Bitcoin, Ethereum Could Dip on Traders Selling ETF News

Key Takeaways

Bitcoin appears to have met significant resistance at $64,000.

Likewise, Ethereum is struggling to break past $4,000.

The open interest and funding rates on both assets point to a retracement.

Share this article

Bitcoin and Ethereum appear to be trading in overbought territory as their funding rates have significantly grown over the past few days. The current market conditions point to a temporary correction in the near term before higher highs.

Bitcoin Looks Set to Retrace

Bitcoin and Ethereum could be set for a brief correction.

Speculation is mounting around the leading cryptocurrency with the first Bitcoin futures ETF due to launch on the New York Stock Exchange Tuesday.

Data from on-chain intelligence platform Glassnode shows that the total amount of funds allocated in open Bitcoin futures contracts is climbing at an exponential rate. More than $23 billion has entered the market through derivatives platforms, representing a five-month high.

Investors appear to be in “extreme greed” mode about a potential price breakout toward a new all-time high of $90,000 once the Bitcoin futures ETF launches. However, the network activity suggests that BTC could pull back before it reaches a new milestone.

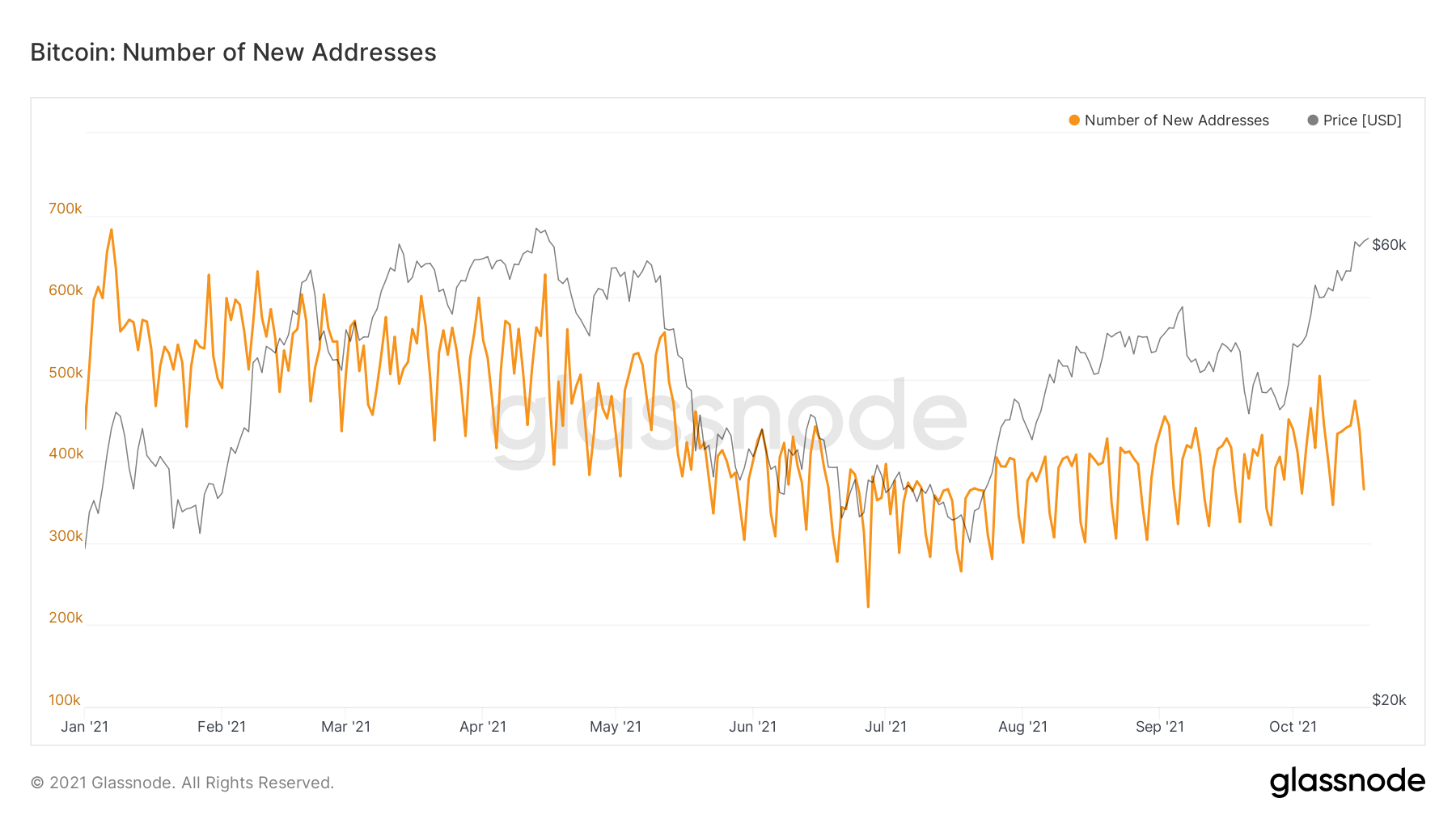

The number of new daily BTC addresses created on the network appears to be forming a bearish divergence against prices. While Bitcoin rose from $54,000 to nearly $63,000 between Oct. 7 and Oct. 15, the number of new daily BTC addresses dropped from 504,000 addresses to 474,000 addresses. Such market behavior suggests a decrease in user adoption over time, which is a bearish signal.

Network growth is considered one of the most accurate price predictors for cryptocurrencies. Generally, a steady downtrend in the number of new addresses created on a given blockchain leads to declining prices over time.

