Top Crypto Hedge Funds Tested by 2022 Bear Market Bite

Several significant crypto hedge funds and traditional hedge funds with crypto exposure have either collapsed or barely escaped in 2022. Crypto price declines have tested the risk tolerances of these firms and have started stacking pressure on leveraged bets.

Hedge funds pool investor money to make significant returns using advanced investment strategies. According to the Securities and Exchange Commission (SEC), a hedge fund does not need to follow specific rules designed to protect investors, nor do they need to file reports with the SEC.

The Risks of Leverage

Due to the risky nature of hedge fund investment strategies, funds often only accept accredited investors. Part of those strategies includes leveraged investments, which involve borrowing money to increase the potential return on investment.

However, the lender, such as a prime brokerage, will often require an investor to supply a minimum amount to borrow against, called margin. The borrower is responsible for ensuring a particular ratio is maintained between the amount they borrow and their margin. If the borrower fails to maintain that ratio, the lender liquidates its position, and the borrower loses their margin investment.

A hedge fund can borrow securities through a prime brokerage to maximize returns for investors while practicing adequate risk management.

When a hedge fund gets liquidated, it can be down to sharp declines in the value of assets posted as margin for leveraged investments or poor risk management. The ongoing crypto winter has seen a fair share of drops in the value of digital assets, some of which have resulted in crypto-focused and hedge funds going under.

3AC Hedge Fund Fell First

The first domino to fall was Singapore-based Three Arrows Capital, whose co-founder Kyle Davies made a series of leveraged bets on rising crypto prices based on the so-called supercycle thesis promoted by fellow founder Su Zhu.

The supercycle thesis posits that crypto prices will appreciate as adoption grows without the risk of a near-term bearish pivot.

Unfortunately for Zhu and Davies, the thesis didn’t hold, with Bitcoin falling over 50% in June 2022 from its all-time high of $69,000 on Nov. 10, 2021. The drop in prices came against the backdrop of the collapse of the TerraUSD stablecoin in May 2022. The collapse rattled confidence in the crypto industry and sent many investors fleeing for the hills.

One of the earliest crypto hedge funds, Pantera Capital, cashed out an investment in the Terra/Luna ecosystem, selling about 80% of its holdings over 12 months before the ecosystem collapsed in May 2022. The company made about ten times its $17 million investment in Luna.

Liquidation Soon Followed

Court documents filed in the British Virgin Islands, where Three Arrows was domiciled, revealed that the hedge fund had borrowed Bitcoin and Ether from derivatives exchange Deribit. However, it failed to supply additional funds when the prices of significant cryptocurrencies started tumbling in mid-June 2022. Three Arrows also owed Canadian crypto broker Voyager Digital over $600 million and crypto lender BlockFi about $80 million. It defaulted on both loans.

When Three Arrows couldn’t meet Deribit’s requirements, the exchange liquidated the hedge fund’s positions. It also advocated that the company undergo liquidation proceedings.

Liquidator Teneo later took control of the liquidation proceedings in the British Virgin Islands. Three Arrows filed for Chapter 15 bankruptcy in the U.S. shortly after.

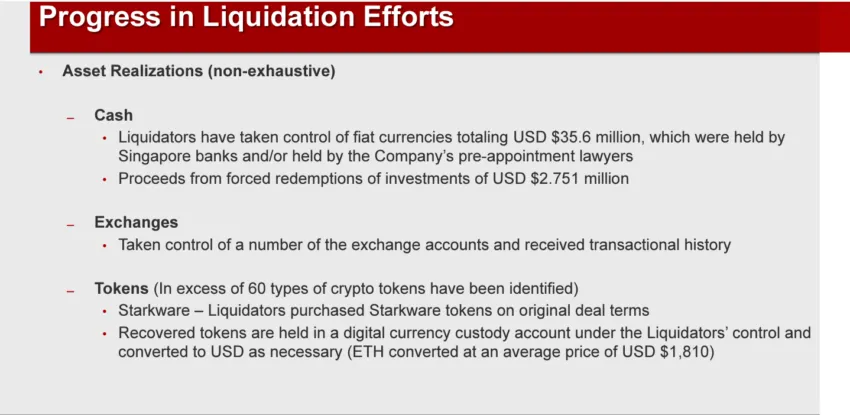

Liquidators told courts on Dec. 2, 2022, that they had seized over $35 million from Three Arrows’ Singapore bank accounts and other crypto tokens, including non-fungible tokens.

Alameda Ruined by Poor Risk Management

A case of poor risk management and falling crypto prices led to the downfall of Alameda Research LLC. This quasi-crypto hedge fund borrowed heavily, using a relatively illiquid crypto token FTT as collateral.

Its founder, former FTX CEO Sam Bankman-Fried, had reportedly deprioritized risk management during the firm’s early days. This lax approach snowballed, resulting in the firm’s shutdown and subsequent bankruptcy proceedings. The lack of risk management was all the more bizarre, considering Bankman-Fried’s earlier stint at trading firm Jane Street Capital, which employed comprehensive risk management.

According to early employees of Alameda Research, the hedge fund made early wagers on the price movements of several cryptocurrencies, many of which turned sour.

Additionally, Alameda borrowed heavily to make several investments without the benefit of regulatory guardrails that limit the amount of risk traditional Wall Street companies can take on.

When crypto prices started falling earlier this year, the price of FTT also fell. This prompted Alameda’s sister company FTX to use customer funds to pay back the risky loans. Both firms soon wound up bankrupt.

SkyBridge Capital Hedge Fund Exposed to Crypto Decline

Anthony Scaramucci’s investment management firm SkyBridge Capital suspended withdrawals from its Legion Strategies Fund on July 19, 2022, amid falling crypto prices. The Legion fund gained exposure to cryptocurrencies through some of SkyBridge’s other funds.

SkyBridge also operates a fund, which investors looked to withdraw from earlier in the year. The Multi-Adviser Fund trades the stakes of other traditional hedge funds. It had 27% of its portfolio allocated to digital asset investments, per a Consolidated Schedule of Investments published on Sept. 30, 2022.

It has also been a tough year for traditional hedge funds without crypto exposure, as macroeconomic conditions caused a pullback in leveraged bets to lower risk exposure. Rising interest rates and geopolitical tensions have driven up the cost of borrowing for hedge funds.

Hedge Fund Research said that hedge fund liquidations increased roughly 24% in Q2 2022 compared to the previous quarter.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.