Ethereum (ETH) Price Retreats, Exchange Supply Plummets

Ethereum price scored big gains after the successful Shanghai Upgrade to reach $2,150. A month later, Ethereum is down 14%. However, critical on-chain data shows that the positive impact of Network Upgrade could now lead strategic investors to start making bullish ETH price predictions.

A month after the Shanghai Upgrade, Ethereum appears to dispel bearish concerns related to fresh ETH 2.0 withdrawals. This comes as investors have begun to move coins off exchanges. With staking deposits also hitting new-high, here’s how bullish investors are positioning for the next price rally.

Ethereum Supply on Exchanges Has Dropped to an All-Time-Low

According to data from the on-chain analytics platform Santiment, ETH supply on exchanges is now at its lowest since the cryptocurrency started trading publicly in July 2015.

The Supply on Exchanges metric evaluates the number of Ethereum coins that are currently deposited in recognized exchange wallets.

The yellow line in the chart below depicts how the number of ETH Supply on Exchanges has entered a sharp decline since May 1. Between May 1 and May 15, investors moved 550,000 ETH off of exchanges.

Notably, ETH supply on exchanges dropped to a new all-time low of 12.4 million on May 11.

When the liquid balance of a cryptocurrency available on exchanges declines considerably, it causes a relative scarcity across the markets which often triggers a price surge.

Turbulent macroeconomic conditions have seen ETH experience price corrections in recent weeks. But, if investors continue to move coins off exchanges, the positive ETH price prediction could be validated once the market sentiment shifts.

Rather than Sell, Investors Are Staking ETH to Earn Yield

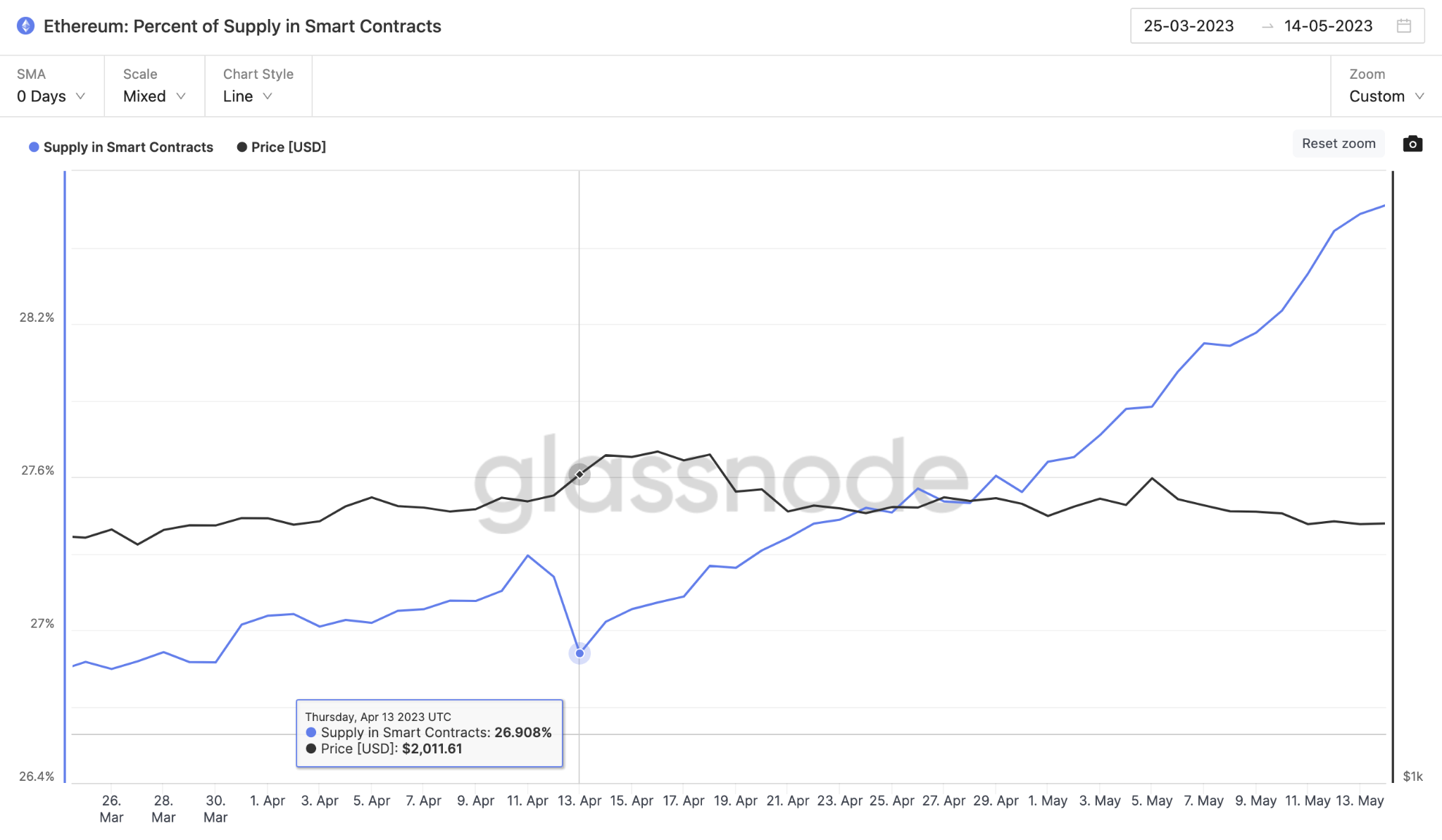

As the network upgrade approached, bearish investors aired concerns that millions of ETH unstaked could trigger a massive sell-off and a price crash. But the Supply in Smart Contracts data now shows that most ETH 2.0 investors are re-staking their coins to earn yield rather than sell.