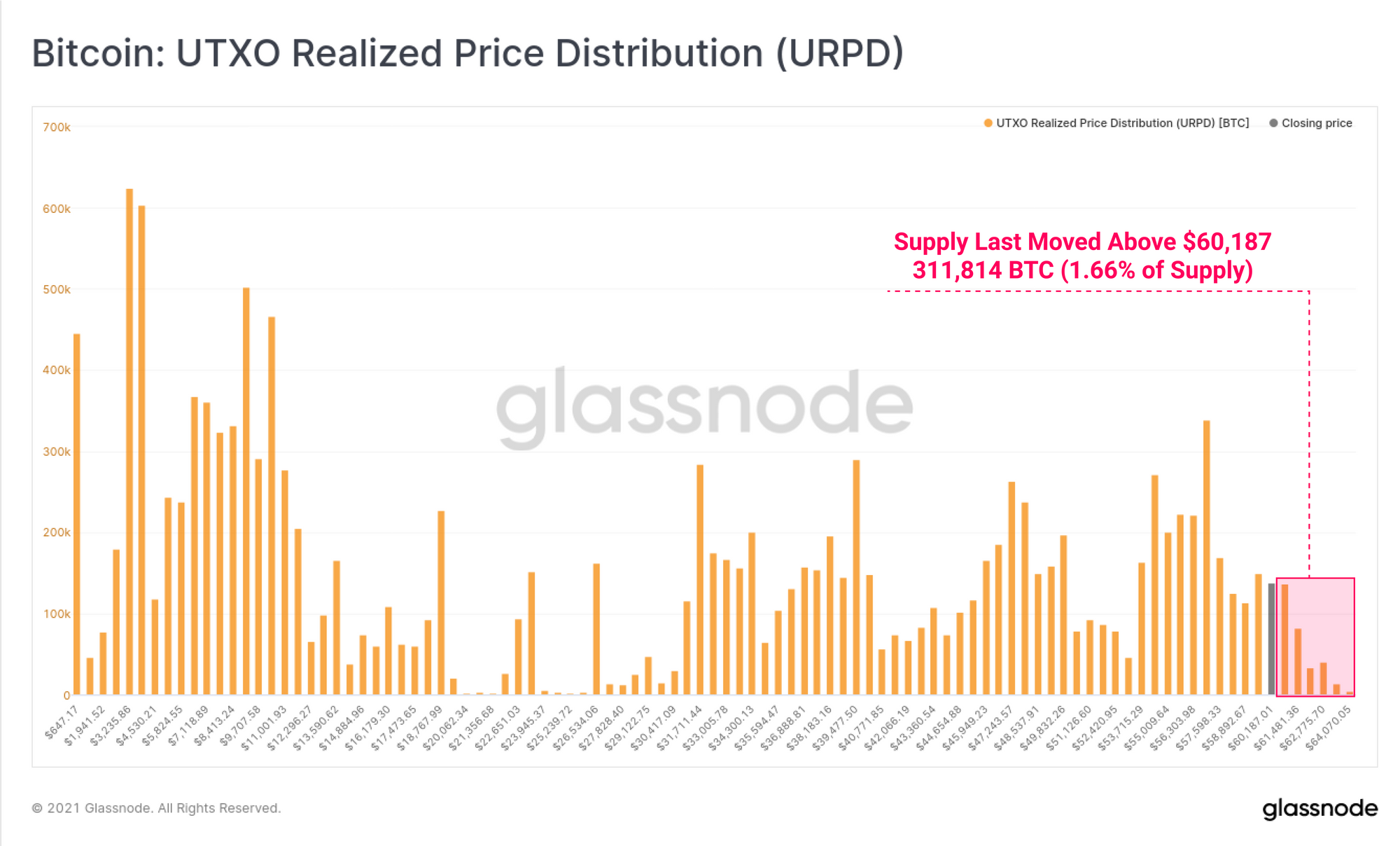

Bitcoin’s realized price distribution shows the amount of BTC last moved at each denominated price level. Currently, only 1.66% of the supply last moved above the current price levels.

Although this means there is very little resistance or overhead supply to the upside, it also reveals that the incentive to sell is growing. As almost 350,000 BTC were acquired around $56,000, this could be a strong foothold that holds in the event of a correction.

