Binance U.S. Flash Crash May Cause Bitcoin, Ethereum Correction

Key Takeaways

Bitcoin and Ethereum are holding above crucial support levels.

Both assets could face significant losses if they lose these key interest areas.

BTC could dive to $58,000 and ETH toward $3,700.

Share this article

Binance U.S.’ trading algorithm suffered from a bug that resulted in a Bitcoin flash crash on Oct. 21. Although prices recovered quickly, both cryptocurrencies are now trying to hold support to avoid further losses.

Bitcoin Reaches Critical Support

Bitcoin and Ethereum are in retreat following a flash crash. Binance U.S. was hit with a bug Thursday, resulting in a flash crash that saw Bitcoin’s price plummet by around 90%. Ethereum also dipped 50% on the exchange.

Though both assets posted a quick recovery, the event has made a significant impact on the market. Bitcoin retraced by 7.4% a few hours after making a new all-time high at $67,000.

The sudden spike in selling pressure pushed the flagship cryptocurrency to a low of $62,050, easing nearly 5,000 points in market value. Although prices have bounced back above $63,000 in the last few hours, it remains to be seen whether BTC can hold above support.

From a technical perspective, Bitcoin’s price action appears to be contained within an ascending parallel channel that developed since Oct. 4. Every time BTC has risen to this technical formation’s upper boundary since then, it has been rejected and retraced to the pattern’s lower edge. From this point, it tends to rebound, which is consistent with the characteristics of a parallel channel.

Now that Bitcoin has reached the channel’s lower trendline, an upswing toward its middle or upper trendline could be underway. These crucial areas of resistance sit at $66,000 and $70,000 respectively.

While the recent price history suggests that a meaningful rebound is imminent, it is crucial to pay attention to Bitcoin’s interaction with the 50 four-hour moving average at $62,000. Any increase in selling pressure that leads to a break of the support level could invalidate the optimistic outlook.

In this eventuality, BTC could drop toward the 100 or 200 four-hour moving average. These demand zones sit at $59,000 and $52,000 respectively.

Ethereum Fails to Make New Highs

While Bitcoin tumbled, Ethereum was heavily rejected on Oct. 21 as it approached its mid-May all-time high at $4,380.

Exchange data from Bybt shows that roughly $46 million worth of long ETH positions were liquidated across the board due to the sudden pullback. Since the flash crash, ETH has also failed to hold above $4,000.

