Is a Market Crash Imminent?

The specter of recession looms ominously over the United States. Financial experts and average citizens alike fear the inevitable fallout of a market crash.

Yet, the question remains: is this impending catastrophe a certainty, or is the market bracing for an impact that may never materialize?

The Growing Signs of Recession

Telltale signs of a recession have been ubiquitous, with whispers of the impending economic storm growing louder. Many have already started feeling the pangs of the financial hardship often associated with recession.

From Binance.US laying off an unspecified number of employees to Coinbase reducing its headcount by 2,050 employees over the past year, the portraits of a deteriorating economic landscape are drawn in vivid strokes.

These narratives may seem bleak, yet they echo the broader economic anxiety of many Americans. Layoffs are more prevalent, consumer spending is dwindling, and corporate cost-cutting is more apparent, causing concerns among economists.

“[As we go through 2023] and into next year, there is still going to be this focus on trying to reduce costs, and it is going to result in more unemployment,” said Thomas Simons, Senior Economist at Jefferies.

Consequently, a domino effect could unfold, where layoffs lead to a pullback in consumer spending. This might drive the US economy further toward recession.

“With a lack of new demand, businesses have been focused on working through back orders. The dropoff in demand for goods should lead to further disinflation in the space, but also more widespread job cuts in the manufacturing sector than we have seen to date,” added Simons.

Markets Show Strong Performance

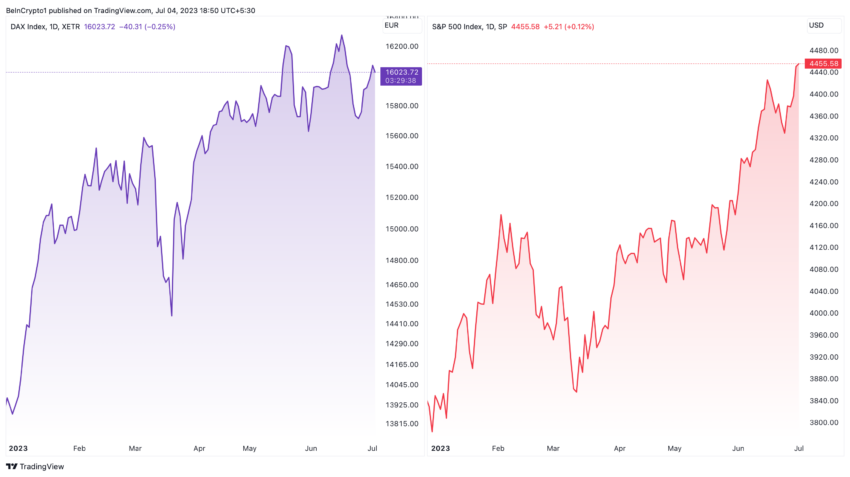

Still, some data points signal a robust economy. A 3.7% unemployment rate and strong stock and crypto performance show the financial and domestic markets’ resilience.

The stock market has demonstrated a bullish trend, with the Nasdaq Composite Index marking its best first-half performance since 1983. Concurrently, Bitcoin has closed its second consecutive month in the green, boasting a year-to-date (YTD) positive performance of 90%.

Many analysts have expressed frustration with these seemingly positive indicators. Indeed, some claim these indexes fail to reflect the reality of the US economy.

“Leading economics indicators have been moving sharply lower, consumer expectations are extremely pessimistic… Everyone is bearish. But the recession has been front-run… We see no reason to change our bullish stance,” said Alex Krüger, Economist at Asgard Markets.

Yet, amid this widespread unease, several factors hint at the market’s resilience and capacity for recovery.

Conventional wisdom suggests that a recession is imminent, given the pervasiveness of key indicators like the inverted yield curve, negative outlook reflected in business surveys, and increasing inflation. Nonetheless, such fears may be premature or overstated.

“The labor market is one of the key stories so far this year. There has been clear slowing, however, the rate of job gains has been pretty strong and we think that has been contributing to resilience spending. That also means as things do cool down with the Federal Reserve rate hikes, we are just not likely to tip over into recession,” said Seth Carpenter, Chief Global Economist at Morgan Stanley.

If it materializes at all, the impending recession has been anticipated well in advance. This foreknowledge allows markets and economic actors to brace themselves, mitigating the possible impact.

Is a Market Crash Imminent?

The belief that stock and crypto prices must hit rock bottom during a recession is based on limited data and fails to account for anomalies. German’s DAX Index, for instance, hit record highs despite the country being in recession, illustrating how markets can defy expectations.

In addition, some argue that current market valuations are not necessarily exorbitant. Instead, perceptions of value can often be shaped by biases in data selection.

For example, forward Price-to-Earnings (P/E) for the S&P 500, excluding FAANG, paints a different picture of market pricing, warranting a closer examination.

Perhaps most critically, the market is forward-looking and is rapidly embracing the artificial intelligence revolution. This technology-led shift, comparable to the internet or the industrial revolution, has the potential to drastically enhance productivity and boost global GDP, providing a counterbalance to recessionary pressures.

“The name of the game now is being okay in a constant state of adaptation, learning and change. Investors should view AI as another tool, instead of an enemy,” said Kassi Fetters, Financial Planner at Artica Financial Services.

Lastly, positioning in the market is currently cash-heavy, providing a buffer against potential market fluctuations. Record levels of cash in money market funds indicate that the financial system has ample liquidity to absorb shocks.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.