Bitcoin Price Holds At $27,900- When Can We Expect The Next Push Up

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price (BTC) has not shown any directional bias since mid-March, consolidating around the $28,000 region. Although we can still spot the larger bullish outlook, a minor retracement might ensue in the next few weeks.

The king crypto exploded almost 40% in the rally that began on March 12. The uptrend elevated BTC to a level above $26,000, where it is now moving sideways as bulls and bears engaged in a tug-of-war. Accordingly, the volatility has kept the flagship cryptocurrency capped under $30,000.

Overall Sentiment Remains Bullish For Bitcoin Price

Bulls in the BTC market are pushing hard to break above the $28,881 resistance level, despite the bearish pressure in the broader market. For the flagship crypto to kickstart the next uptrend, it would need a significant catalyst.

Based on a recent update, the largest cryptocurrency exchange in the United States, Coinbase, has hinted at integration Bitcoin lightning network. Notably, the lightning network would make Bitcoin transactions faster and cheaper, the main purpose of its invention.

My tweets auto-delete after some number of months, so there is no search history.

Lightning is great and something we’ll integrate.

— Brian Armstrong (@brian_armstrong) April 8, 2023

The comment came as the Coinbase CEO responded to the tweet “Brian Armstrong is actively ignoring the Bitcoin Lightning Network.” The response by Armstrong hinted that the upgrade could soon feature on Coinbase.

The lightning network expedites the process of sending or receiving BTC as it helps move the transaction off the main blockchain. It uses a smart contract for off-blockchain payments between the sender and recipient. Once the channels are established, the flagship crypto can be transferred instantaneously between the two parties.

It is worth mentioning that the network inclusion hype kicked off among the broader exchanges. Nevertheless, while the rest of the firms have shown a lack of haste to roll out the project, Coinbase is the first to express interest in the protocol.

What Next For Bitcoin?

At the time of writing, BTC was trading at $28,060 after gaining almost 0.5% in the last 24 hours. If buying pressure increases from the current level, Bitcoin price could shatter the immediate resistance level (mentioned above).

In highly bullish cases, Bitcoin price could extend a neck up to confront the next barricade at $31,348. Notably, these are levels last tested in June.

The bullish outlook for Bitcoin price was supported by strong downward support, particularly due to the Exponential Moving Averages (EMAs). For starters, the 50-day EMA at $25,824 was the first buyer congestion zone that bulls could take advantage of to replenish their buying momentum. If this failed, bulls could use either the 200- or 100-day EMAs at $23,938 and $23,140, respectively, as turn-around points for a rally north.

Additionally, given that these EMAs were pointing upward, it showed that the path with the least resistance was northward. The Relative Strength Index (RSI) had just tipped upward with a price strength of 59. This showed that more bulls were coming into the market, and Bitcoin price could increase.

There was also a pending buy signal that would be authenticated once the RSI (purple) crossed above the Stochastic RSI (yellow). This could happen if the bullish trend continued. If bulls heed this call, Bitcoin price could increase. This is something that could be observed in the coming week.

Also note that every time the RSI headed north, Bitcoin price reacted in tandem, taking a northbound move. If the current uptick for the trend-following indicator continues, BTC could follow suit. This, bolstered by the positive Awesome Oscillator (AO) above the mean line, added credence to the bullish case.

The bullish trajectory would be reinforced by sidelined investors taking advantage of the current consolidation to buy Bitcoin before the next bull run begins.

