Are They Driving TON Price Higher?

Telegram Bot tokens have emerged as one of the hottest topics across the crypto sphere in recent weeks. On-chain analysis examines the correlation between the upturn in social sentiment surrounding the TON coin and the growing popularity of Telegram-affiliated Bot tokens.

The Telegram instant messaging platform has remained a staple among crypto enthusiasts, having explored blockchain technology in the past. Toncoin was initially founded under “Telegram Open Network” (TON). But after facing legal challenges, the name was eventually jettisoned for “The Open Network” in 2020.

The Rise of Telegram Bot Tokens

Three years later, Telegram-related cryptocurrencies like UNIBOT, Moonbot (MBOT) AIMBOT, and other tokens powered by Artificial Intelligence have moved to actualize that vision.

Interacting with Telegram’s API, the bot tokens allow users to automate critical DeFi functions. Such as trading on decentralized exchanges (DEXs), wallet management, yield farming, token sniping, and more.

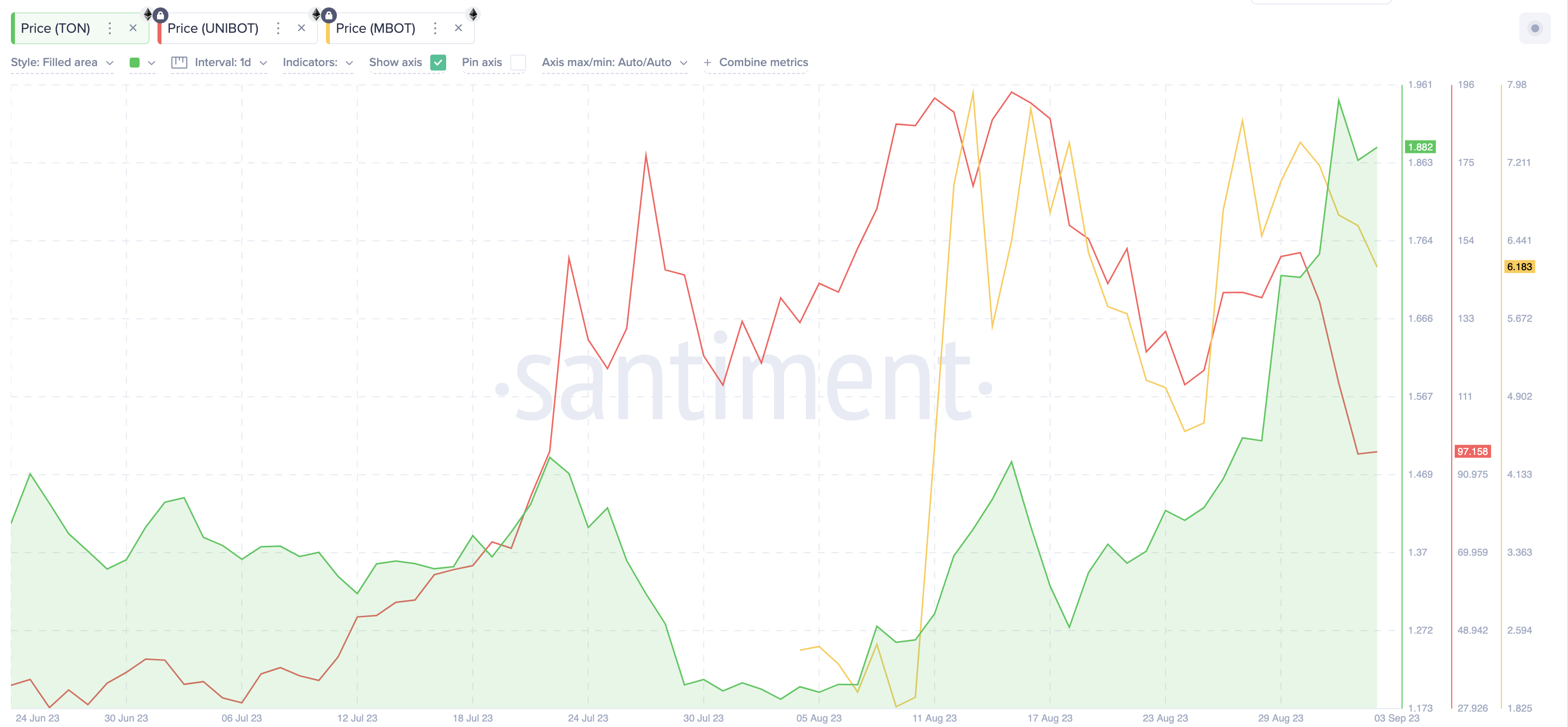

On-chain data analysis explores the correlation between the recent Toncoin price rally and the Telegram-bot tokens’ rise to prominence.

Toncoin (TON) is the native token that underpins “The Open Network.” It is mainly used for network operations, transactions, games, and pay for collectibles built on the blockchain network.

On-chain data shows that TON has attracted significant attention from investors, particularly over the last three months. The Santiment chart below shows that the TON Social Dominance witnessed a noticeable spike around June 2023.

Since June 7, TON Social Dominance has increased nearly ten-fold from 0.05% to 0.42% as of Sept 3.

Social Dominance measures the percentage of social media mentions a cryptocurrency attracts in reference to the top 50 most talked about projects. The spike observed above shows that Toncoin has attracted a considerably higher share of media discussions over the last three months.

This intense investor attention has helped propel TON’s price 38% upward from its recent low of $1.2, recorded on August 6.

But interestingly, it appears that the buzz surrounding Toncoin has also shone the spotlight on Telegram-Bot tokens. This brings to the fore the TON Network’s historical affiliation with the instant messaging giant.

Telegram-Bot Tokens Exhibit Close Correlation to Toncoin Price Action

Despite having distinct use cases, the price action of several Telegram-associated bot tokens has closely correlated to TON performance in recent weeks.

According to Coingecko, UNIBOT is currently the top-ranked Telegram bot token in terms of trading volume and market capitalization. Among other functions, it allows DeFi users to buy and sell tokens on Uniswap V3 directly from their Telegram apps. Between July 31 and September 3, Unibot delivered a blistering 115% price performance. It jumped from $115 to its all-time high of nearly $240 before heading into its recent downtrend.

Similarly, MoonBOT (MBOT) – an advanced and customizable Telegram trading bot that executes automated transactions, has also gained significant traction. Between August 4 and September 3, it gained an impressive 125%, skyrocketing from $2.4 to $6.12.

The global crypto market cap has contracted nearly 10% since August 1. Meanwhile, these telegram-affiliated tokens have delivered at least double-digit gains during that period. This correlation suggests a possible evolution of yet another burgeoning sector within the crypto market.

It is also important to note that these Bot tokens are not yet listed on mainstream exchanges. Hence, Fear of Missing Out (FOMO) could still heighten among strategic investors looking to front-run possible gains from exchange listings like Binance and Coinbase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.