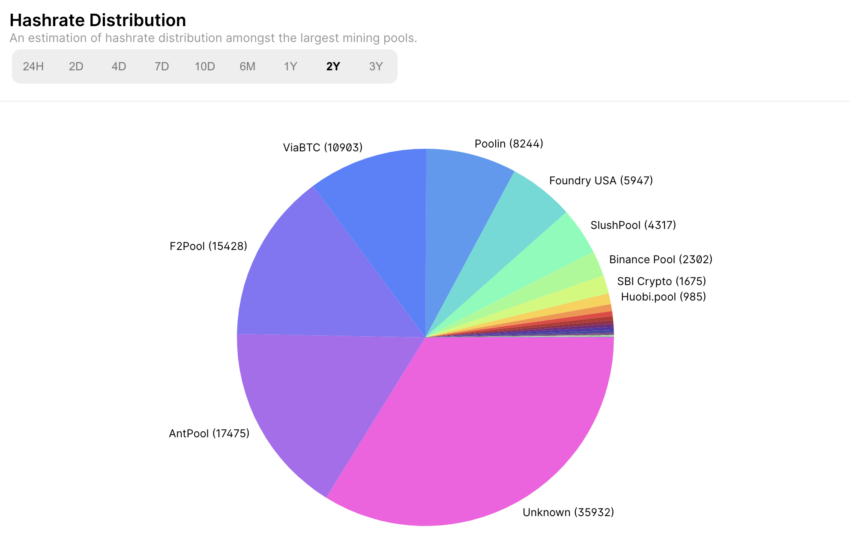

This potential exit of smaller miners could lead to further mining centralization, with an increasing share of the network’s mining power being controlled by a few large mining pools. This centralization poses a potential risk to the network’s security and resilience. It could make the network more vulnerable to attacks or manipulation.

A higher degree of centralization may also undermine one of Bitcoin’s core principles – decentralization – by concentrating influence over the network in the hands of a few entities.

Additionally, the impact of the halving on miners might lead to changes in the mining landscape, with miners seeking locations with lower energy costs or more favorable regulatory environments. This could shift the geographical distribution of mining operations and further impact the network’s decentralization.

Wider Implications for the Crypto Market

The upcoming Bitcoin halving event is expected to have broader implications for the entire cryptocurrency market. As mining rewards decrease, investors, miners, and users may turn their attention to altcoins that offer better mining rewards, more efficient consensus mechanisms, or unique value propositions that cater to specific use cases or industries.

This shift in focus could lead to increased interest in and adoption of altcoins. Therefore, impacting their prices, market capitalization, and overall relevance in the cryptocurrency ecosystem.

For instance, investors may diversify their portfolios with less susceptible cryptos to halving events’ effects. These include those using Proof of Stake (PoS) consensus mechanisms, which don’t rely on mining for network security and token distribution.

Additionally, the halving event may serve as a catalyst for technological innovation within the blockchain industry. Developers and researchers may explore new ways to optimize mining efficiency, reduce energy consumption, and enhance transaction processing capabilities.

These innovations could lead to the emergence of new consensus mechanisms, Layer-2 scaling solutions, and blockchain architectures that address the current limitations of existing networks, including Bitcoin.

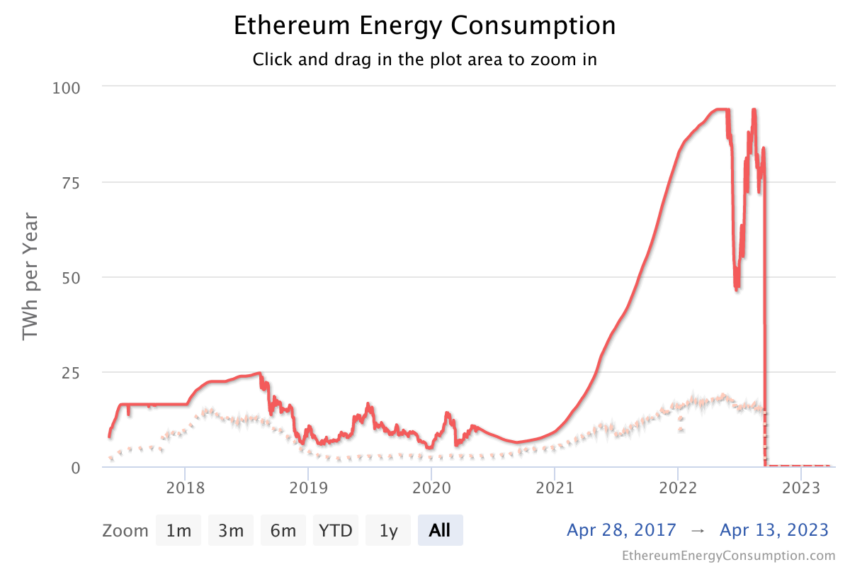

The halving event may also prompt a reevaluation of the current market dynamics. It could bring attention to the long-term sustainability of Proof of Work (PoW) networks and the impact of mining operations. This scrutiny could encourage the industry to adopt more sustainable and efficient technologies. It may also incentivize the development of novel solutions that balance decentralization, security, and environmental concerns.

Furthermore, the halving could impact regulatory developments in the cryptocurrency space. As the event garners attention from investors, governments, and financial institutions, it may trigger discussions around the appropriate regulatory framework for cryptocurrencies and the need for clearer guidelines to ensure market stability, investor protection, and compliance with existing financial regulations.

Bitcoin Halving 2024: BTC Price Prediction

The upcoming Bitcoin halving event has far-reaching implications for the crypto market. As the countdown begins, market participants must closely monitor the event and adjust their strategies accordingly.

Many investors anticipate a similar bullish trend as witnessed in previous halving events, with BTC prices reaching new all-time highs. This optimism stems from the increasing adoption of crypto, growing institutional interest, and the perception of BTC as a hedge against inflation and global economic uncertainties.

However, some cautionary factors could impact the market sentiment surrounding the 2024 halving. Regulatory developments, such as potential central bank digital currencies (CBDCs) and stricter rules for crypto exchanges and wallets, might introduce uncertainties and volatility in the market. Additionally, the increasing environmental concerns surrounding Bitcoin mining and the rise of more energy-efficient cryptos could influence investors’ perception of Bitcoin’s long-term value proposition.

Institutional investors will play a crucial role in shaping the market sentiment during the 2024 halving. As they continue to accumulate and allocate resources to crypto, their strategies and reactions to the halving event will significantly impact Bitcoin’s price and the broader cryptocurrency market.

These investors will likely weigh the potential returns from Bitcoin against the risks posed by regulatory changes and competition from altcoins.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.