Bitcoin Miners Are Selling to Cover Investments Post Halving

Bitcoin market selling pressure is increasing, and miners are adding to it in what has been described as a ‘strategic move.’ According to analysts, savvy Bitcoin miners will likely continue to increase the sale of assets to cover costs as the next halving approaches.

On January 26, on-chain analytics provider CryptoQuant reported that miners selling Bitcoin reserves ahead of the halving was a strategic move likely to result in more selling pressure.

Bitcoin Miners Add to Selling Pressure

A “significant shift” is occurring in the Bitcoin mining sector as the halving nears, according to analysts.

On-chain data shows that there has been a notable reduction in the Bitcoin reserves held by miners. Moreover, there has also been an increase in BTC transfers to centralized exchanges. It asserted:

“In fact, the flow of Bitcoin from miners to exchanges is now three times higher than the movement from exchanges to miners. This trend signals strong selling pressure from the mining community.”

Miners typically take profits ahead of a halving event to cover operational costs and prepare for future investments. The halving has been estimated to occur in 87 days, around April 22, according to CoinGecko.

Moreover, with the reward for mining a block getting slashed to 3.125 coins, this effectively reduces the miners’ income unless the price of Bitcoin increases proportionally.

Read more: Who Owns the Most Bitcoin in 2024?

To keep up with the ever-increasing competition, Bitcoin miners need to constantly invest in more efficient equipment. Therefore, selling some of their BTC reserves provides the capital for these overheads and investments. CryptoQaunt noted:

“The increased selling pressure from miners could impact Bitcoin’s price in the short term.”

Bitcoin miner reserves are currently 1.83 million BTC, which is worth around $73.4 billion. They have been dwindling since the selling phase began at the end of October.

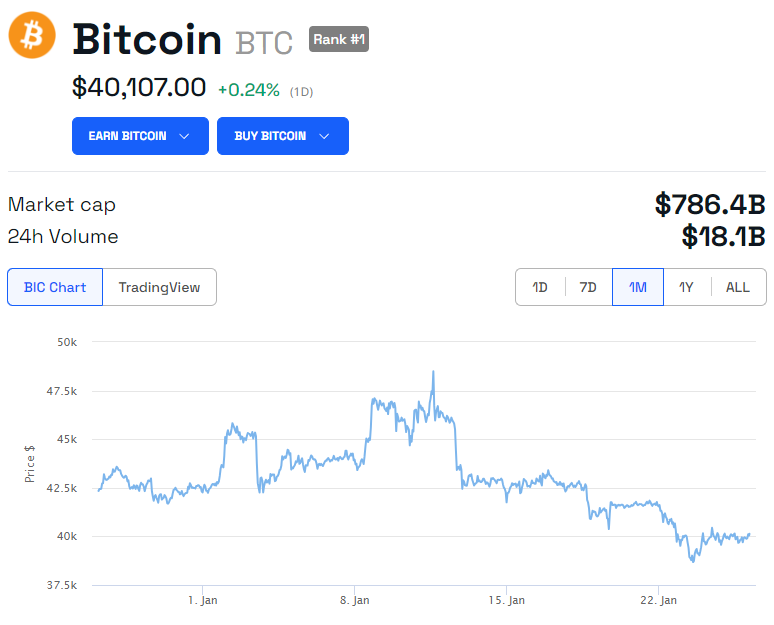

BTC Reclaims $40,000

Selling pressure has also been exacerbated by outflows from the industry’s largest crypto asset manager, Grayscale.

The Grayscale Bitcoin Trust has sold around 106,575 BTC since spot ETFs were approved in the US on January 11.

Moreover, the US government also has plans to auction off over 2,930 BTC, worth about $130 million, seized in the Silk Road case.

Nevertheless, Bitcoin prices reclaimed the psychological $40,000 level during the Friday morning trading session in Asia.

The asset was changing hands for $40,120 at the time of writing following a minor daily gain. However, it has dropped 13% over the past fortnight, and the short-term outlook is bearish.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.