Ethereum Could Follow Bitcoin

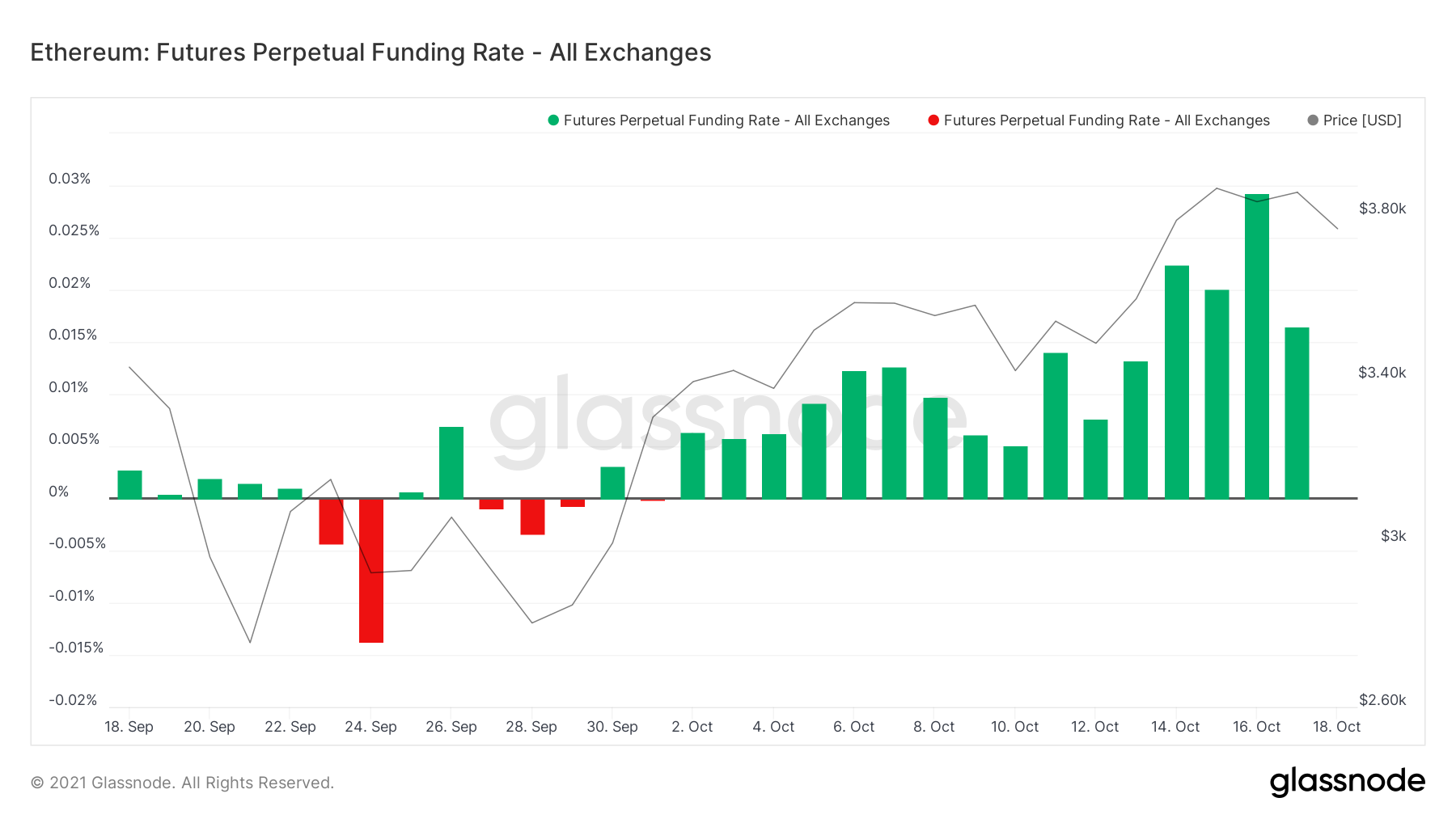

Similar to Bitcoin, Ethereum’s perpetual swaps funding rates indicate that investors might be getting overconfident about the future price action.

The second-largest cryptocurrency by market cap has enjoyed favorable funding rates since the beginning of the month. Such market behavior suggests that speculators are growing optimistic as long traders pay short traders’ funding.

Although Ethereum is yet to see funding rates of 0.1% or higher every eight hours, the steady increase in this metric can be considered a warning signal for a potential correction.