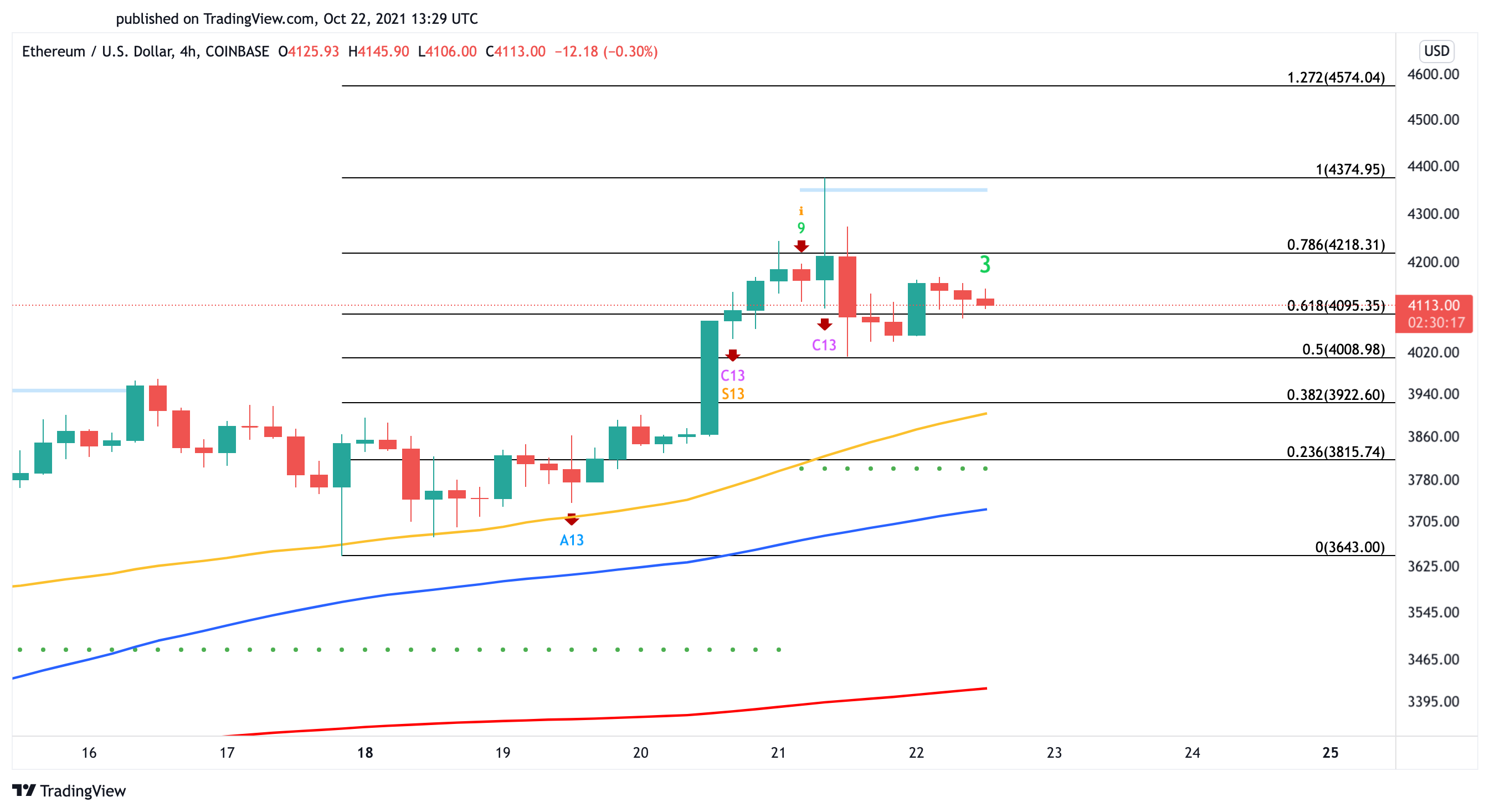

The Fibonacci retracement indicator, measured from the Oct. 17 swing low at $3,640 to the Oct. 21 swing high at $4,375, suggests that Ethereum is sitting on stable support. The combination of the 50% Fibonacci retracement level with the 50 four-hour moving average at $3,922 is the most significant interest area underneath ETH.

As long as prices avoid closing below this barrier, odds favor a resumption of the uptrend toward a new all-time high at $4,574.

Nevertheless, a decisive four-hour candlestick close below the $3,922 level could lead to a steeper correction. Ethereum could then dive to look for support around the 100 four-hour moving average at $3,700 or even test the 200 four-hour moving average at $3,400.

Disclosure: At the time of writing, the author of this feature owned BTC and ETH.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

The Top Bridges for Interoperability With Ethereum

Bridges offer a way to migrate assets between blockchains. Crypto Briefing unpacks some of the top bridges offering interoperability between Ethereum and other chains. Ethereum Bridges Usher in Multi-Chain Era…

Peter Thiel Wishes He Had Bought More Bitcoin

In a recent interview, Peter Thiel weighed in on cryptocurrencies, admitting he feels underinvested in Bitcoin and that “the answer is to go long” on the asset. Peter Thiel is…

How a Bitcoin Spot ETF Would Differ from a Futures ETF

The first Bitcoin futures ETF in the U.S. went live on the New York Stock Exchange this week. However, there’s still a lot of confusion over how it differs from…

What is a Crypto Airdrop: Why Projects Airdrop Crypto

Crypto airdrops occur when new tokens are freely distributed to different wallets in order to drive initial growth and build a community. They represent a popular marketing tactic that new projects use to spread…