BTC/USDT 1-day chart

On-chain Metric To Argue The Bullish Case

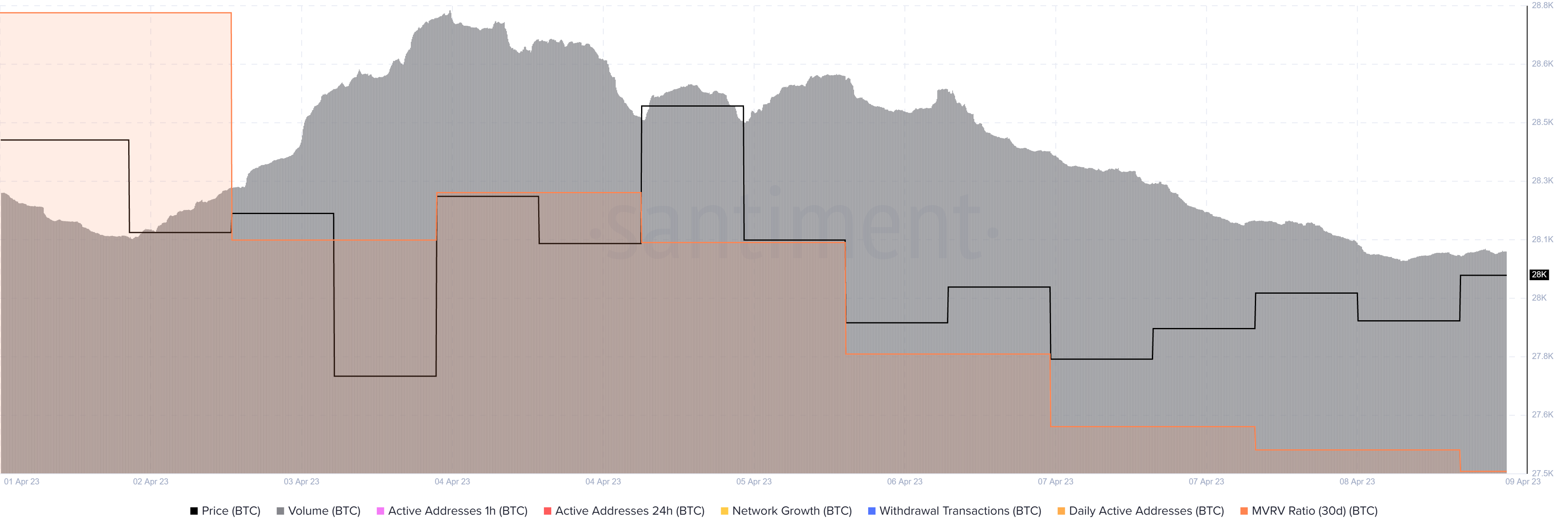

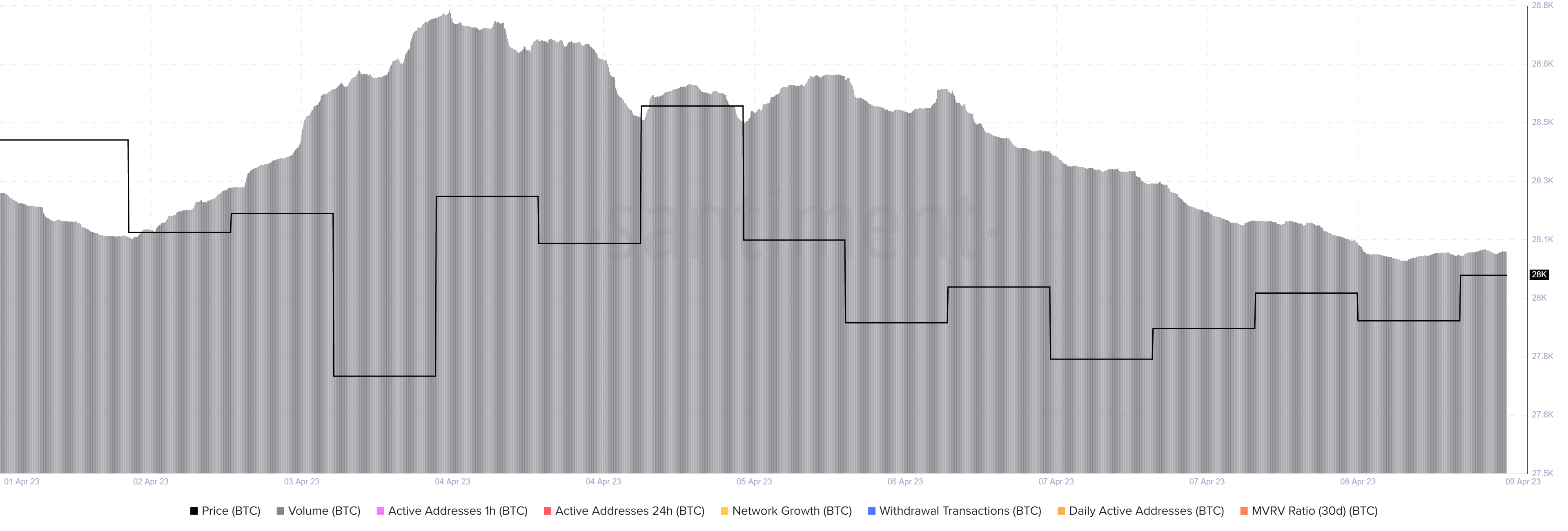

The 30-day Market Value to Realized Value (MVRV) ratio has held above price, suggesting Bitcoin market valuation, though struggling, remains above water.

Besides the BTC price and the MVRV ratio, the volume metric also recorded a significant buoyancy, dropping only around 700 in a week. Noteworthy, the flagship crypto has outperformed many altcoins in this performance metric.

The volume drop indicates a weakening buying momentum for BTC, presumably because investors are shifting their attention to assets that are displaying less boring price actions. It can also be interpreted as selling pressure increasing, hence the reduced demand for the giant crypto. Nevertheless, the fact that it is still that high despite bearish market sentiment, is a good sign for Bitcoin as it shows investors maintain their faith in the largest crypto.

On the flipside, Bitcoin price could drop if profit-taking begins. This could happen if traders and investors get spooked by general market FUD as well as the overall bearish trend.

If this happens, Bitcoin price could first retrace to tag the immediate support at $26,555. If this position does not hold, the king crypto could extend a leg down to find support at $24,092 or, in the dire case, find solace at the March 9 lows around $20,003.

Given that the AO was flashing red, it showed that bears were slowly gaining ground, and chances of a pullback were increasing.

Bitcoin Alternative

While we wait for Bitcoin price to kickstart a rally, consider Love Hate Inu, a meme token providing real utility in a voting system built atop blockchain technology. The token is a safe and transparent platform for voting on important issues.

