Solana and Avalanche Enter New Uptrend

Key Takeaways

Solana and Avalanche have risen by roughly 20% in the past 36 hours.

SOL needs to stay above $42 to advance to $52.

AVAX could trigger an upswing to $28 if it breaks $24.

Share this article

Solana and Avalanche are gaining bullish momentum after slicing through crucial resistance areas.

Solana and Avalanche Overcome Resistance

Solana and Avalanche appear well-positioned for gains as the broader cryptocurrency market enjoys new tailwinds.

Solana’s SOL token has risen by nearly 20% over the past 36 hours. It soared from a low of $38.60 to post a new monthly high of $46.10. The sudden upswing has allowed Solana to overcome a crucial area of resistance, potentially leading to higher highs.

Solana sliced through the middle trendline of a parallel channel that had developed on its four-hour chart. Trading history shows that every time SOL has breached this barrier since June 20, it has advanced toward the channel’s upper boundary. Now, similar price action could push the asset to $49 or even $52.

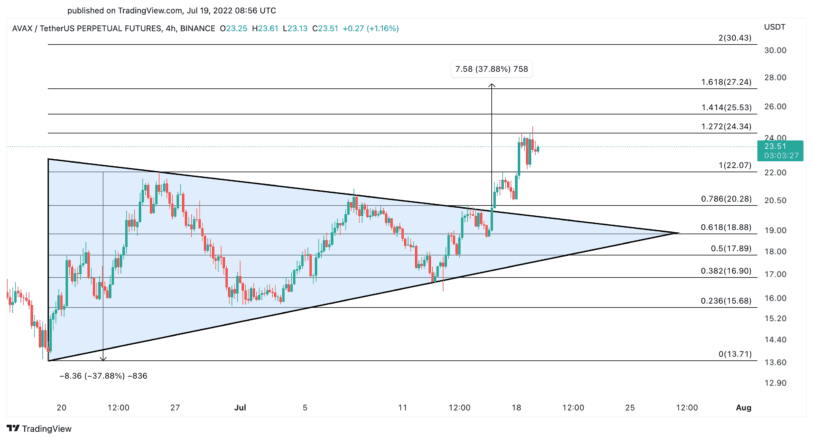

Avalanche has also seen a wave of bullish momentum over the past 36 hours, surging from a low of $20.60 to a high of $24.80. The upward impulse was triggered after AVAX broke out of a symmetrical triangle that had developed on its four-hour chart. With two corrections occurring after the breakout, it appears that the token has collected enough liquidity to advance further.

The height of the triangle’s Y-axis suggests that Avalanche has entered a 38% uptrend toward $28. A sustained four-hour candlestick close above the $24.30 resistance level could further validate the bullish thesis.

Although the odds appear to favor the bulls, the support levels are crucial due to the ongoing uncertainty across crypto and global financial markets.

If Solana fails to keep the channel’s middle trendline at $42 as support, the optimistic outlook may be invalidated. A four-hour candlestick close below this vital level could trigger a spike in profit-taking that sends SOL to $38.50 or $35.20. Similarly, Avalanche needs to avoid dipping below $22 as the downswing could initiate a retracement to $20.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.