Grayscale Considering 25 More Crypto Assets for Investment Products – Altcoins Bitcoin News

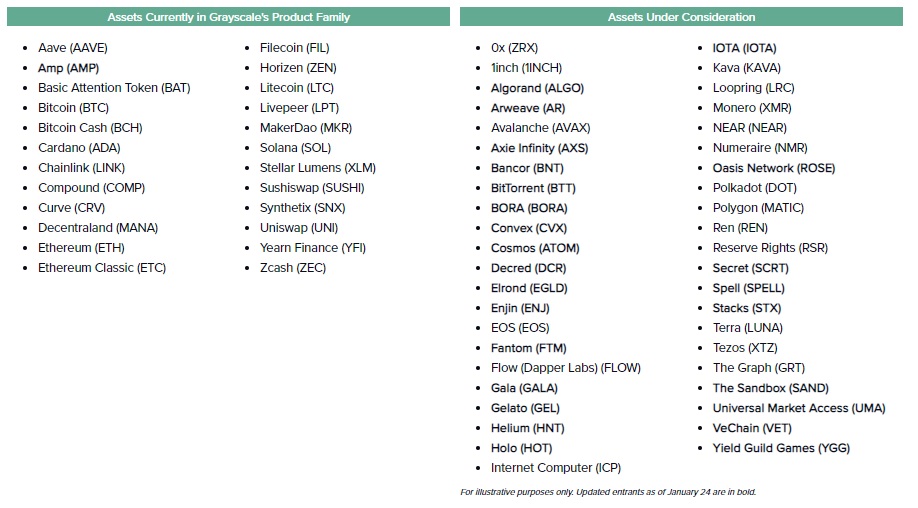

Grayscale, the world’s largest crypto asset manager, is considering 25 more crypto assets for investment products. With the latest additions, the company’s list of coins under consideration has grown to 43. “The process of creating an investment product similar to the ones we already offer is a complex, multifaceted process,” said Grayscale.

25 Crypto Assets Added to List of Coins Under Consideration for Grayscale’s Investment Products

Grayscale Investments announced Monday that it has updated its list of digital assets under consideration for 2022. Grayscale currently has $30.6 billion in net assets under management.

The company explained that the “Assets Under Consideration” list comprises “some digital assets that are not currently included in a Grayscale investment product, but that have come to our attention as part of our exploration of this sector, and that our team has identified as possible candidates for inclusion in a future investment product.” Grayscale detailed:

With our most recent update in January 2022, we’ve added one additional asset to our product family column, and 25 assets to our assets under consideration column.

Amp (AMP) is the only digital asset added to Grayscale’s product family.

The 25 additional assets under consideration are Algorand (ALGO), Arweave (AR), Axie Infinity (AXS), Bancor (BNT), Bittorrent (BTT), Bora (BORA), Convex (CVX), Cosmos (ATOM), Decred (DCR), Elrond (EGLD), Enjin (ENJ), Fantom (FTM), Gala (GALA), Gelato (GEL), Helium (HNT), Holo (HOT), Iota (IOTA), Oasis Network (ROSE), Secret (SCRT), Spell (SPELL), Stacks (STX), The Sandbox (SAND), Universal Market Access (UMA), Vechain (VET), and Yield Guild Games (YGG).

Grayscale added:

The process of creating an investment product similar to the ones we already offer is a complex, multifaceted process.

“It requires significant review and consideration and is subject to our internal controls, custody arrangements, and regulatory considerations, among other things,” the asset management firm elaborated.

What do you think about Grayscale considering 43 crypto assets for investment products? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.