Bitcoin sinks below $100,000, altcoins tumble following Fed’s hawkish signals

Key Takeaways

Bitcoin price fell under $100,000 due to a hawkish Federal Reserve stance.

Meme tokens experienced sharp declines amid market sell-off.

Share this article

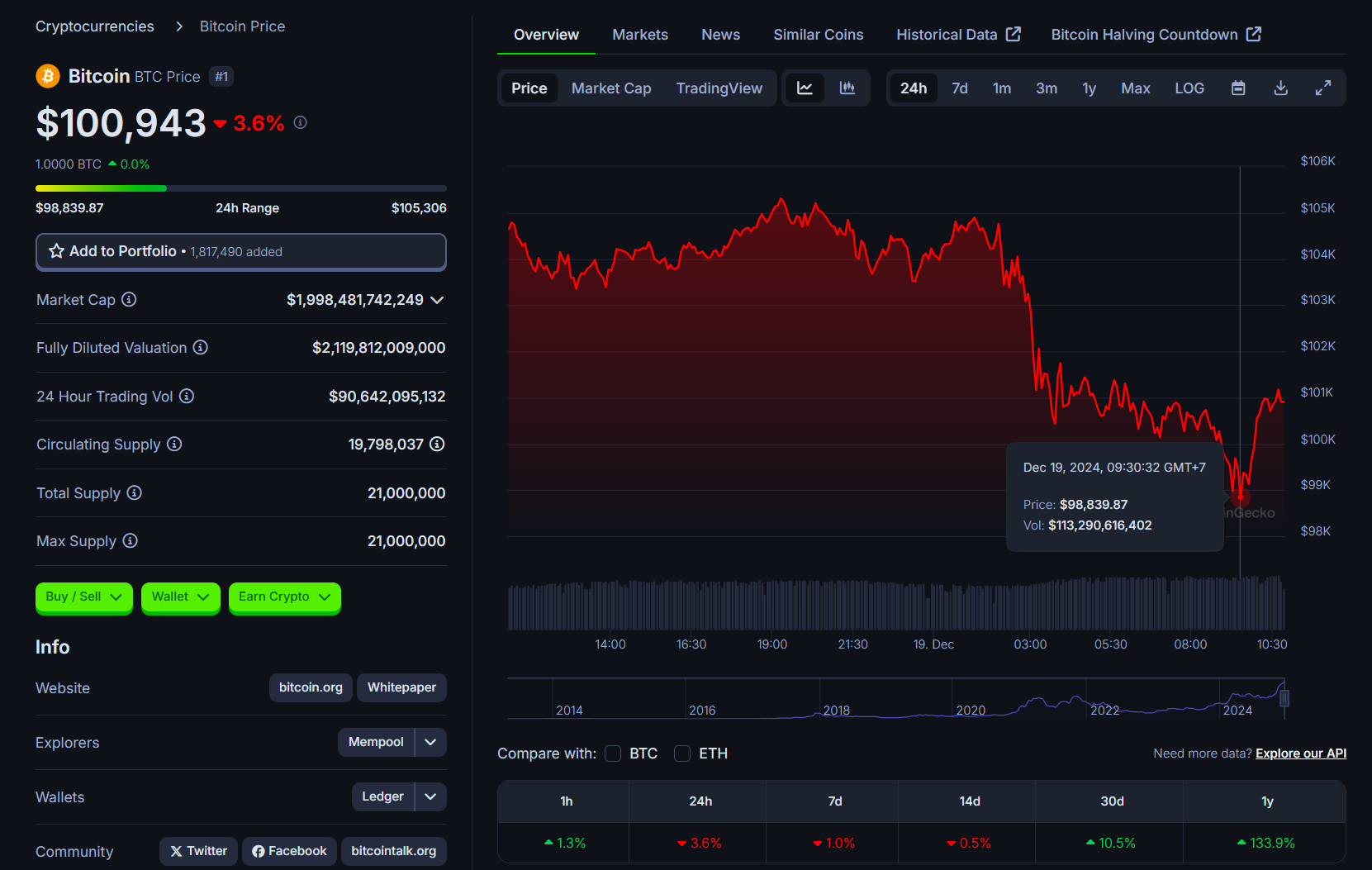

Bitcoin fell close to 6%, trading under $100,000 amid a market-wide sell-off after the Fed adopted a hawkish tone at Wednesday’s FOMC meeting, according to data from CoinGecko.

The Fed cut its benchmark interest rate by 25 basis points as expected but projected only two rate cuts in 2025, down from its previous forecast of four cuts. Fed Chair Jerome Powell indicated that the central bank would be more cautious when considering further adjustments to its policy rate.

