Bitcoin on the Brink of a New Uptrend

Key Takeaways

Bitcoin surged above $45,000 Wednesday.

The bullish price action signals a potential trend reversal.

Breaking $48,250 could send BTC towards $56,000.

Share this article

Bitcoin is back in the spotlight after gaining more than 20% in market value over the last three days. Further upward pressure may have the strength to kick start a new uptrend.

Bitcoin Regains Lost Ground

Bitcoin continues trending upwards, signaling the possible beginning of a new uptrend.

The flagship cryptocurrency is on the rise as the buying pressure behind it increases. Prices surged to an intraday high of $45,350 at press time, following three days of upward momentum. While global markets remain on shaky grounds, it appears that Bitcoin could be heading to greener pastures.

The parabolic SAR suggests the downtrend BTC has been trapped in since early November 2021 may have reached exhaustion. The stop and reversal points moved below the price of Bitcoin on the weekly chart, which is considered to be a positive sign. The recent flip indicates that the direction of the trend changed from bearish to bullish.

Historically, parabolic SAR has been highly effective in determining the course of Bitcoin’s price. The last four times the stop and reversal system flipped from bearish to bullish on the weekly chart, BTC’s price surged by 73%, 644%, 43%, and 250%, respectively.

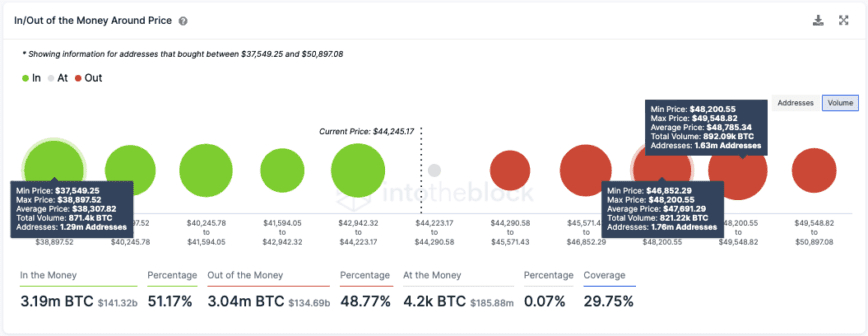

Even though the odds appear to favor the bulls, IntoTheBlock’s IOMAP reveals that the top cryptocurrency may still face stiff resistance ahead.

Nearly 3.40 million addresses had previously purchased more than 1.71 million BTC between $47,000 and $49,500. Given the significance of this supply wall, traders may need to wait for a decisive weekly close above it to confirm the optimistic outlook. Breaking through the $48,250 barrier could then propel Bitcoin towards $56,000.

It is worth noting that Bitcoin must remain trading above $38,300 for the bullish thesis to prevail. Failing to hold above this support level could trigger a sell-off that sends prices back towards $30,000.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

How to Profit From Market Volatility Using Linear and Inverse Contract…

Perpetual contracts are agreements between buyers and sellers with no specific expiry date, unlike other types of similar contracts such as options or futures. It is for the buyer and…

As Sanctions Pile, Bitcoin Flips the Russian Ruble

Thanks to unprecedented financial sanctions from the West, Bitcoin now has a higher market capitalization than the Russian ruble. Russian Ruble Plummets Following Western Sanctions Bitcoin has flipped the Russian…

CME Group To Offer Micro Bitcoin and Ethereum Options

The world’s largest futures and options exchange by daily volume has announced its plans to offer micro Bitcoin and micro Ethereum options starting March 28, 2022. New Options Contracts at…

Latin America Continues Steps Toward Bitcoin Adoption

Two Latin American nations, Mexico and Brazil, have taken initial measures toward Bitcoin adoption. Crypto Interest in Latin America Grows More Latin American countries are exploring cryptocurrency regulation. Since El…