Digital Collectible Owners Continue to Take Loans out Using NFTs as Collateral – Blockchain Bitcoin News

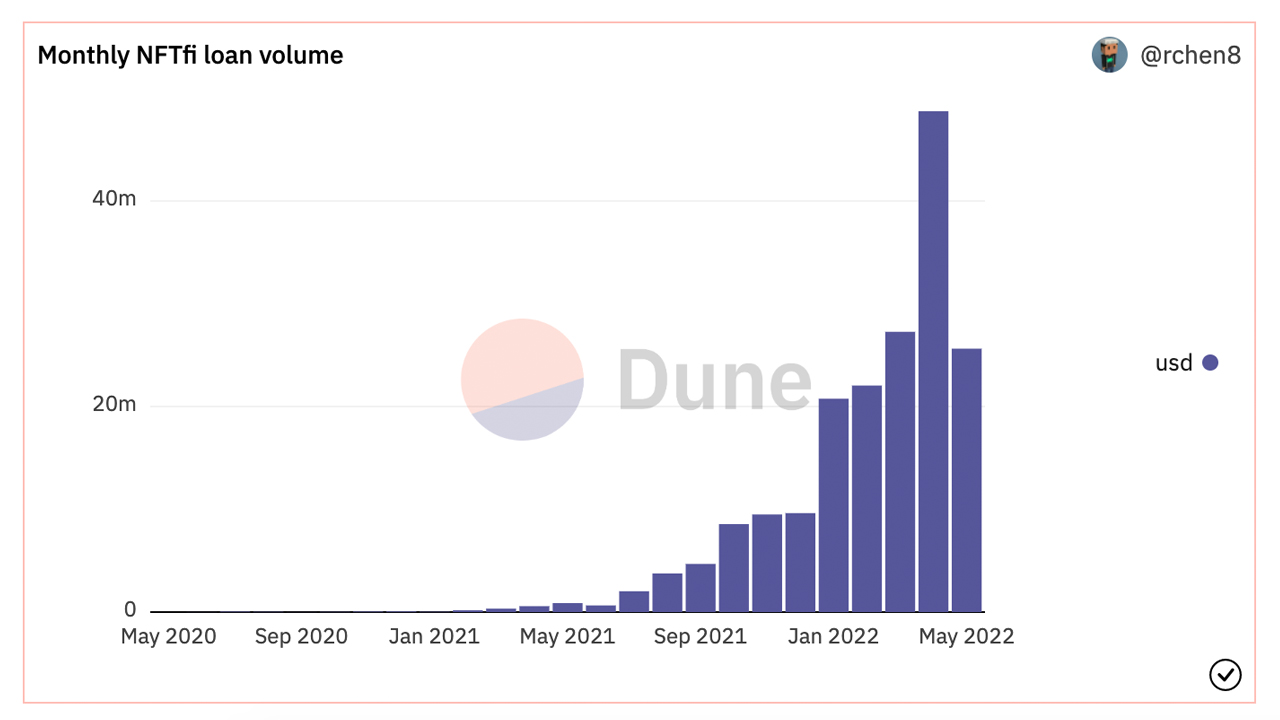

While non-fungible token (NFT) collectibles have become a hot commodity over the last 12 months, a number of NFT owners are taking loans out against their NFTs. This month, a project called Nftfi has facilitated $25.6 million in NFT loans so far, and last month the lending marketplace recorded nearly $50 million in NFT loans.

NFT Lending and Borrowing Continues to Grow

NFTs have become a billion-dollar industry during the last year and a popular blockchain technology use case. Even though sales have slid in recent times amid the crypto market downturn, NFTs are still selling for hundreds of thousands and even millions of dollars per digital collectible. In addition to the NFT sales and auctions, NFT owners are also loaning their digital collectibles for access to liquidity. For instance, a decentralized finance (defi) platform called Nftfi has seen $185.4 million in cumulative loan volume since the market’s inception.

In the last week, the peer-to-peer marketplace for NFT collateralized loans recorded four loans for more than $100K or more each. On May 16, Bored Ape Yacht Club (BAYC) 7,813 was used for a $100K loan, and Autoglyph 231 was leveraged for a $200K loan on May 12. BAYC 6,276 was used for a $150K loan on May 10, and the BAYC 371 owner was able to obtain a $115K loan for the NFT the day before. So far this month, Nftfi has facilitated $25.6 million in NFT loans, according to statistics from Dune Analytics. Nftfi is also partners with the blockchain firms Flow and Animoca Brands.

NFT Lending Competition

Nftfi is not the only NFT lending platform on the block, as there are others like Arcade, Nexo.io, and Drops. Statistics show the Drops loan market has facilitated $6,746,515 in lending. Arcade has raised $17.8 million from investors like Pantera Capital, Franklin Templeton Investments, Castle Island Ventures, and Protofund. Another competitor is the peer-to-peer NFT lending marketplace Flowty, which is built on the Flow blockchain network. Flowty raised $4.5 million in the company’s first investment round from two lead investors and 23 total.

Nftfi has a wide selection of NFTs and an assortment from a number of blue-chip digital collectible collections as well. For instance, there are ENS names, Unstoppable Domains, Axies, Doodles, Sanbox land, Otherdeeds, Hashmasks, Bored Ape Yacht Club, and Mutant Ape Yacht Club (MAYC). Just recently the platform phased out its old smart contract (Nftfi V1) on April 4, 2022, and launched a new smart contract called Nftfi V2. According to the web portal, Chainsecurity and Halborn audited the platform’s V2 smart contract.

What do you think about people lending out their NFTs for collateral to acquire a loan? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.