Supply in Smart Contracts tracks the percentage of a cryptocurrencies’ total circulating supply that holders have locked up across various DeFi protocols.

When it increases, it causes a momentary decrease in the supply of tokens available to be traded on exchanges. This could put upward pressure on the price of the underlying coin.

Between April 13 and May 15, investors have now locked up an additional 2.15 million ETH coins (1.76% of total circulation supply) in smart contracts.

At current prices of $1,800, the recently locked-up ETH coins are worth approximately $3.9 billion. This shows that most ETH 2.0 un-stakes appear to be investing their newly-withdrawn coins into the Ethereum ecosystem.

This could be attributed to the fact that most stakers are unwilling to sell because the current ETH prices are still much lower than their purchase price.

Also, the increased burn rate has placed deflationary pressure on ETH, boosting investors’ confidence in potential price gains.

In summary, when investors move huge amounts of coins of exchanges within a short period while increasing the smart-contract staking, it can be bullish for various reasons.

Firstly, staking incentives can reduce the chances of a massive sell-off. Secondly, it increases security and provides much-needed liquidity for projects built on top of the Ethereum network to develop.

The bullish Ethereum price prediction could soon be validated if both trends continue.

ETH Price Prediction: Bulls Can Reclaim $2,100

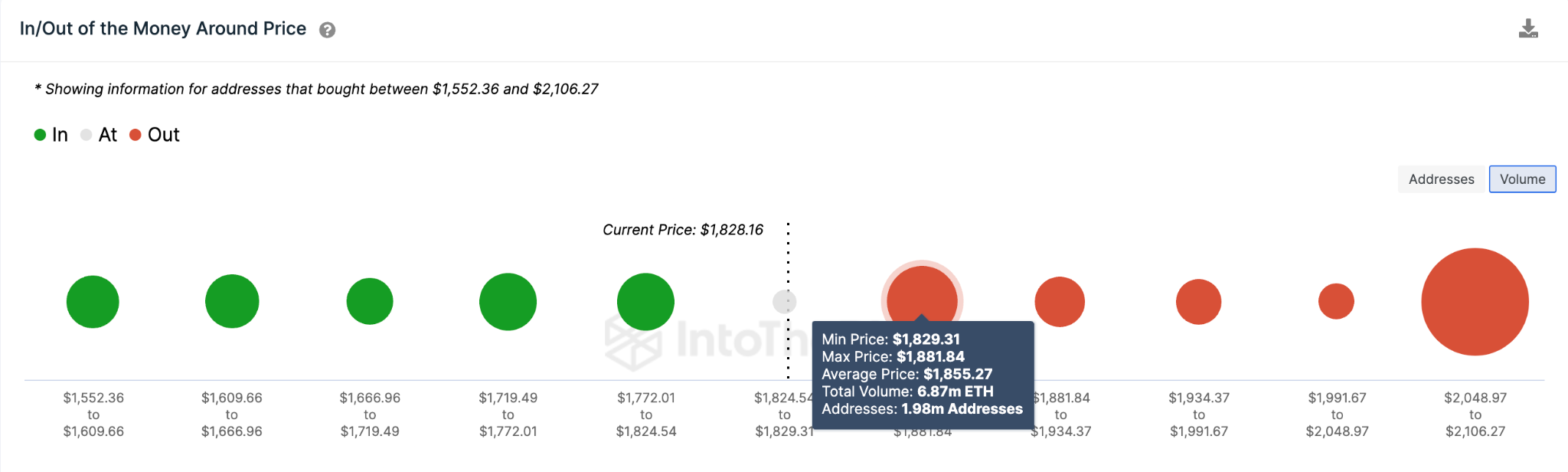

IntoTheBlock’s In/Out Money Around Price data points towards a possible rally toward $2,100 if market sentiments shift significantly. But to be confident of the bullish ETH price prediction, Ethereum must first clear the initial $1,855 resistance.

At that zone, 1.98 million investors that bought 6.87 million ETH at the average price of $1,855. This poses a firm resistance.

But if the bulls can garner enough momentum to push past $1,855, the ETH price rally could reach $2,100 again.

However, key resistance levels can be seen at crucial buying points such as $1,900 and $2,000 respectively. Both these clusters have approximately 4.21 million ETH distributed between 3.75 million wallets.

Still, the bears could invalidate the positive Ethereum price prediction if the ETH price drops below $1,772. But, the 2.58 million investors that bought 3.48 million ETH at the average price of $1,772 will likely prevent it.

If that support level cannot hold, it could trigger a much larger decline toward $1,650.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.