Grayscale Files Lawsuit Against SEC Over Spot Bitcoin ETF Rejection – Finance Bitcoin News

Grayscale Investments, the world’s largest digital currency asset manager, has filed a lawsuit against the U.S. Securities and Exchange Commission (SEC) challenging the securities regulator’s decision to reject its application to convert the Grayscale Bitcoin Trust to a spot bitcoin exchange-traded fund (ETF).

Grayscale Takes SEC to Court Over Spot Bitcoin ETF Application

Grayscale Investments filed a “petition for review” Wednesday challenging the decision by the U.S. Securities and Exchange Commission (SEC) to deny the company’s application to convert the Grayscale Bitcoin Trust (GBTC) to a spot bitcoin exchange-traded fund (ETF).

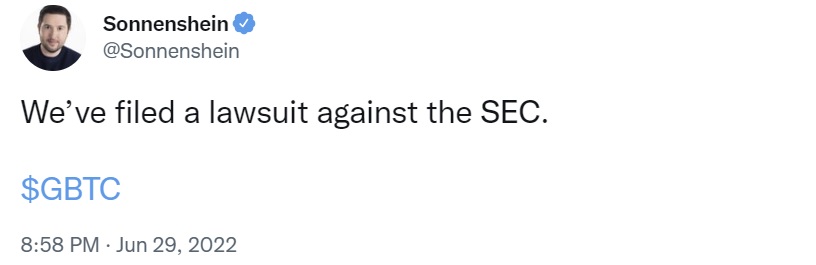

Michael Sonnenshein, Grayscale’s CEO, tweeted soon after the SEC rejected his company’s application: “We’ve filed a lawsuit against the SEC.”

Sonnenshein commented: “We are deeply disappointed by and vehemently disagree with the SEC’s decision to continue to deny spot Bitcoin ETFs from coming to the U.S. market.” He added:

We believe American investors overwhelmingly voiced a desire to see GBTC convert to a spot bitcoin ETF, which would unlock billions of dollars of investor capital while bringing the world’s largest bitcoin fund further into the U.S. regulatory perimeter.

Donald B. Verrilli Jr., Grayscale’s senior legal strategist and former U.S. solicitor general, detailed:

The SEC is failing to apply consistent treatment to similar investment vehicles, and is therefore acting arbitrarily and capriciously in violation of the Administrative Procedure Act and Securities Exchange Act of 1934.

The lawyer continued: “There is a compelling, common-sense argument here, and we look forward to resolving this matter productively and expeditiously.”

Do you think Grayscale will win against the SEC? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.