Bitcoin’s Hashrate Slips Below 200 Exahash, BTC Mining Profits Drop Lower – Mining Bitcoin News

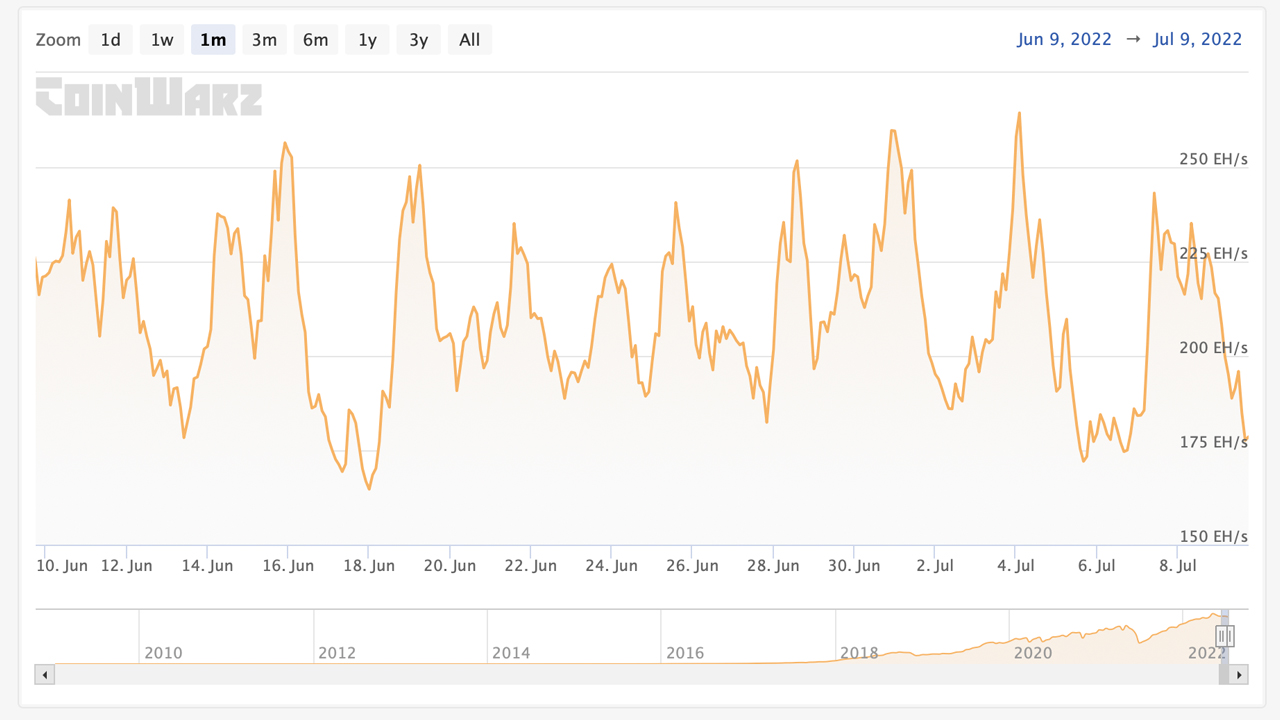

Bitcoin’s hashrate has declined in recent times after reaching an all-time high on June 8, 2022, at block height 739,928. 30-day statistics show the hashrate has slipped from 243 exahash per second (EH/s) to today’s 178.44 EH/s, losing 26.56% during that time frame. After two drops in a row, the difficulty adjustment algorithm (DAA) is expected to drop again roughly 11 days from now or 1,600 blocks away.

Following the June 8 All-Time High, Bitcoin’s Hashrate Dropped 26% in 30 Days

Lower bitcoin (BTC) prices have impacted bitcoin miners who are not seeing the profits they once did a month ago today. Using today’s BTC exchange rates a block subsidy value is worth $136,625 per block and during the last 90 days, the hashrate averaged around 213.8 exahash per second (EH/s).

On June 8, 2022, the hashrate tapped a high of around 292.02 EH/s at block height 739,928 and today it’s much lower at 178.44 EH/s. Statistics recorded over the last month indicate that BTC’s hashrate slipped 26.56% lower than the average after the first week of June.

While BTC’s price is lower and hovering just above the $21K region, BTC miners have caught a break during the last two DAA changes after they saw two downward adjustments. The last two DAA shifts made it 3.76% easier to find BTC blocks and the next DAA change is expected to decrease again 0.13% lower.

However, there’s still 11 days left until the next DAA change and the time it takes to find 2,016 BTC blocks will determine if the DAA goes up or down. Since March 3, 2022, the Bitcoin network has recorded six downward adjustments and four increases.

Crunchtime: Less Than 100K Blocks Left Until the Next Block Subsidy Halving

While the hashrate has slipped by 26% during the last 30 days, 4,216 block subsidy rewards were discovered by miners. Foundry USA found the most with 959 blocks found last month and around 22.75% of the global hashrate.

Foundry was followed by Antpool which captured 14.61% of the global hashrate and discovered 616 blocks last month. There are 14 known BTC mining pools today, and unknown hashrate or stealth miners obtained around 56 block rewards last month which equated to 1.33% of the 30-day hashrate.

There’s less than 100K blocks left until the next reward halving (95,699 block away at press time) and miners will see revenues slashed in half at that point in time. The halving is expected to occur on or around April 16, 2024, which is 647 days away.

After that date, bitcoin miners will only get 3.123 BTC per block in comparison to today’s 6.25 BTC block reward. Metrics on Saturday, June 9, 2022, indicate that mining rig profitability at $0.12 per kilowatt-hour (kWh) is low.

The most profitable ASIC mining rig today is the Bitmain Antminer S19 XP which produces 140 terahash per second (TH/s). The Antminer S19 XP makes an estimated $5.13 in profits with electrical costs at $0.12 per kWh.

What do you think about the hashrate slipping lower? Let us know what you think about the state of bitcoin mining during the past 30 days in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, coinwarz.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.