Decentraland (MANA) Price Prediction for March Shows Downside

The Decentraland (MANA) price could complete the final leg of its correction before resuming its previous increase.

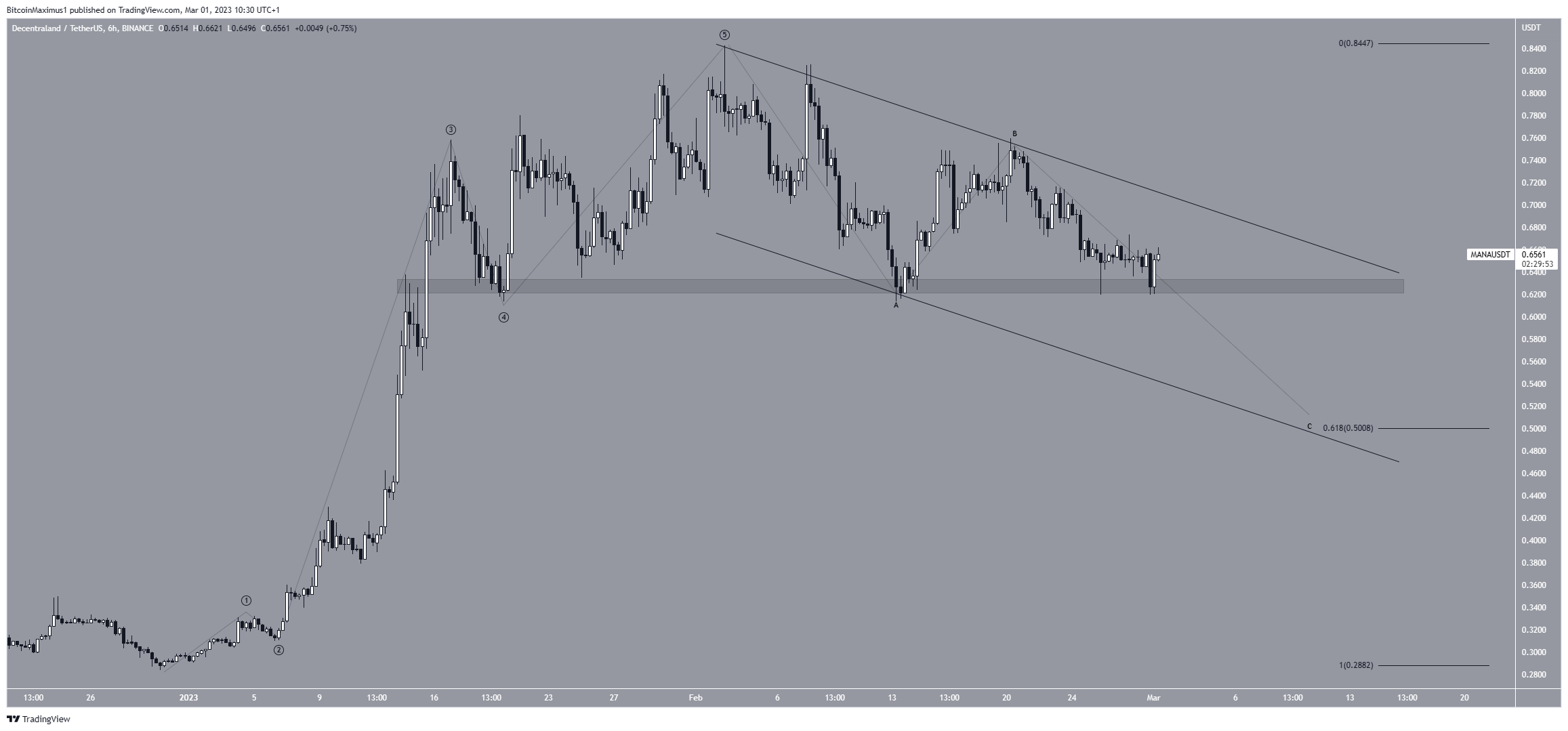

The Decentraland price has fallen below a descending resistance line since reaching a yearly high of $0.842 on Feb. 2. During the descent, the price has traded above the long-term $0.625 horizontal support area. These two structures combine to create a descending triangle, which is considered a bearish pattern. Therefore, the price is expected to break down from it.

If the price breaks down, the closest support level would be at $0.500. This is the upward movement’s 0.618 Fib retracement support level (white).

On the other hand, a breakout from the descending resistance line could lead to an increase toward $0.80.

Due to the presence of a bearish pattern and the fact that the daily RSI is below 50 (red icon), a breakdown is the most likely scenario.

Decentraland (MANA) Price Prediction for March: More Pain Before Reversal

The technical analysis from the short-term six-hour chart shows that the MANA token price completed a five-wave upward movement and could now be in the C wave of an A-B-C corrective structure (black).

If so, the digital asset’s price will soon break down from the $0.625 horizontal support area and complete its correction. If so, the support line of a descending parallel channel would coincide with the $0.500 support area. Since channels usually contain corrections, this outline would perfectly fit with the possibility of a correction.

However, as outlined previously, a breakout from the descending resistance line would invalidate this short-term bearish Decentraland price prediction for March and could lead to a drop toward $0.80.

To conclude, the most likely Decentraland price prediction for March is a drop to the $0.500 support area before the upward movement eventually continues.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.