Crypto market participation continues to dip

Key Takeaways

Trading volume, liquidity and volatility are all falling in the crypto markets

Even Bitcoin’s strong rise thus far this year has been steady and methodical rather than via sudden spikes, as in the past

Bitcoin dominance is rising, uncharacteristic during periods of price increases, highlighting a potential divergence

Regulatory crackdown is suppressing market participation through lawsuits against exchanges and heightened legal uncertainty

Volatility should return eventually, but previous six months have been the most placid in recent memory

It’s all quiet on the blockchain front.

The crypto markets continue to plod along with volume, liquidity and volatility all extraordinarily low. All across the board, the numbers point to market participation lowering incessantly.

Even Bitcoin’s rise year-to-date, which is impressive thus far at 76%, has come through steady, methodical gains. This contrasts sharply with previous bull markets, which have seen the asset spike higher in very short time periods. Then again, the market seems unsure of whether this is a bull market, a bear market, or something in between.

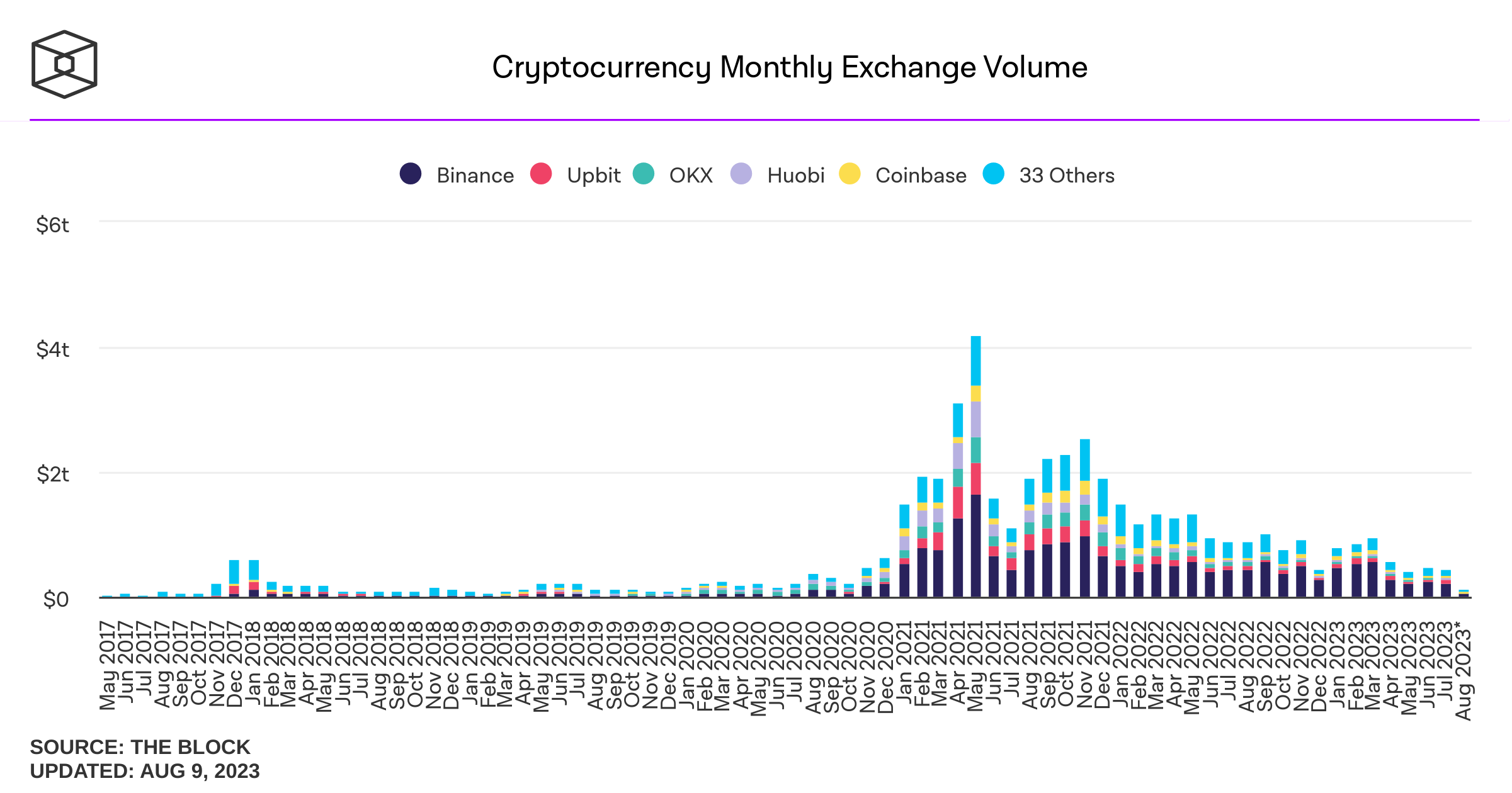

The slow but steady incline this year has come amid a further fall in trading volume. Last year, volumes on centralised exchanges fell 46%. This came amid a vicious bear market, highlighted by several scandals, such as the FTX collapse, Terra’s death spiral and numerous bankruptcies.

The year 2023 has seen the trading slump continue lower, without even the dramatic episodes of volatility such as those aforementioned scandals. The Block’s data for July has trading volumes now at levels last seen in 2020:

