Nansen unveils new tool to track smart funds and real-time trading moves

Share this article

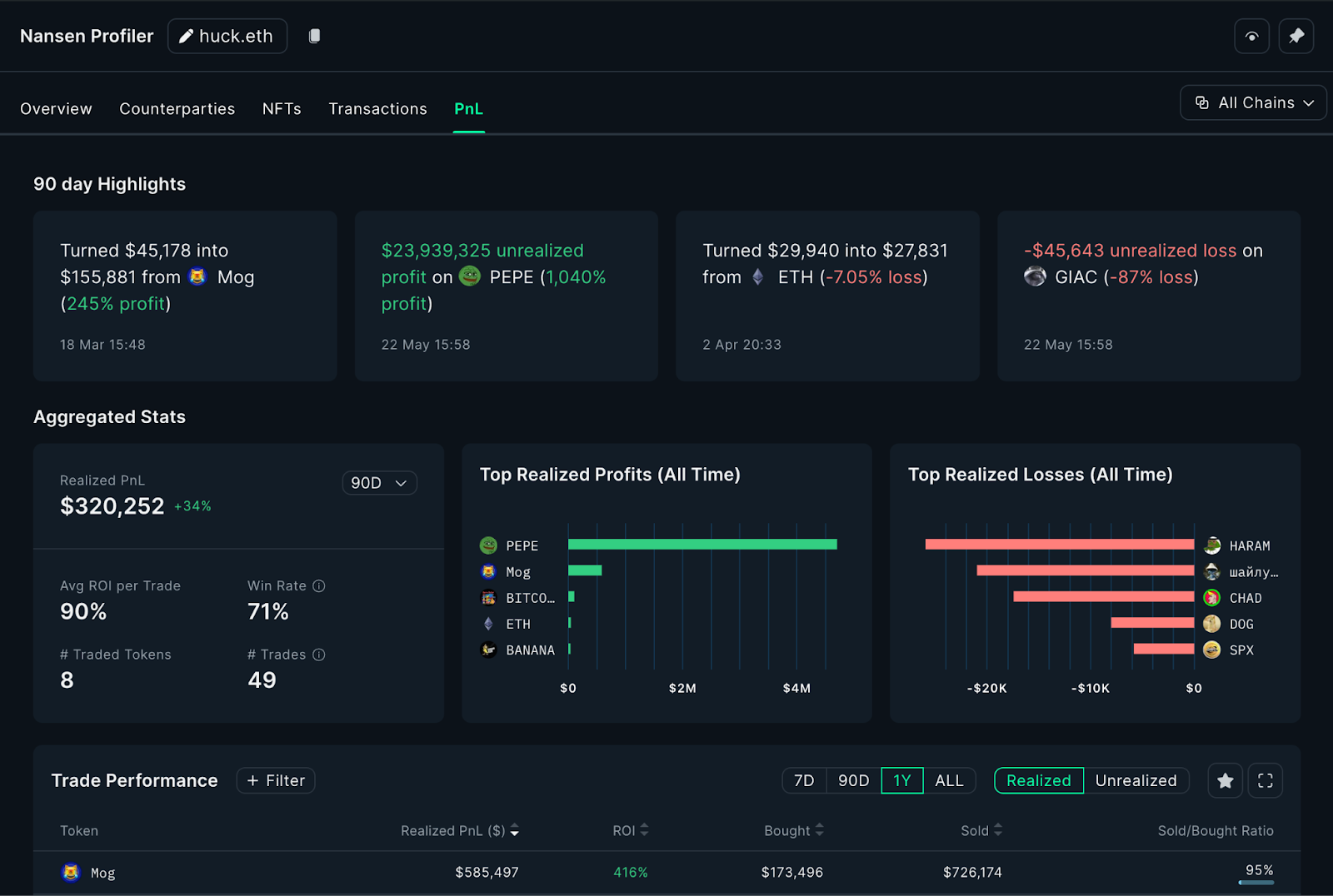

Nansen, the leading on-chain analytics platform, has launched a new Profiler PnL feature that enables crypto investors to track and analyze the performance of top investors across multiple blockchain networks, including Ethereum, Base, and Arbitrum, according to a recent press release shared by the company.

The Profiler offers a suite of metrics, such as average return on investment (ROI), win rates, and specifics on the best and worst trades, Nansen noted. The tool is designed to provide insights into both realized and unrealized profits and losses per token.

Moreover, users can set up alerts to track the investment moves of leading traders in real-time. This allows them to mimic strategies that have shown profitable outcomes.

With this feature, Nansen aims to provide analytics that help investors uncover hidden opportunities within wallet activities.

According to the team, the PnL feature already showcased its utility with memecoin trader huck.eth, who yielded an unrealized profit of over $23 million on PEPE and a 90% average ROI per trade.

In addition to this launch, Nansen said it has improved its system to better categorize funds. The team expects enhanced fund categorization to help users distinguish between the most successful and consistent players, labeled Smart Funds, and other market participants.

Similar to the PnL feature, the Smart Money Fund label revealed the success of entities like Kronos Research, with substantial profits and high ROIs on various tokens, said Nansen.

Alex Svanevik, CEO of Nansen, said the latest upgrades not only increase transparency in DeFi analytics but also provide actionable insights that empower experienced traders and newcomers to optimize their strategies and potentially enhance their returns.

“It brings a new level of transparency to the table,” said Svanevik. “Users can now track and understand the trading moves and performance of top players in the industry, getting key insights into their strategies. Whether you’re a big name or a savvy investor, this feature helps you stay informed and make confident decisions.”

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight – and oversight – of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.