How ‘Bitcoin With Smart Contracts,’ Ethereum Classic, Outperformed ETH

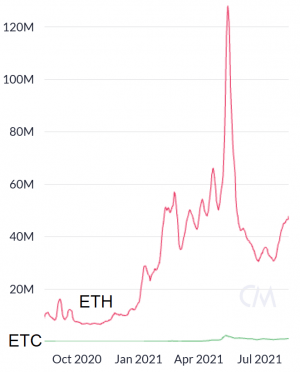

Ethereum Classic (ETC) has had as good a bull market as pretty much every other top-50 cryptoassets out there. Long neglected by virtue of its well-documented vulnerability to 51% attacks, it nonetheless outperformed Ethereum (ETH) on various days in May, while enjoying a nearly 2,900% rise in trading volume.

It continued to attract attention at the end of June, when it posted an 80% surge in just over a week, and capped off a 200% rise in one quarter. For those who’d grown used to disregarding the cryptoasset and its blockchain, such rises caused them to sit up and take notice, wondering what exactly was driving this growth.

Well, according to industry players, interest in ETC has been caused by a combination of Ethereum’s transition to proof-of-stake (PoS) and an increase in development work. As such, they expect Ethereum Classic to have long-term viability as a smart contract platform with a commitment to proof-of-work (PoW) and a supply cap.

Ethereum Classic and Ethereum 2.0

On January 1, ETC was priced at around USD 6. However, it rose to USD 167 by May 6, representing an increase of 2,847% in roughly five months.

At the time of writing, ETC, ranked 21st by market capitalization, trades at USD 64 and is up by 821% in a year, compared with ETH’s 671%. (But ETH outperformed ETC in the past month.)

However, ETC is still far away from ETH when it comes to usage and adoption of this original Ethereum blockchain.

Active addresses count

__

Miner revenue, USD

In either case, for the long term supporter of ETC, IOHK, the company behind Cardano (ADA), such increases in the price have been caused by a number of factors.

“In 2021, crypto experienced a bull market. During this time ETC has indeed attracted a lot of attention given that Ethereum 2.0 is just around the corner and with moving from proof-of-work to proof-of-stake consensus algorithms, even Vitalik Buterin notes that developers that want to remain on PoW would most likely move to the ETC ecosystem, as would miners who will no longer be viable on a proof-of-stake chain,” Tim Richmond, a communications manager at IOHK, told Cryptonews.com.

According to him, the approach towards Ethereum 2.0 has sparked a huge influx of interest in Ethereum Classic and how it can be leveraged.

However, according to Bob Summerwill, Executive Director of ETC Cooperative, the entity tasked with the development and growth of the ETC protocol, Ethereum 2.0 isn’t the only reason for Ethereum Classic’s recent good fortunes.

“The return of IOHK to the ETC ecosystem has made a big difference in the perception of ETC, I think. IOHK has around 20 people working on their Mantis client; Charles Hoskinson recently joined the board of the ETC Coop,” he told Cryptonews.com.

Summerwill also noted that IOHK and the Ethereum Classic Cooperative have collaborated on introducing the Ethereum Classic Treasury System, which is a decentralized funding platform focused on maintaining and developing ETC.

Such an open commitment to improving the capabilities and security of Ethereum Classic has generated renewed interest in ETC, from a number of sources.

“With large institutions showing an interest, and constant news reaching the mainstream like Digital Currency Group buying USD 50m of Ethereum Classic Grayscale Shares, there is increased overall market confidence,” said Tim Richmond.

Miner migrations

In particular, Ethereum Classic rolled out its much-anticipated Magneto upgrade in July. This reproduced Ethereum’s Berlin upgrade on ETC, providing a series of optimizations for gas usage and security.

It’s this kind of upgrade that has helped renew confidence in ETC, yet Ethereum’s aforementioned transition to Ethereum 2.0 — and proof-of-stake — is another. With Ethereum’s miners being shut out, there’s an expectation that a significant portion of them may move to Ethereum Classic.

“It is hard to tell what will happen, but ETC would seem an obvious target for ‘refugee’ ETH miners following the transition to PoS, yes,” said Bob Summerwill.

Tim Richmond agrees that Ethereum Classic could likely be the main target for displaced Ethereum miners.

“Miners may have to choose new chains if all dapps move to ETH 2.0 [rather than staying with ETH 1.0], and Ethereum Classic is a natural choice as the Ethereum GPU hardware that miners rely on is compatible with the Ethereum Classic mining algorithm, and very few operational changes would need to be made,” he said.

Richmond noted that a substantial inflow of miners would go quite a long way to improving Ethereum Classic’s security, in the sense of reducing the likelihood of a 51% attack.

That said, he noted that Ethereum Classic is already taking steps towards improving its robustness on its own account.

“IOHK has proposed in ECIP 1097 (Ethereum Classic Improvement Proposal) a mechanism (CheckPointing) to mitigate such 51% attacks. The core idea is to employ an external set of parties that securely run an assisting service that guarantees the ledger’s properties and can be relied upon at times when the invested hashing power is low,” he explained.

Likewise, Bob Summerwill also affirmed that Ethereum Classic doesn’t need migrating miners to grow, even if they would provide enhanced security.

“ETC can and will grow on its own, irrespective of what happens with those ETH miners, though,” he said, adding that miners tend to follow price action.

Future hopes

Another thing that Summerwill and Richmond agree is that Ethereum is staking and will stake a claim to a unique status within the crypto ecosystem.

“There is a strong value proposition for a smart contract with a long-term commitment to PoW — essentially ‘Bitcoin with smart contracts’,” said Summerwill.

Similarly, Richmond argues that ETC’s cap (to ETC 210m, out of a current supply of ETC 128.8m) allows it to combine some of the best elements of Bitcoin (BTC) with those of Ethereum.

“The Ethereum Classic blockchain is an excellent proposition and home for Ethereum developers as it offers both a store of value given the limited supply; alongside the ability to run smart contracts given it is an EVM [Ethereum Virtual Machine] implementation. ETC can be thought of as programmable gold and as a result, it is especially attractive for those in the DeFi, NFT, and DAO spaces,” he said.

Accordingly, Richmond expects Ethereum Classic to continue attracting investors, developers and community members. And this might be helped by its ongoing development, which should make it more usable and more secure.

He says, “ETC project Mantis is proposing innovative functionalities such as Prism (increased throughput), flyClients (for lightweight clients without requiring to run a full node), and more.”____Learn more: – Ethereum Miners Can Transition to These Coins and Boost Their Values- 6YO Cardano Still Compensates Lack Of Adoption With Plans & Hopes

– One Old Presentation by Buterin Brings an Unresolved Ethereum Issue Again- It’s Time to Build Ethereum Beyond DeFi and Price Focus – Vitalik Buterin