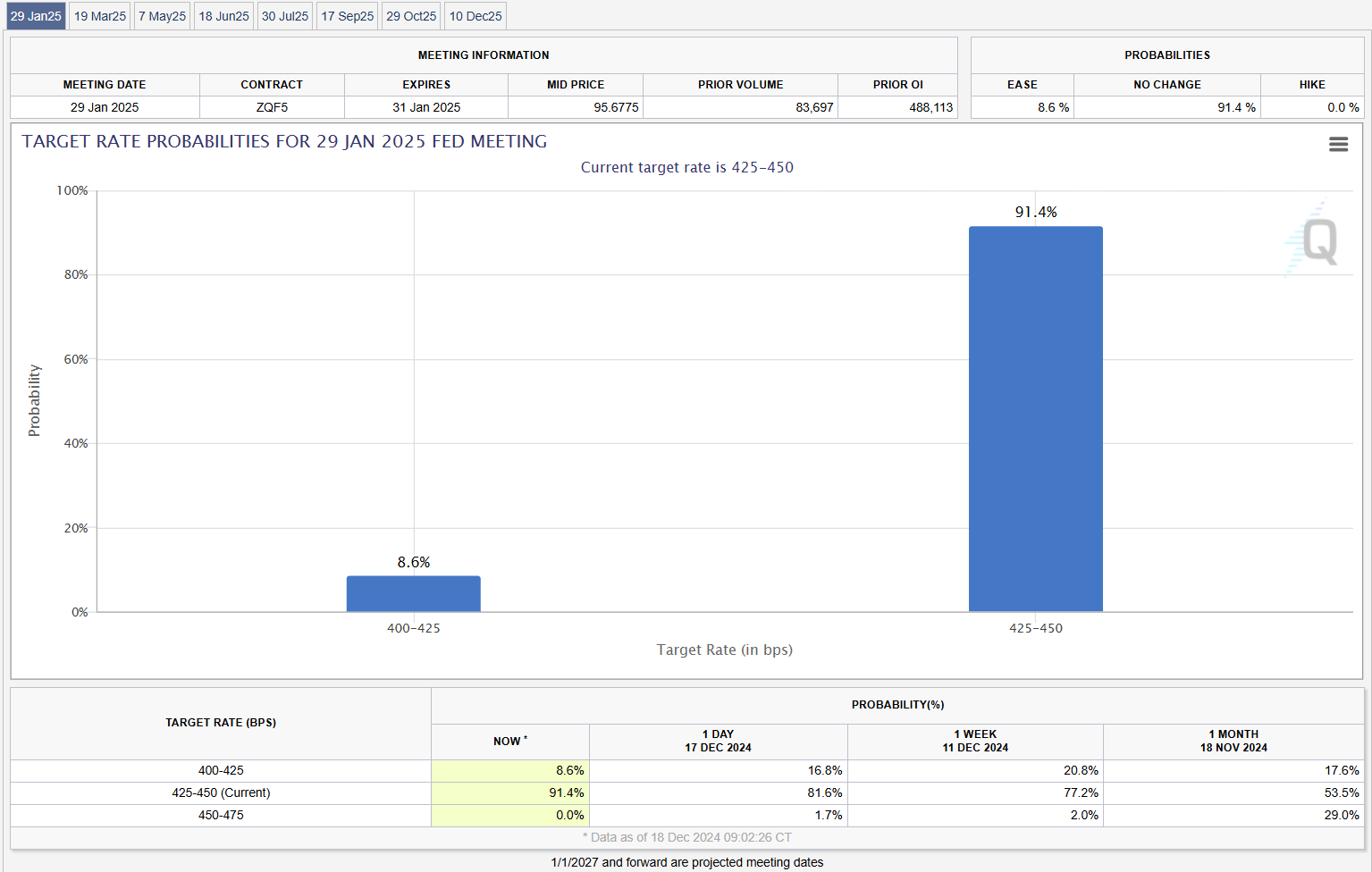

The Fed’s surprisingly hawkish stance has prompted analysts to adjust their rate cut forecasts. Analysts at Morgan Stanley noted that they no longer expect a rate reduction in January 2025.

Likewise, market expectations for a rate cut at the Fed’s January meeting have diminished. The probability of a rate cut at the Fed’s January meeting fell to 8.6%, based on CME FedWatch Tool data, while the likelihood of maintaining current rates rose to 91% from about 81% a day earlier.

Stock and crypto markets reacted strongly to Powell’s hawkish signals. The Nasdaq dropped more than 3%, and the Dow recorded its longest losing streak in 50 years. The dollar reached a two-year high as bond yields increased across the curve.