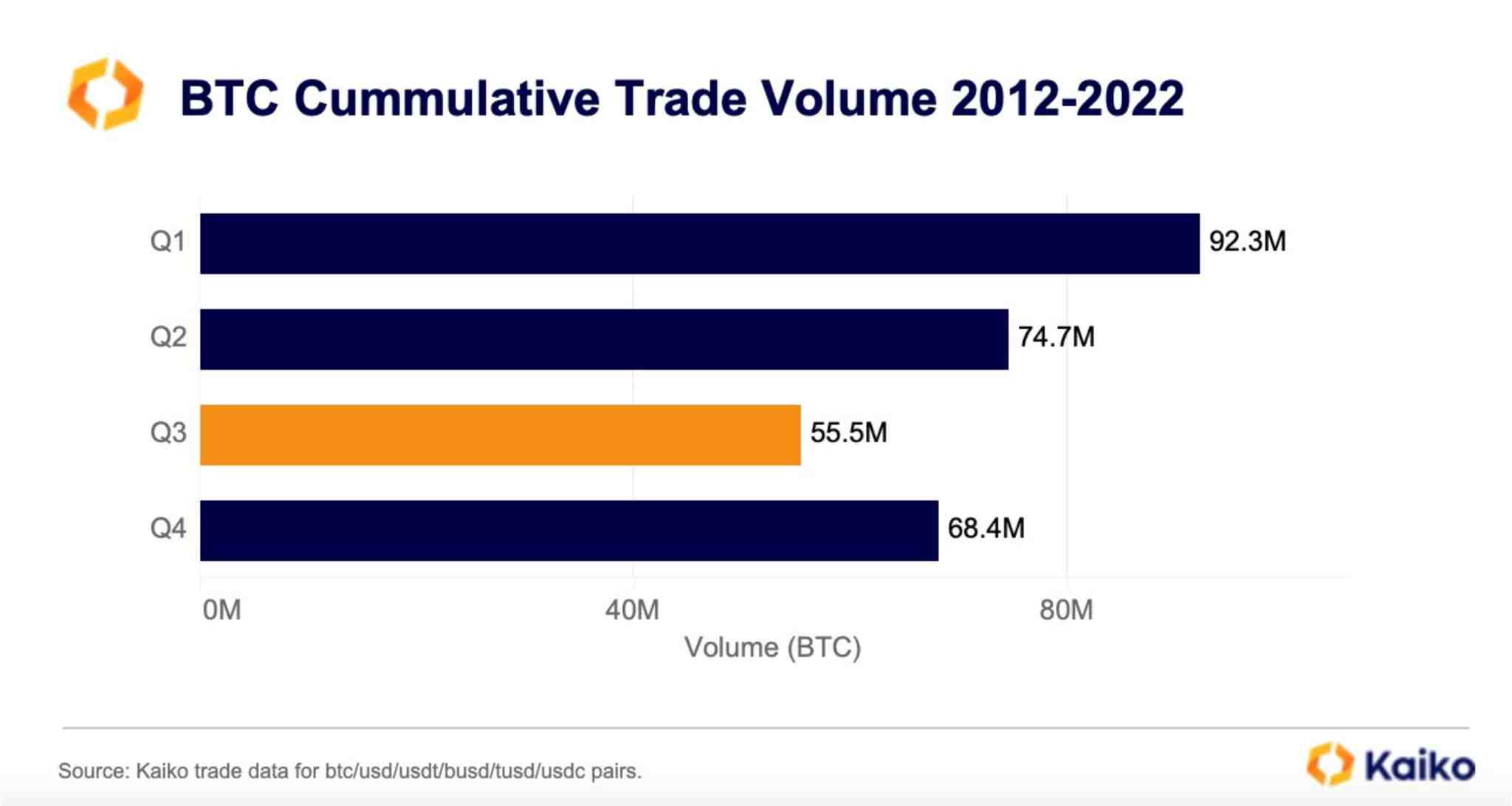

As we analysed here recently, this is partially a result of a typical summer trading lull, something which affects asset classes beyond crypto, too. The next chart from Kaiko shows this, with Q3 frequently yielding the lowest volume in Bitcoin’s short history. However, it is prudent to note that this is heavily skewed towards the last couple of years, with Bitcoin surging into mainstream consciousness and its liquidity therefore rocketing. Hence, blaming this lull on seasonality alone feels misguided.

Bitcoin dominance is rising

Looking beyond Bitcoin, altcoins have also been quiet. There have been stories of the odd meme coin (Bald and Pepe, to name a couple) that have gained attention, but in comparison to previous years, the altcoin market has been devoid of the usual intrigue.

