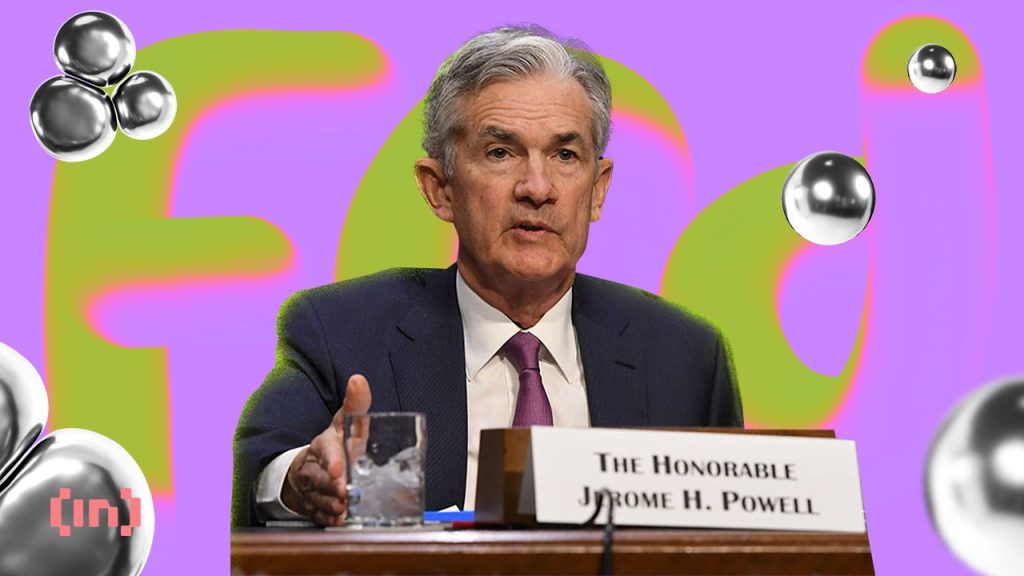

Jerome Powell Says Recession Unlikely as Bitcoin Rises as Hedge

Federal Reserve Chair Jerome Powell reassured the nation, asserting a strong stance against the looming fear of recession, while Bitcoin gains as a hedge.

Powell’s confidence stems from analyzing current economic data and trends, disassociating from political influences often cloud economic forecasts. This assertion comes amidst a climate of skepticism toward monetary policy’s role in ensuring long-term economic stability.

Recession Is Unlikely This Year

Jerome Powell’s declaration aligns with his previous comments, underscoring the Federal Reserve’s commitment to data-driven decisions.

The core PCE, stripping out the volatile costs of food and energy, rose by 2.8% over the past 12 months. Meanwhile, the overall inflation rate stood at 2.5% from the previous year. Powell said that this aligns with his forecasts, and it is encouraging to witness outcomes that meet expectations.

Powell’s optimism, acknowledging a low risk of recession, reflects a pragmatic view of the economy. Moreover, he downplayed the possibility of reducing interest rates until the “Federal Open Market Committee is confident that inflation is moving down to 2% on a sustained basis.”

“Growth is strong. As I mentioned, the economy is in a good place. And there’s no reason to think the economy is in a recession or is at the edge of one,” Powell said.

This perspective redirects focus towards structural elements of economic growth, away from the short-term effects of monetary adjustments.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

While Powell maintained that a recession is unlikely this year, Bitcoin benefits from the uncertain fiscal and monetary environment.

Jason Trennert, CEO Strategas Research Partners, attributed this to recent regulatory advancements and the growing desire for alternatives to traditional fiat currencies. The approval of a Bitcoin ETF and the simultaneous rise in gold prices reflect a collective hedge against the debasement of the US dollar.

“In the US, there’s really no coordination between fiscal and monetary policy when it comes to inflation. And I think people are looking for hedges against fiat currencies, particularly the dollar. So I think that’s another reason why people are looking for alternatives to what would traditionally be, again, seen as, as fiat currencies,” Trennert explained.

Read more: Jerome Powell Loses America’s Trust: Is Bitcoin the Solution?

As Powell steers the monetary helm with a steady hand, the conversation around Bitcoin’s viability as a safe haven intensifies. With the US grappling with a ballooning national debt and the looming reevaluation of debt terms, Bitcoin’s role as a potential bulwark against fiscal instability has gained traction.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.