Bitcoin briefly lost $5,000 during Powell’s speech and fell to $98,900 on Wednesday evening before recovering above $100,000. Other crypto assets also declined, with Ethereum falling over 5% to $3,600, Ripple dropping nearly 9%, and Dogecoin declining 8%, per CoinGecko data.

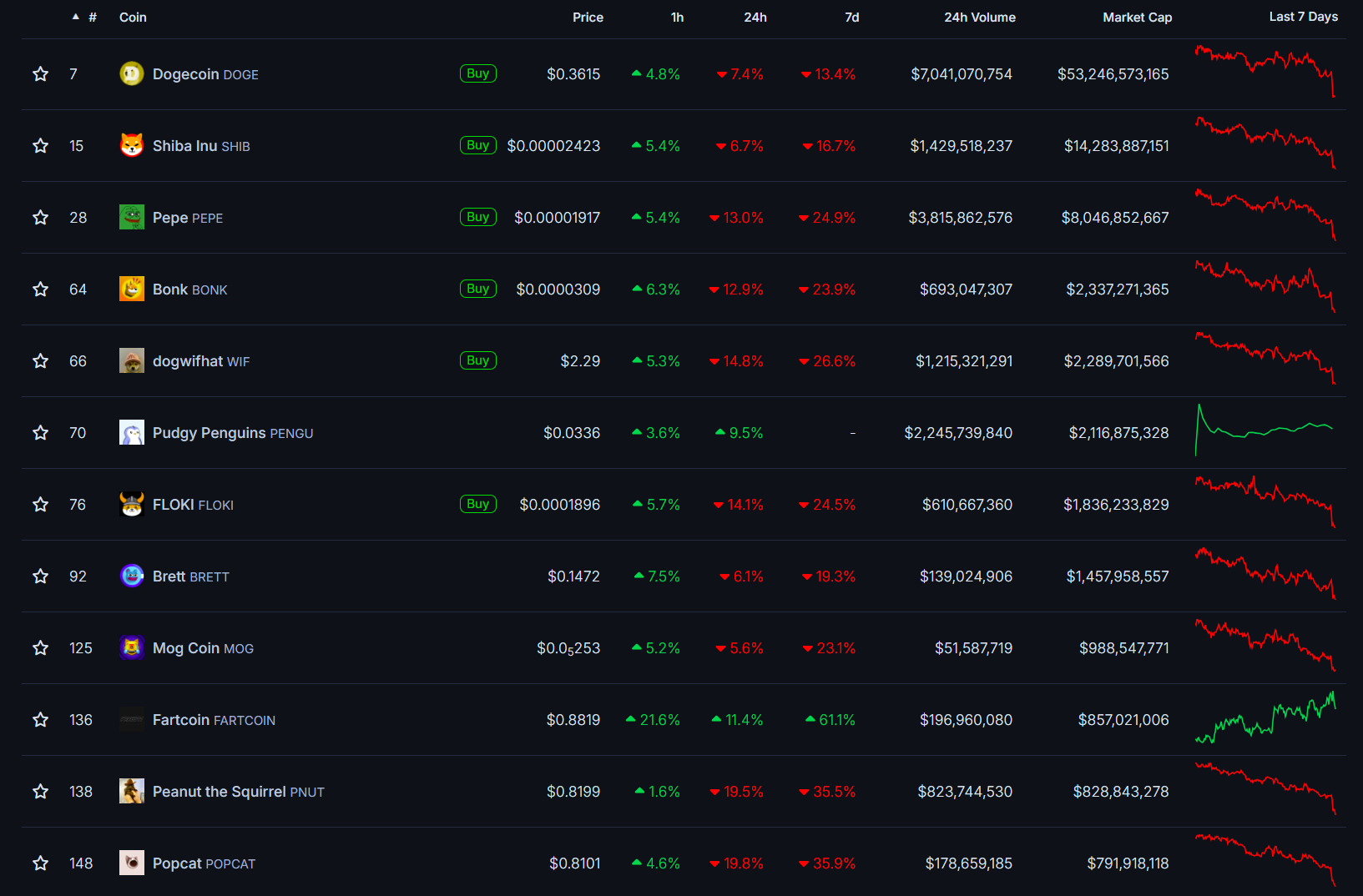

Meme tokens experienced the steepest declines over 24 hours, with Popcat (POPCAT) falling 20% and Peanut the Squirrel (PNUT) dropping 19%. Other meme coins including Pepe (PEPE), dogwifhat (WIF), Bonk (BONK), and Floki (FLOKI) all recorded double-digit losses.

Share this article