Government Set to Present Virtual Asset Bill to Parliament – Regulation Bitcoin News

The Botswana government is set to present a “Virtual Asset Bill” to the country’s parliament, a move that could see it become one of the first countries in Africa to have laws regulating cryptocurrencies.

Preventing the Proliferation of Risks Associated With Cryptos

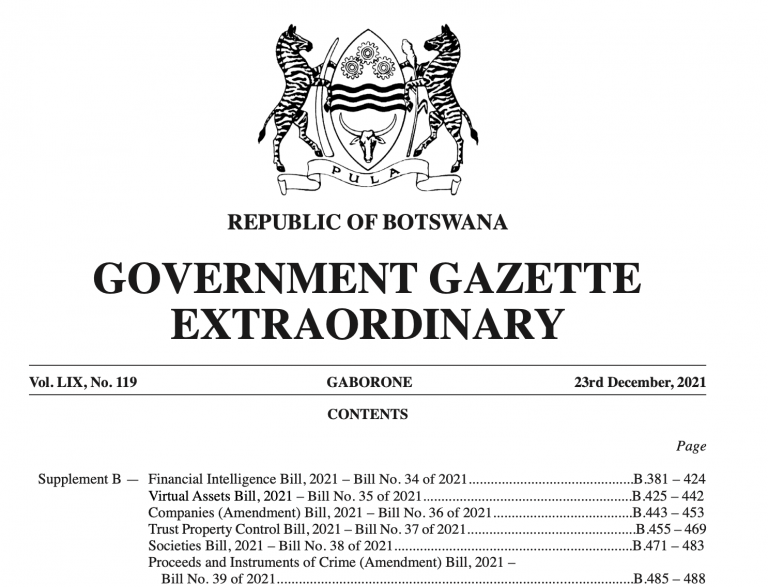

A Botswana government draft document that proposes to regulate new and developing virtual assets businesses, as well as to provide a regulatory body with its functions and powers, is now set to be presented before the country’s lawmakers, a recent government gazette has shown.

The planned presentation of the Virtual Asset Bill alongside other bills such as the Financial Intelligence Bill comes just over two months after the country’s central bank warned residents engaged in cryptocurrency trading that Botswana does not have a regulatory framework to govern such trading.

Yet, in the draft that was published in the Extraordinary Government Gazette on December 23, Botswana authorities suggest they are not only seeking to recognize crypto trade but plan to include “provisions for managing, mitigating and preventing money laundering and financing of terrorism” into the proposed law. The draft also seeks to prevent the proliferation risks that are associated with virtual assets and new emerging business practices and technologies.

Concerning companies or entities that issue tokens, the draft bill states:

Part III further provides that the Regulatory Authority may grant a licence if the applicant demonstrates that it has the necessary infrastructure and resources to carry out the business activities of a virtual asset service provider or issuer of initial token offerings and that the applicant is a fit and proper person. The definition of “fit and proper” is provided for in clause 11 (2) consistently with the provisions of the Financial Intelligence Act.

Elsewhere, the draft explains the instances where the regulator can grant an operating license to applicants. For their part, license holders are expected to protect assets belonging to clients. They are also expected to “prevent market abuse and provide measures for the acquisition of a beneficial interest in their businesses.”

White Paper Issuance Mandatory

With respect to the advertisement of token offerings, the draft states:

“Part IV further provides that a licence holder shall issue a white paper that contains full and accurate information for potential purchasers of virtual assets and initial token offerings to make informed decisions.”

Meanwhile, some crypto enthusiasts have speculated that Botswana’s proposal to amend its financial laws could be linked to the country’s removal from the Financial Action Task Force’s (FATF) graylisted countries in October 2021. The FATF had previously cited deficiencies in the country’s anti-money laundering (AML) and counter-terrorist financing (CTF) regimes as reasons for flagging the country.

However, in late 2021 — nearly three years after grey-listing — the FATF said it had removed Botswana from the list after noting some improvement.

What are your thoughts on this story? You can share your views in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.