Sources Say Valkyrie Bitcoin Strategy ETF Set to Launch on Nasdaq This Week – Finance Bitcoin News

After the Proshares Bitcoin Strategy exchange-traded fund (ETF) listed and smashed records in the first two days of trading, Vaneck’s bitcoin futures ETF was given the green light to start trading next week. Furthermore, sources say that the Valkyrie Bitcoin Strategy ETF is set to launch this week with a possible listing on Friday.

Proshares Bitcoin ETF Smashes Records

October is the month of bitcoin exchange-traded funds as the United States approved the first ETF last week. Proshares Bitcoin Strategy ETF (NYSE: BITO) listed on Tuesday and saw close to $1 billion in volume on its first day of trading.

The following day, BITO continued to perform remarkably and bitcoin (BTC) spot markets tapped a new lifetime price high at $67,017 per unit.

If $BITO keeps up this pace of inflows it wont have any futures left to buy by the end of the month due to pos limits (via rough back of envelope calc w/ @JSeyff ). https://t.co/KauFuaPzhb

— Eric Balchunas (@EricBalchunas) October 21, 2021

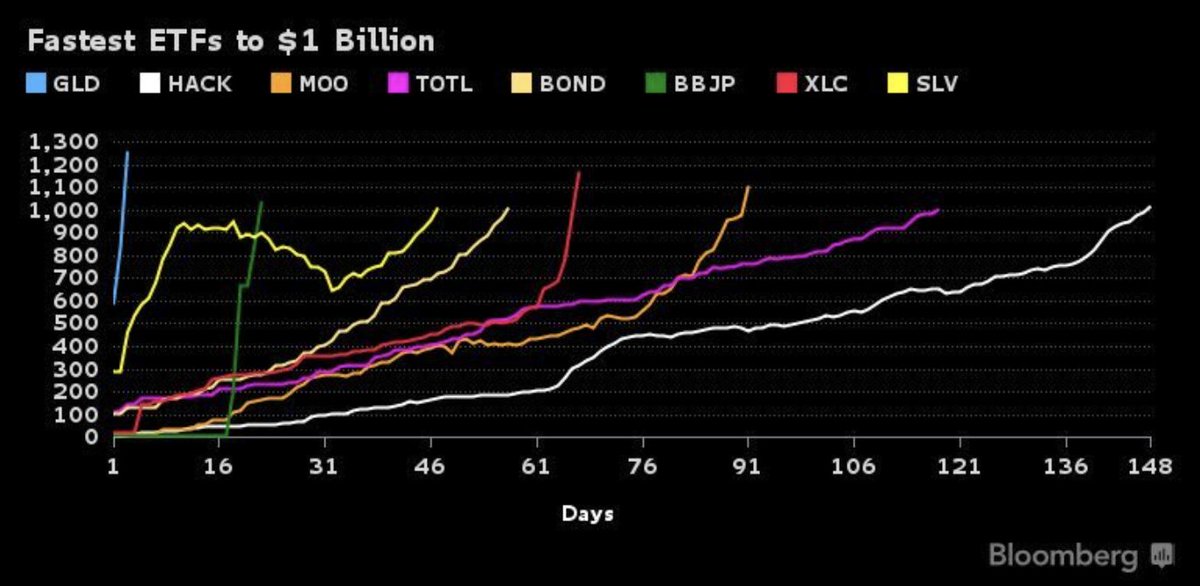

In fact, the senior ETF analyst for Bloomberg Intelligence, Eric Balchunas, explained how the bitcoin ETF was one of the fastest in history to capture $1 billion in assets. Balchunas said:

RECORD BREAKER: BITO assets up to $1.1b after today, making it the fastest ETF to get to $1b (2 days) breaking [gold’s] 18 [year] old record (3 days), which is poetically apropos.

Two Sources Say Valkyrie Bitcoin Strategy ETF Set to Launch Friday

Balchunas is one source that has said that the Valkyrie Bitcoin Strategy ETF is set to launch this week. In addition to statements from Balchunas, crypto reporter Danny Nelson confirmed with a Valkyrie spokesperson that the fund will begin trading on Friday after it “cleared the final regulatory hurdles.” Bloomberg’s senior ETF analyst also explained the news on Twitter.

“Just got word Valkyrie is changing the ticker back to BTF 🙁 SEC prob wasn’t a fan of BTFD. Also odds [are] growing they will launch tomorrow. Not final yet [though],” Balchunas said.

Then he corrected his tweet and noted that the Valkyrie ETF would list on Friday. “I had said this was launching [tomorrow] it’s actually going to be on Friday. Sorry about that,” the analyst further detailed.

The Valkyrie fund will leverage the ticker symbol “BTF” but there was talk about the company adopting the ticker “BTFD.” Unlike Proshares and Vaneck, the Valkyrie ETF will list on Nasdaq rather than the New York Stock Exchange (NYSE).

Valkyrie’s ETF was originally filed in August and the operating expenses per year are 0.95%, according to the pre-effective amendment filed Wednesday morning.

What do you think about the possibility of Valkyrie’s ETF launching this Friday? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Eric Balchunas Twitter,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.