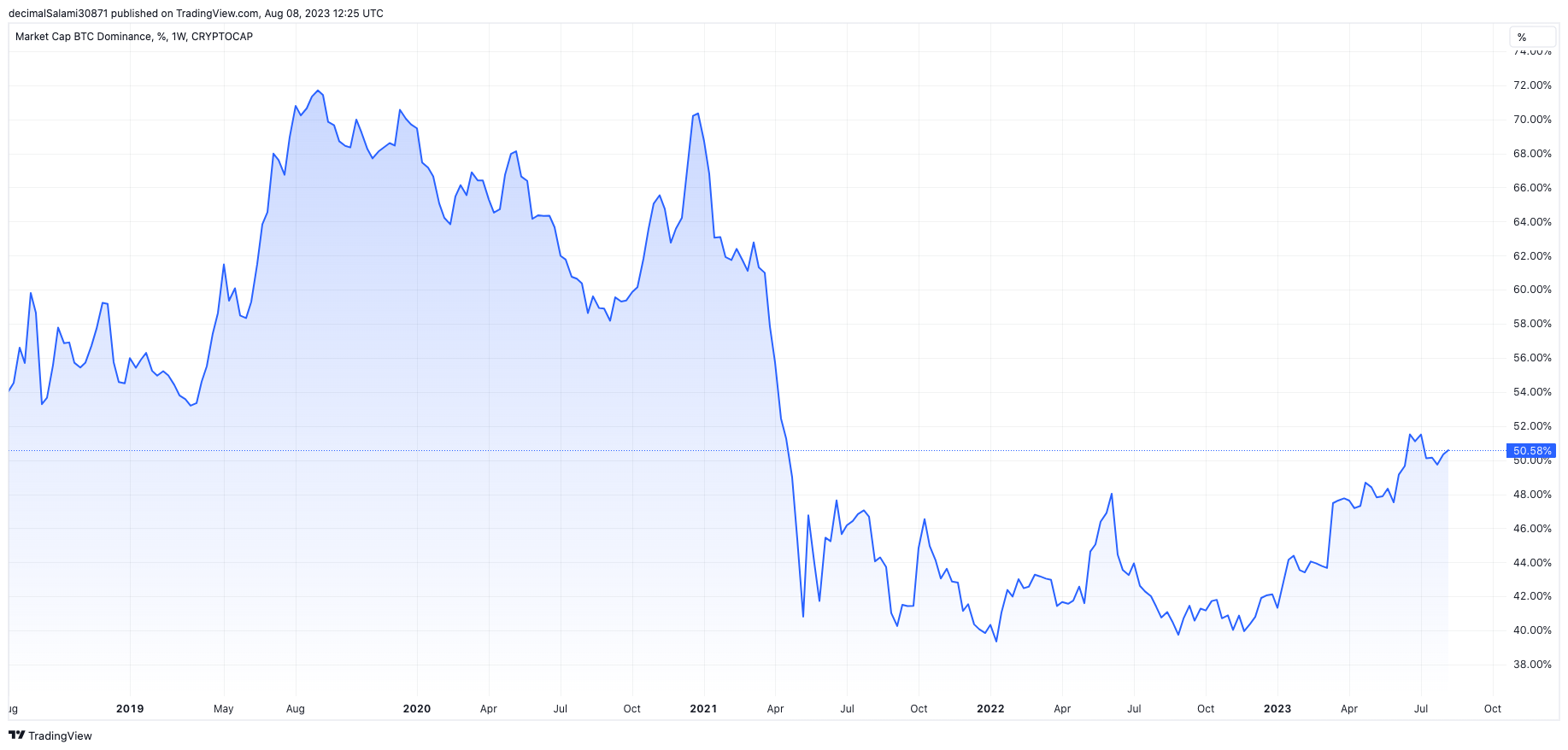

One way of looking at this is the notable rise of Bitcoin dominance, which measures the ratio of the Bitcoin market cap to the entire cryptocurrency market cap. It has risen above 50%, up from around 40% at the start of the year.

This rise in Bitcoin dominance is unusual because it has occurred during a period of price expansion across the industry. Previously, Bitcoin has tended to underperform alts in bull markets, with dominance therefore falling.

This rise in Bitcoin dominance is unusual because it has occurred during a period of price expansion across the industry. Previously, Bitcoin has tended to underperform alts in bull markets, with dominance therefore falling.

One factor in both the rise in Bitcoin dominance and the low market participation across crypto is the impact of the regulatory crackdown in the US. The SEC outlined several coins as securities, including Solana (SOL), Polygon (MATIC) and Cardano (ADA), and while Ripple secured an optimistic ruling in its own case against the SEC, the climate is undoubtedly more uncertain with regard to where all these tokens fit in.

Bitcoin, on the other hand, has largely been left out of the securities wars, and has even seen a slew of spot ETF applications lodged in recent months. Lawmakers very much seem to be dealing with Bitcoin as a separate genre of asset (as many in the sector have long done).

The regulatory crackdown on exchanges themselves has also been severe, and has certainly contributed to falling volumes across the space, Bitcoin or otherwise. Both Coinbase and Binance were sued in June, with Binance also the subject of a Department of Justice investigation, with some reports claiming charges may be imminent.

Moreover, we need to be careful when assessing the apparent trading volumes. One of the (many) accusations in the SEC case is that Binance manipulated trade volumes, meaning the true figures could be even lower.

