$850 Million Liquidated as Bitcoin, Ethereum Dip

Key Takeaways

More than $210 billion was shaved off the entire cryptocurrency market capitalization today.

The flash crash resulted in over $850 million worth of liquidations.

The funding rates across all derivative trading platforms point to a steeper correction.

Share this article

The cryptocurrency market has taken a steep nosedive after posting steady gains throughout October. Although some lower cap assets have rebounded, traders appear to be overleveraged, leading to another downswing.

Crypto Market Suffers Crash

Volatility remains rampant in the cryptocurrency market despite the beginning of a new uptrend.

Roughly $210 billion has been wiped from the entire cryptocurrency market capitalization in the last few hours. The sudden flash crash resulted in more than $850 million worth of long and short positions liquidated across the leading crypto derivatives trading platforms.

Bitcoin, Ethereum, and most other lower cap assets were affected by the downswing.

Only a handful coins are up today. Aave, 1inch, and Mask Network surged in tandem shortly after Korean exchange Upbit announced it would list their tokens. Likewise, Shiba Inu has been posting higher highs on rumors that Robinhood will add it to its crypto-related offerings.

Red Flags Appear

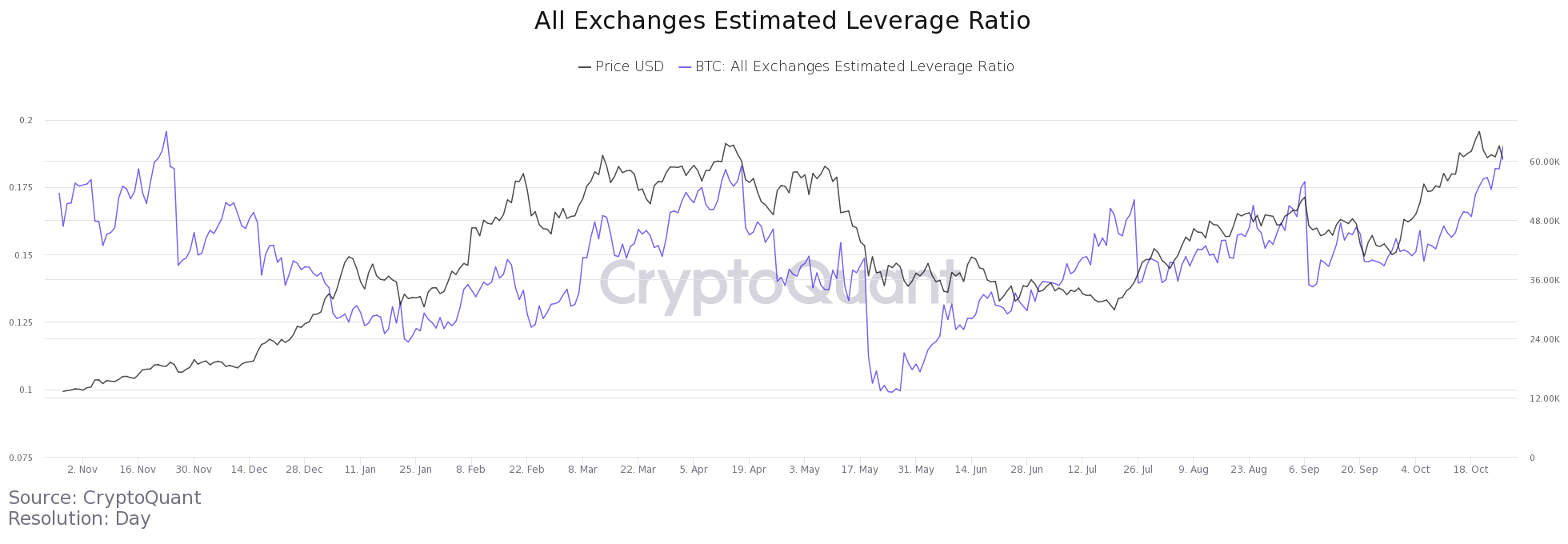

Although it appears that the correction could be over, there are a few signals that point to a deeper correction. The estimated leverage ratio across crypto derivatives exchanges is about to hit a yearly high.

Favorable funding rates of 0.1% or higher every eight hours are generally considered unsustainable. Higher rates suggest that market speculators are more optimistic as long traders pay short traders’ funding. When this happens, traders can begin to feel so-called “euphoria” in their positions, which often leads to steep corrections.

Data from CrytoQuant reveals that Bitcoin’s estimated leverage ratio across all exchanges is hovering around 0.19%, a negative signal for the continuation of the uptrend.

Funding rates across all derivatives trading platforms may need to normalize for the cryptocurrency market to maintain a healthy bull run. Although a rally could continue without a reset of the funding rates, the market could see a similar event to today’s flash crash.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

1inch, Aave Soar on Korean Exchange Listing

1inch, Aave, and Mask Network have put in double digital gains following the announcement that the Korean crypto exchange Upbit has listed all three assets for trading. Upbit Lists 1inch,…

What is Rarible: A DAO for NFTs

What was once dismissed as a silly and expensive sector, NFTs give creators access to global markets in a way that’s never been possible before, and it’s all thanks to blockchain.Those familiar…

Binance U.S. Flash Crash May Cause Bitcoin, Ethereum Correction

Binance U.S.’ trading algorithm suffered from a bug that resulted in a Bitcoin flash crash on Oct. 21. Although prices recovered quickly, both cryptocurrencies are now trying to hold support…

Bitcoin Sets New All-Time High Above $66,000

The world’s largest cryptocurrency by market dominance surpassed new all-time highs today. The update comes the day after the first U.S. Bitcoin futures ETF went live on the New York…