The project brought a new executive only recently, Carl Dawkins, coming in to help push toward the project’s vision.

JUST REVEALED ON BINANCE LIVE 😱

Presenting The CEO of $LHINU

😍😈😍😈😍😈😍😈😍😈😍😈😍#meme #coin #pre #love #hate pic.twitter.com/kJtJDrsx53

— Love Hate Inu (@LoveHateInu) April 7, 2023

Dawkins brings a wealth of industry knowledge and experience, as well as the commitment to beat LHINU market competitors.

I’m here to beat the 10x on Tamadoge.

Commenting further about the project, Dawkins said, “Love Hate Inu has the serious side to it – trying to bring legitimacy to online voting through applying Web3, after seeing so many bots used on Twitter, etc. – while also having the playful side of it being an Inu coin and the community engagement that comes with that.”

The native token of the Love Hate Inu ecosystem is LHINU, which is currently in the presale stage. Thus far, the fundraiser has accumulated upwards of $3.21 million, with five days left to the next stage.

Listen up #LoveHateInu Crew!🐶

Stage 4 of the #Presale is here, and you don’t wanna miss out on getting some $LHINU before the price goes up!💰📈

Tick tock, time’s running out!⏱️

Get yours today!🚀#CryptoCommunity #AltCoins #MemeCoins

— Love Hate Inu (@LoveHateInu) April 8, 2023

At the moment, you can buy LHINU at $0.000105. This is the ideal price to buy the altcoin before the price rises to $0.000115.

Read More:

Love Hate Inu – Newest Meme Coin

Decentralized Polling – Vote to Earn

Early Access Presale Live Now

Ethereum Chain

Featured in Yahoo Finance

Mint Memes of Survey Results as NFTs

Staking Rewards

Viral Potential, Growing Community

Join Our Telegram channel to stay up to date on breaking news coverage