Then there is the issue of, even if real, how much volume is meaningful. Binance ceased zero-fee trading for all Bitcoin pairs in March, and before this, zero-fee trading accounted for approximately 75% of volumes on the exchange. After the promotion ended, however, it promptly fell to 36%, with the majority through the stablecoin which Binance continued to promote zero-fee trading on: TrueUSD. Prior to this development, TrueUSD was seldom used with minimal liquidity.

Volatility

With the fall in volume, it follows that there is also a fall in volatility. Traders live and die by volatility, and it is closely correlated with volume. In fact, volatility is currently around three-year lows.

The effects of the drain in market participation are being seen on volatility beyond Bitcoin, too. The below chart shows that Ethereum volatility has recently dipped to the level of Bitcoin’s, or even below it. That contrasts with what we have come to expect historically, with Ethereum typically trading with higher volatility than its big cousin.

The volatility is more notable when considering that liquidity is also so thin. Order books are as shallow as they have been in a long time. Liquidity took a particular fall in November when prominent market maker Alameda collapsed amid the FTX scandal. Since then, not only has its capital not been replaced on order books, but more US market makers have pulled out or scaled back operations in the wake of the regulatory climate.

All things considered, the crypto markets are showing remarkably low levels of liquidity, trading volume and volatility. This comes via a combination of factors, from investors retreating on the risk curve to other bear market-related factors. Regulation is also a key factor, however, and undoubtedly suppressing market activity while uncertainty is so high.

The turbulent price action will return. But for now, crypto charts are not throwing up their trademark chaos.