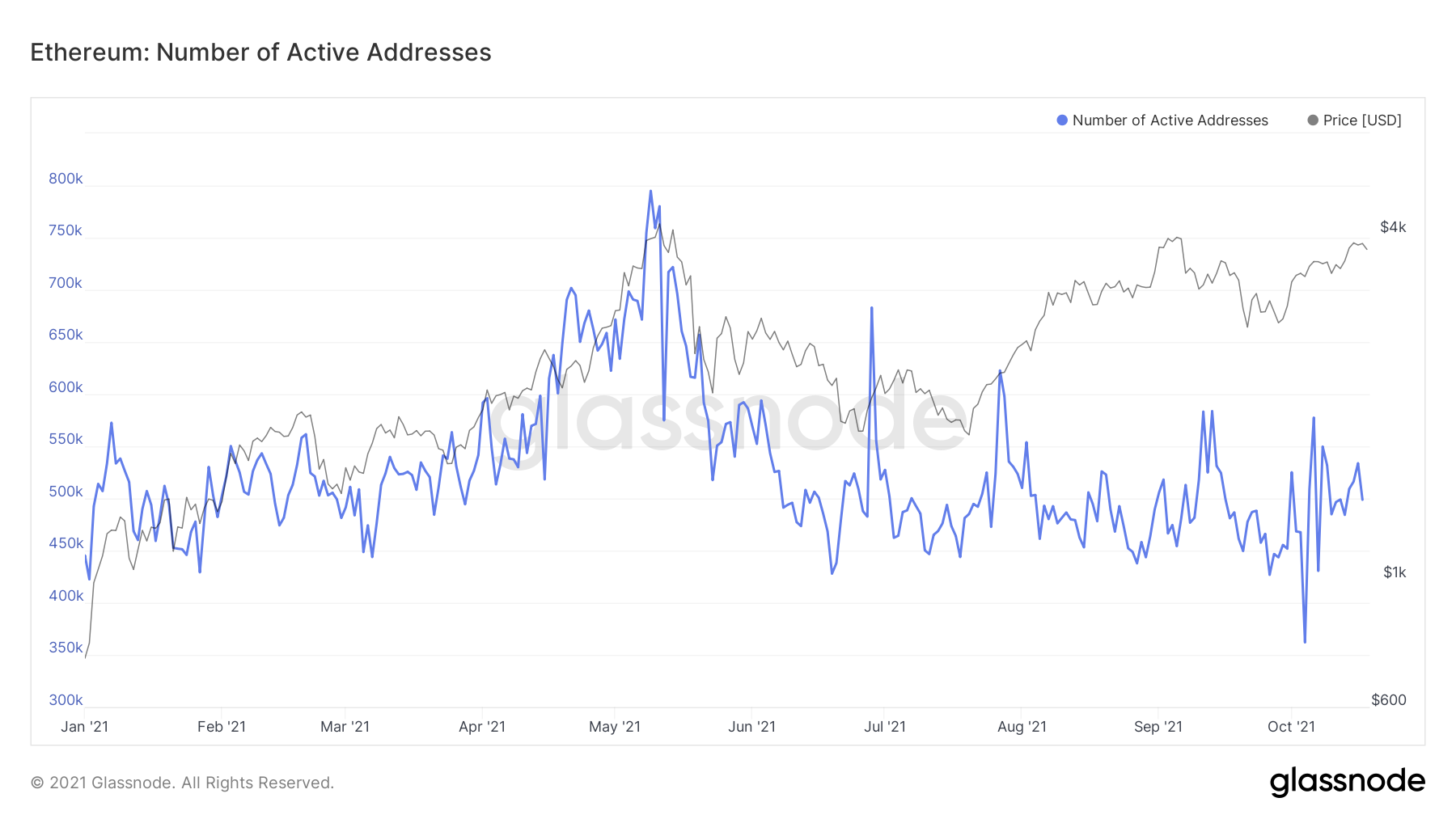

The declining number of active addresses on the Ethereum network also indicates that a correction could be looming. A spike in network activity usually determines an influx of buyers. On the other hand, when this on-chain metric trends down, it indicates less interest from retail investors, which leads to less volatility or price retracements.

If this trend continues, Ethereum could drop toward $3,400 or even $3,200 before the bull run resumes.

It is worth noting that more than $30 billion worth of Ethereum has been put out of circulation since the launch of the ETH2.0 deposit contract and the London hardfork. Meanwhile, the exchange supply continues to decline, hitting a three-year low of 15 million ETH recently. Such network dynamics point to an impending supply shock that could see ETH outperform BTC the coming months. If Ethereum maintains bullish momentum, a decisive close above $4,000 could lead to a rise toward a new all-time high of $6,000.

Disclosure: At the time of writing, the author of this feature owned BTC and ETH.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Bitcoin Touches $60,000 Amid ETF Approval Rumors

The top cryptocurrency is continuing its ascent amid rumors of a potential Bitcoin futures ETF approval. While buy orders are piling up, transaction history shows that BTC could be on…

What is Impermanent Loss and How can you avoid it?

DeFi has given traders and investors new opportunities to earn on their crypto holdings. One of these ways is by providing liquidity to the Automated Market Makers (AMMs). Instead of holding assets,…

Crypto Miners Are Stockpiling Bitcoin and Ethereum Rewards

On-chain metrics and company production reports show that Bitcoin and Ethereum miners are holding off from selling their mining rewards. The value of crypto held by miners has reached new…

Critical Bug in Ethereum 2.0 Staking Pools Safely Patched

Dmitri Tsumak, the founder of the ETH 2.0 staking platform StakeWise, discovered a severe vulnerability affecting ETH staking competitors Rocket Pool and Lido. The exploit has now been patched, with…