How to Use Trading Tools to Navigate Market Volatility

Editorial Note: The following content does not reflect the views or opinions of BeInCrypto. It is provided for informational purposes only and should not be interpreted as financial advice. Please conduct your own research before making any investment decisions.

Recent extreme market volatility has brought liquidation events to the forefront of contract trading discussions. According to Coinglass, on January 14th, 2024, global crypto liquidations amounted to a staggering $800 million, impacting 264,389 users. The largest single liquidation was on Binance’s ETHUSDC contract, totaling $24.95 million.

Such frequent liquidations highlight not only the market’s extreme volatility but also traders’ challenges in predicting market trends. This is where candlestick charts and their associated indicators emerge as essential tools, helping users analyze trends, forecast price movements, and develop scientific trading strategies.

Gate.io Supports 11 Types of Candlestick Indicators

Candlestick charts are indispensable for traders, offering insights into market trends and aiding in precise trade timing. Gate.io offers a diverse set of indicators categorized into two types:

Main Chart Indicators. These overlay directly onto the candlestick chart, aligning with price movements. Examples include:

Support/Resistance Lines

Moving Average (MA)

Exponential Moving Average (EMA)

Bollinger Bands (BOLL)

Parabolic SAR (SAR)

Sub-Chart Indicators. These appear below the candlestick chart, offering supplementary analysis. These include:

MACD (Moving Average Convergence Divergence)

KDJ

RSI (Relative Strength Index)

WR (Williams %R)

OBV (On-Balance Volume)

StochRSI

Both novice and experienced traders can leverage these indicators. Beginners may find MA and BOLL useful for spotting trends, while seasoned traders often combine tools like MACD and RSI for deeper market analysis and refined strategies.

Gate.io Offers 10 Drawing Tools for Advanced Analysis

Drawing tools play a crucial role in technical analysis, helping traders visualize key price levels, trends, and potential market patterns. Gate.io offers a variety of drawing tools for precise market analysis:

Line Tools: Trend lines, horizontal lines, vertical lines, and rays to map market movements.

Shape Tools: Channels, rectangles, and parallelograms to highlight trading ranges and patterns.

These tools help users identify support/resistance levels, trendlines, and potential breakout points. Saved drawings enable long-term trend analysis, improving decision-making accuracy.

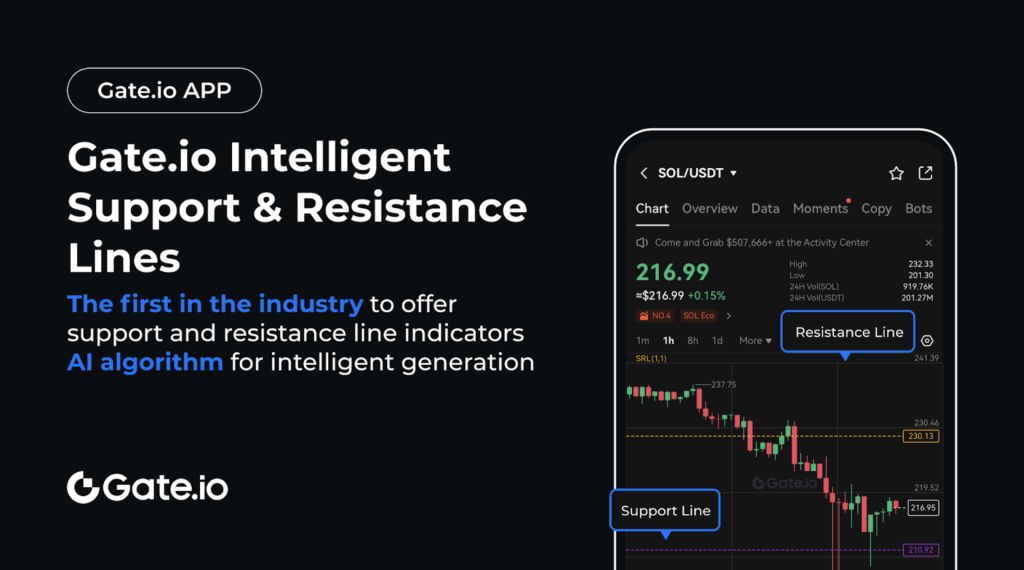

Smart Support and Resistance Lines: A Game-Changer in Trading

In the fast-moving crypto market, precision trading tools are essential. Gate.io’s Smart Support and Resistance Lines leverage AI algorithms and BOLL20 indicators to automatically detect critical market levels. These lines act as “signposts” for price reversals or breakouts, helping traders decide when to hold, buy, or sell.

Advantages:

Automation and Precision: AI eliminates manual errors and saves time.

Ease of Use: Intuitive for beginners while offering robust functionality for experts.

Enhanced Strategies: Simplifies stop-loss and take-profit planning, optimizing trade execution.

1-Second Candlestick Charts: Precision Analysis for Rapid Markets

Gate.io’s 1-second candlestick charts provide real-time price changes at a second-level frequency, offering unparalleled market precision. While similar tools often come with fees on other platforms, Gate.io provides this service free of charge for spot, margin, and contract markets.

By providing high-frequency data, this feature helps both novice and professional traders refine their strategies. In 2025, Gate.io plans to introduce additional tools such as liquidation charts and basis rate indicators, further enhancing its analytical suite.

Practical Case Study: Enhancing Decisions with Indicators and Tools

By applying support and resistance indicators on a candlestick chart:

Near Support Lines: Price may rebound, signaling a potential buy opportunity.

Near Resistance Lines: Price may face resistance, indicating a sell or observation point for breakouts.

Through practical application, traders can combine these tools with other indicators to refine their strategies and achieve greater success in volatile markets.

Gate.io’s extensive suite of tools and indicators empowers traders to confidently navigate the complexities of the crypto market, mitigate risks, and seize profitable opportunities.

Using the BOLL Indicator to Identify Consolidation Ranges

In a sideways (consolidation) market, the BOLL (Bollinger Bands) indicator helps traders gauge price volatility and identify potential reversal points.

When the price approaches the upper band, it may indicate overbought conditions, potentially leading to a pullback.

When the price nears the lower band, it may signal oversold conditions, increasing the likelihood of a rebound.

Using Fibonacci Retracement to Analyze Support and Resistance

The Fibonacci Retracement tool is a widely used technique for pinpointing key support and resistance levels in market trends.

In an uptrend, traders apply the tool by selecting the lowest price as the starting point and the highest price as the ending point.

The system automatically calculates and plots retracement levels, which act as potential support zones during pullbacks or resistance zones for rebounds.

By analyzing price reactions at these levels, traders can make more precise predictions about future market movements.

These real-world examples illustrate how different indicators and tools offer distinct insights into varying market conditions. By integrating these tools, traders can build structured strategies, minimize uncertainty in decision-making, and enhance trading performance in volatile market conditions.

In today’s rapidly evolving and highly volatile crypto market, the use of scientific tools and indicators has become essential for traders. Technical analysis methods not only enhance the accuracy of trading decisions but also provide deeper market insights for participants.

Applying these tools effectively enables traders to make informed, data-driven decisions, manage risks proactively, and optimize returns in an ever-changing market.

Disclaimer: The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please be noted that Gate.io may restrict or prohibit the use of all or a portion of the Services from Restricted Locations. For more information, please read the User Agreement.

Disclaimer

This article contains a press release provided by an external source and may not necessarily reflect the views or opinions of BeInCrypto. In compliance with the Trust Project guidelines, BeInCrypto remains committed to transparent and unbiased reporting. Readers are advised to verify information independently and consult with a professional before making decisions based on this press release content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.